Asian markets were loving the bad US economic data today. The lower US dollar was taken as a boon for the region as it increased the relative value of commodity exports and lowered repayments on USD-denominated bonds for corporates in the region. With many Asian currencies and equity markets heavily influenced by commodity markets, this also saw the energy and materials sectors performing strongly across the region.

The probability of a Fed rate hike in 2015 fell away considerably with the disappointing set of US data last night. It is becoming increasingly clear that the almost 9% increase in the US dollar index seen from the start of the year to August effectively functioned as a “phantom rate hike” by considerably tightening US financial conditions.

This is the argument that Fed member Lael Brainard was putting forward: The massive strengthening of the US dollar has effectively functioned as equivalent to two US rate hikes. With US CPI inflation still at 0.2% year-on-year, real interest rates would increase dramatically in the event of a rate hike. The high US dollar is also clearly affecting US manufacturing and tourism.

The bond market pricing for a Fed rate hike has emphatically responded to these changes with the probability of a Fed rate hike in in December falling to 29%, and a March 2016 rate hike sitting below 50%, at 48.6%.

The Aussie and the Kiwi dollars saw significant gains on the US dollar weakness. But these gains paled in comparison to the biggest losers this year in Asian currencies (Malaysian Ringgit, Indonesian Rupiah and Korean Won), which all saw huge intraday increases. The Korean Won was further boosted by the central bank leaving rates on hold today, and expectations that Bank Indonesia will leave their rates unchanged at the meeting later today as well.

The hotly anticipated Australian employment data came in below expectations. While the Aussie dollar briefly retraced some of its gains on the release, it proved to be only a speedbump on its continued rise upwards today.

Australian employment declined 5100, below even the lowest estimate of a zero increase. Although this did not push the unemployment rate back out to 6.3%, it does heighten concerns about the weakening of the Australian economy. Vehicle sales were strongly up 5.5% month-on-month.

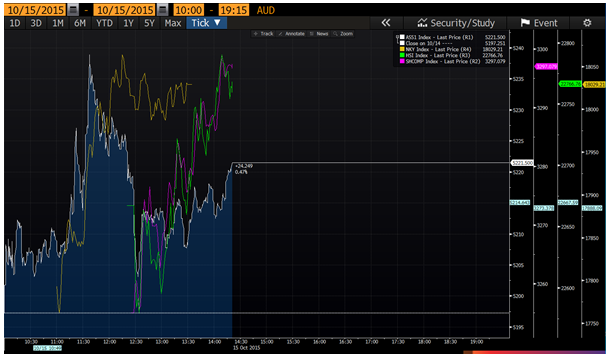

The ASX opened relatively flat in the morning, but seemed to rally strongly along with the Aussie dollar ahead of the employment data release at 11.30 am AEST. The ASX almost touched 5240 at its intraday high, and while it gave this away it still continued to trade comfortably above the 5200 level clearly finding some support there.

Materials and energy continued to see strong gains on the back or further USD weakness. But gold miners were the star performers in the space, with the gold price rising over 1% overnight to touch $1190 (You're analyst here called a short-term price target of $1200-$1250 last week: www.youtube.com/watch?v=RsRu1oPkzMQ). The materials sector was the best performing on the index rising 1.8%. Among the top performing gold miners were Evolution Mining Ltd (AX:EVN) (+7.7%), Newcrest Mining Ltd (AX:NCM) (+4.9%), Northern Star Resources Ltd (AX:NST) (+4.5%) and Regis Resources Ltd (AX:RRL) (+4.3%). Fortescue Metals Group Ltd (AX:FMG) also had a strong day beating cost-cutting estimates and lowering its outstanding debt, this saw the stock rise 6.3%.

News that the ACCC had issues with the Brookfield Prime Property Fund (AX:BPA) takeover of Asciano Ltd (AX:AIO) saw its stock dive 7.9%.

The banks had a mixed day in the wake of Westpac’s capital raising and ongoing trading halt. Commonwealth Bank Of Australia. (AX:CBA) and Macquarie Group Ltd (AX:MQG) were both up over 1%, while ANZ Banking Group (AX:ANZ) saw quite a bit of selling and dropped 0.5%.