Inverse and leveraged exchange-traded funds (ETFs) typically replicate the reverse or the leveraged (usually twice or three times) of the returns of an index daily. Assets in such products increased from around $90 billion in 2020 to over $121 billion in 2021.

Given the recent declines in broader markets, many investors are looking for ways to protect their portfolios or take advantage of the negative sentiment on Wall Street. We have previously outlined several inverse products.

Today's article introduces two other inverse funds that could appeal to experienced short-term traders. However, as in our previous discussions, we should remind readers that these ETFs are not suitable as long-term investments. Instead, they should potentially be used on a short-term basis for hedging or speculative purposes. Finally, such specialized funds typically have high expense ratios, affecting total returns.

1. ProShares Short S&P 500

- Current Price: $14.73

- 52 Week Range: $13.47 - $18.20

- Expense Ratio: 0.88% per year

Our first fund, the ProShares Short S&P 500 (NYSE:SH), aims to achieve daily returns that correspond to the inverse (-1x) of the daily returns of the S&P 500 index. The fund was first listed in June 2006, and net assets stand around $1.4 billion.

In 2021, the SPDR® S&P 500 (NYSE:SPY), the most important ETF that tracks the S&P 500, returned more than 27.5%. However, in the first three weeks of January, SPY declined 7.8%.

On the other hand, SH has returned 8.1% so far in 2022. Short-term traders looking to short the S&P 500 index daily could consider allocating a small part of their portfolio to a fund like SH.

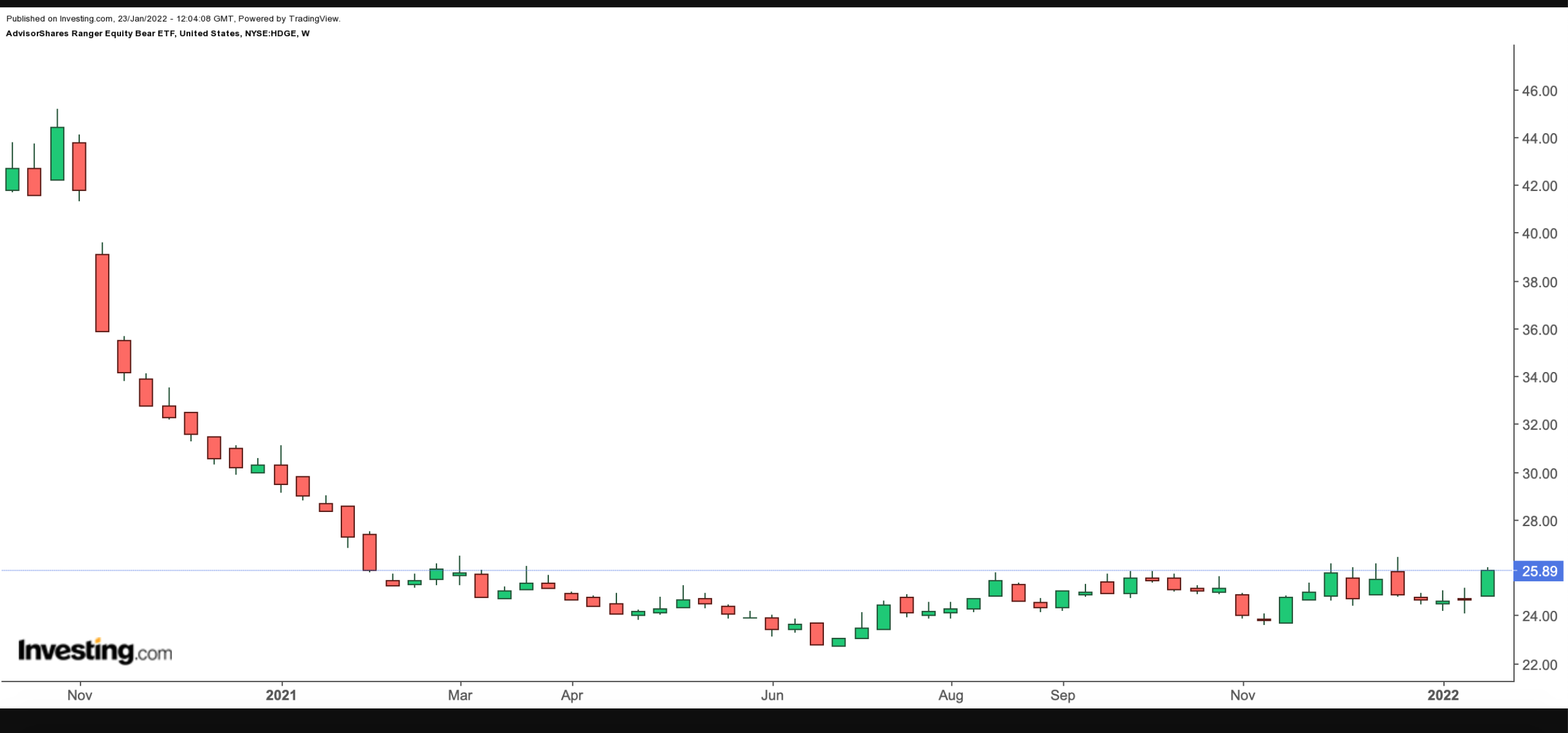

2. AdvisorShares Ranger Equity Bear ETF

- Current Price: $25.89

- 52 Week Range: $22.67 - $28.60

- Expense Ratio: 3.36% per year

Our second fund, the AdvisorShares Ranger Equity Bear ETF (NYSE:HDGE), is an actively-managed short-only fund. In other words, it does not duplicate inverse returns of a given fund. Therefore, it is not necessarily an inverse fund but rather a 'bear' ETF.

HDGE, which typically shorts stocks with low earnings quality, has about $65.5 million in net assets. The ETF started trading in January 2011, and currently has 55 holdings.

Fund managers can also add tactical trading positions depending on market sentiment. The ETF's (short) sector exposure includes: information technology (29.1%), consumer discretionary (14.5%), industrials (7.0%) and telecom services (6.6%).

Among those names currently shorted are the clothing company Hanesbrands (NYSE:HBI); Snap-On Inc (NYSE:SNA), which provides equipment primarily to auto mechanics; biofuel energy name Renewable Energy Group (NASDAQ:REGI); Restaurant Brands International (NYSE:QSR), which owns Burger King, Popeyes, Tim Hortons, and Firehouse Subs; and website-building platform Wix.com (NASDAQ:WIX).

So far this year, HDGE is up about 5% but down 15.9% over the past 12-months. The fund might be appropriate for a range of investors feeling a disconnect between frothy valuations in the companies in HDGE and current macroeconomic conditions.

On a final note, 3% of HDGE is currently invested in another ETF, namely the ProShares Short Russell 2000 (NYSE:RWM).

Many institutional investors regard the Russell US indices as key benchmarks. For instance, the Russell 3000 index represents around 98% of all investable US shares, and encompasses numerous sub-indices.

Of those, the small-cap Russell 2000 index is widely followed. Many investors include the iShares Russell 2000 ETF (NYSE:IWM), which tracks the returns of this index, in their portfolio. Since the start of 2022, IWM has lost close to 11.5%.

On the other hand, the RWM fund seeks to return the inverse (-1x) of the Russell 2000 Index on a daily basis. Therefore, it could be an appropriate hedging or short-term trading tool for some readers.

This fund began trading in January 2007, and has over $275 million under management. So far in January, RWM is up 12.4%.