The amount of money managed by exchange-traded funds (ETFs) continues to grow significantly. “In the first five months of 2021, ETF net inflows are nearly $282 billion… Over the last three years, US ETF net inflows were $1.2 trillion,” according to recent metrics.

At the same times, new ETFs are launched on Wall Street. According to the New York Stock Exchange (NYSE), there are currently 2,567 ETFs listed stateside. In the first six months of the year, “127 new active ETFs launched and 24 issuers entered the market for the first time, bringing the total number of firms with active strategies to 117.”

Today, we introduce two such new ETFs that could appeal to a range of readers. Both funds are still small and deserve closer study by potential investors as they do not yet have much trading history.

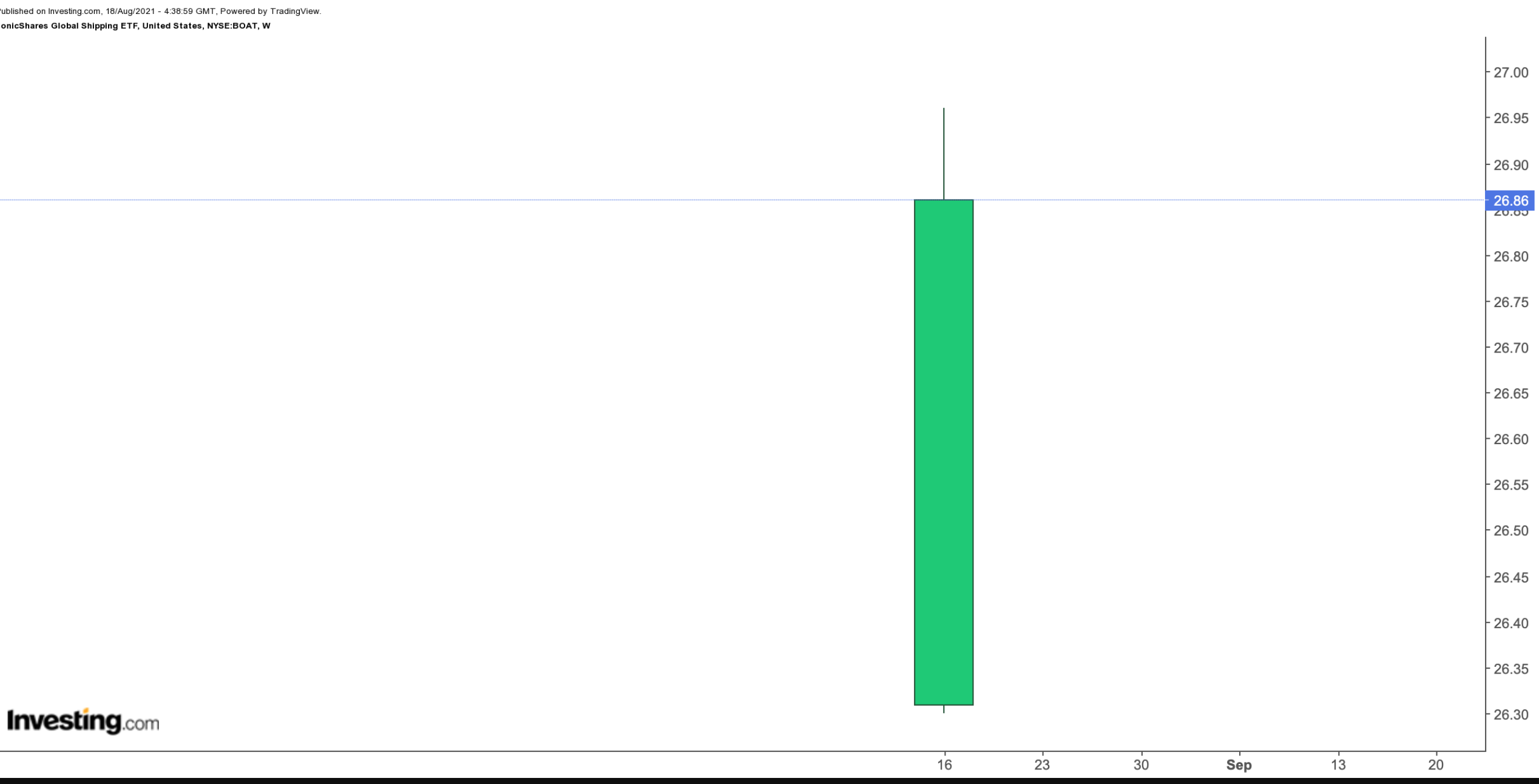

1. SonicShares Global Shipping ETF

- Current Price: $26.86

- 52-Week Range: $24.49 - $27.07

- Expense Ratio: 0.69% per year

The Organisation for Economic Co-operation and Development (OECD) highlights,

“The main transport mode for global trade is ocean shipping: around 90% of traded goods are carried over the waves… As demand for global freight increases, maritime trade volumes are set to triple to 2050.”

Our first fund, the SonicShares Global Shipping ETF (NYSE:BOAT), gives exposure to global shipping companies, which transport goods and raw materials, including consumer and industrial products, vehicles, dry bulk, crude oil and liquefied natural gas.

BOAT, which has 46 holdings, tracks the returns of the Solactive Global Shipping Index. The fund started trading on Aug. 4, and has around $1.32 million in assets.

In terms of the sub-sectoral breakdown, the Container Deep Sea & Offshore Shipping sector makes up the highest portion with 53%, followed by the Dry Bulk Deep Sea & Offshore Shipping and the Crude Oil Transportation sectors with 15% and 11%, respectively. The largest 10 holdings account for over 60% of the fund.

Japanese groups Mitsui OSK Lines (OTC:MSLOY) and Kawasaki Kisen Kaisha (OTC:KAIKY), Germany-headquartered Hapag Lloyd (DE:HLAG), Denmark-based AP Moeller - Maersk (OTC:AMKBY) and Honolulu, Hawaii-headquartered Matson (NYSE:MATX) lead the names in the roster.

Since inception, the fund is up about 7%. Those readers wishing to include a pure-play maritime shipping company ETF in their portfolios should keep the fund on their radar. The names in BOAT are likely to benefit from the potential growth in global shipping as well as continued economic recovery.

2. Viridi Cleaner Energy Crypto Mining & Semiconductor ETF

- Current Price: $32.58

- 52-Week Range: $24.28 - $38.48

- Expense Ratio: 0.90% per year

Our second fund could appeal to readers interested in the environmental impact of increased crypto mining and trading levels. Earlier in the year, Elon Musk, CEO of Tesla (NASDAQ:TSLA), made the headlines when he said the company would not accept Bitcoin because of the high levels of energy consumption during mining.

Nic Carter of Harvard Business Review highlights, “Bitcoin consumes as much energy as a small country.” And according to the Cambridge Bitcoin Electricity Consumption Index (CBECI), “the amount of electricity consumed by the Bitcoin network in a single year… could satisfy the total electricity needs of the entire University of Cambridge for 627 years [or] could power all tea kettles used to boil water in the UK for 19 years.”

Put another way, the “crypto-rush” comes with an environmental catch that is of concern to many investors worldwide. In recent months, numerous groups have extended their support for the Crypto Climate Accord.

The Viridi Cleaner Energy Crypto Mining & Semiconductor ETF (NYSE:RIGZ), an actively managed fund, is focusing on the use of renewable energy in crypto mining. It does not hold digital assets directly. Instead, the ETF invests in semiconductor names as well as crypto miners and mining hardware groups with cleaner energy policies.

RIGZ, which has 19 holdings, started trading in July 2021, and has around $6.2 million in assets. The fund’s top 10 holdings account for over 70% of all holdings in the fund.

Among the top names in the roster are the blockchain infrastructure and crypto mining companies Bitfarms (NASDAQ:BITF), Hut 8 Mining (NASDAQ:HUT), Marathon Digital (NASDAQ:MARA), and Digihost Technology (OTC:HSSHF), as well electronics group Samsung Electronics (OTC:SSNLF) and chip heavyweights NVIDIA (NASDAQ:NVDA) and Advanced Micro Devices (NASDAQ:AMD).

Since its inception in July, the fund is up close to 40%. The recovery in the price of Bitcoin as well as the strength in chip stocks have provided tailwinds for the fund. Those investors who believe the crypto space will become greener sooner than later might consider researching RIGZ further.