-

Earnings season has been one the bulls would like to forget with selling pressure being put on companies beating estimates and those missing

-

Profitability outlooks have been less than stellar as CEO trepidation remains the theme

-

Two fintech companies grabbed our attention for preliminary earnings announcements, both with full reports due out this month

October lived up to its billing as being among the most volatile months on the calendar. What began as a light-volatility correction at the start of August gradually escalated into more broad-based selling, with some of the market’s year-to-date leaders finally being taken out to the woodshed. A few of the Magnificent Seven had their dates with the bears during earnings season all while small caps seemed to fall another percent or two each passing week.

November through mid-January is often when the bulls overtake the reins, though. The “Santa Claus Rally” doesn’t technically begin until after Christmas, but holiday cheer sometimes overpowers October fear. Can we always count on seasonal technical trends to persist? Of course not. Just look back to the dismal Q4 of 2018 for an instance when history fails to rhyme.

Lowering Expectations

What might it take for stocks (and bonds) to reverse course after three dismal months? Maybe nothing special. Consider that we are more than halfway into earnings season, the guidance tally was quite bleak. Companies were generally cautious, something our team highlighted before and as the reporting period began.

We noted that corporate uncertainty had increased to its highest level since the pandemic, based on the Late Earnings Report Index (LERI) reading. Price action played out that way, too. Even earnings beats were met with intense selling pressure in some instances – Alphabet (NASDAQ:GOOGL) being a high-profile company eclipsing top and bottom-line estimates1, but then falling hard the following session.

Words Over Numbers?

It has been a while since we have seen a quarter where CEO commentaries and outlooks were so pivotal. Moreover, companies issuing preliminary earnings announcements may be asking for share-price trouble if they signal to investors that quarterly results will not live up to expectations. We found two firms that posted preliminary reports over the past several weeks, both with full earnings later this month.

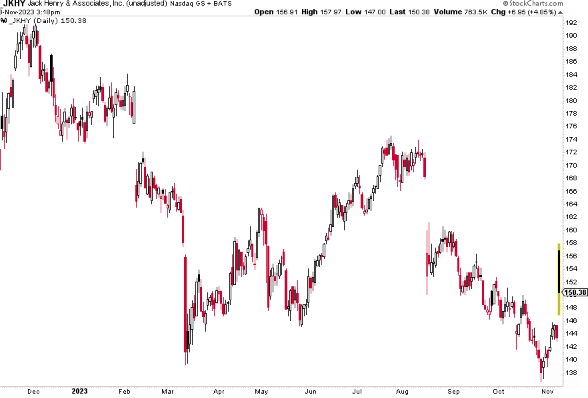

Jack Henry: Poor Earnings-Reaction History, Bulls Battling Bad News

First up is a twist on your normal preannouncement. Jack Henry & Associates Inc (NASDAQ:JKHY) put out a press release on October 25 confirming that it would release quarterly deconversion revenue numbers on October 30, which was prior to the release of its full quarterly earnings results.

Just recently, Goldman Sachs (NYSE:GS) downgraded the stock from neutral to sell as it expects JKHY’s multi-year public cloud investment plan to be slow to implement. That and tax law changes are seen as unfavorable for the Missouri-based company. Higher corporate uncertainty could lead to reduced corporate capex and muted bank M&A activity may keep deconversion fee revenue low over the coming quarters, so says Goldman.

Jack Henry thumped the bears with an impressive Q1 earnings report, however. A solid profit story coupled with a more sanguine guidance stance sent shares soaring on November 8, though the stock finished significantly off the session high. The jump bucked the previous trend of negative earnings reactions, but more volatility could be on the way on Tuesday, November 14 when JKHY hosts a Shareholder Meeting.

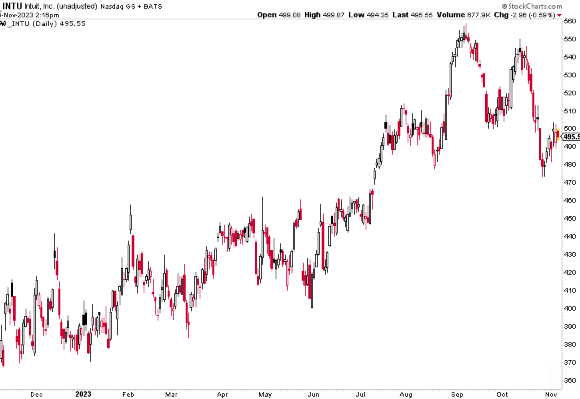

Intuit: Will A Solid Q1 Report Stop the Bleeding? FY 2024 Guidance Re-Affirmed.

We interrupt this corporate event update to ask: Are your tax ducks in a row? Year-end is quickly approaching, and Intuit Inc (NASDAQ:INTU), maker of TurboTax, Credit Karma, QuickBooks, and Mailchimp, hopes many taxpayers flock to their platform and services in Q4 and during the upcoming tax season. The stock had indeed been soaring for much of 2023, but like so many other high-flyers, Intuit was unable to evade the bears. By late October, shares were down nearly 15% from their $558 YTD peak.

The $10 billion market cap Transaction and payment Processing Company within the Financials sector has struggled mightily in the last year. Shares are down from a peak near $200 last November to near $140 in advance of both its preliminary report and the full Q1 2024 earnings announcement.

INTU turned lower in September following headlines that the Federal Trade Commission (FTC) ruled against the tax software giant, suggesting that the company engaged in “deceptive advertising.”6 Then, a $4 billion debt offering may have been unnerving to shareholders given the steep rise in borrowing costs over the previous several months.7 Just a few days later, insider selling news did not project confidence either.8 Nevertheless, analysts expect earnings to have grown substantially compared to year-ago levels when it reports full Q1 2024 results on Tuesday, November 28 AMC.

Catching our attention, however, was its September 28 preliminary earnings report.9 The global financial technology platform provider reaffirmed its first-quarter financial guidance and full fiscal year 2024 numbers at its Investor Day event. The management team was optimistic that an exciting era was underway, with data and AI fueling future innovation and durable growth. AI continues to be a hot theme among C-suites across Wall Street, but firms may have to deliver the earnings goods sooner rather than later. We’ll see if that is the case for Intuit later this month.

The Bottom Line

The stock market’s correction has left few bulls standing. Companies big and small, domestic and foreign, value and growth, have all endured bouts of selling pressure. Companies issuing earnings results were hit particularly hard, in aggregate, during the first half of the reporting season. Can the Bulls turn things around? It’s all about expectations and where company execs set the bar going forward.