Apple (NASDAQ:AAPL) stock hit an all-time high of $157.16 on Sept. 7. The up move was, in part, due to buying the rumour before the iPhone launch event of Sept. 14.

On the day, management revealed the new iPhone 13 lineup alongside with the 2021 iPad range and the Apple Watch Series 7. Yet, the market’s reaction was lukewarm. And since then, AAPL shares have come under pressure along with the broader markets.

As we write on Sept. 20, Apple is hovering at $142.5, or down about 9% from the Sept. 7 record high. Yet, AAPL stock is still up 7% year-to-date.

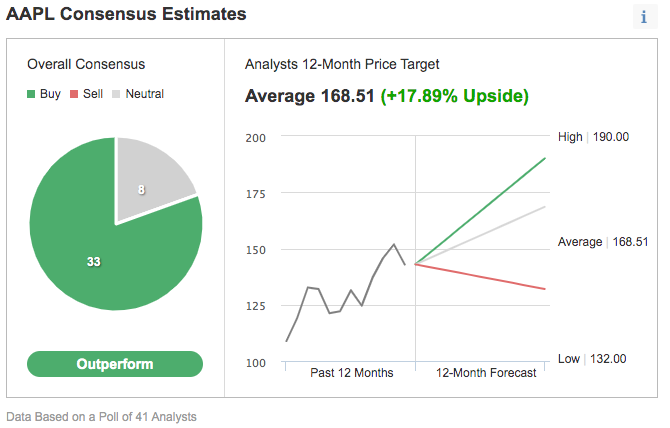

Among 41 analysts polled via Investing.com, Apple stock enjoys an ‘outperform' rating. In addition, the shares have a 12-month price target of $168.51, implying an increase of 18%. This means that despite the recent profit-taking, Wall Street is still bullish in the long run. The 12-month price range currently stands between $132 and $190.

Therefore, today we introduce two exchange-traded funds (ETFs) that have APPL as a leading holding. These funds could appeal to investors who want some, but not full, exposure to Apple.

1. iShares Global 100 ETF

Current Price: $71.64

52-Week Range: $53.96 - $75.10

Dividend Yield: 1.47%

Expense Ratio: 0.40% per year

The iShares Global 100 ETF (NYSE:IOO) gives exposure to a broad range of large-capitalization global companies. The fund was launched in December 2000.

IOO, which has 104 holdings, is based on S&P Global 100 Index. In terms of sectors, the weighting includes information technology at 29.48% followed by consumer discretionary (14.63%), health care (11.69%), consumer staples (10.78) and financials (10.04%).

Close to 72% of the businesses are based in the US. Next in line are those from the UK (6.89%), Switzerland (5.75%), France (4.56%) and Germany (3.44%). The top 10 names make up about half of the net assets of $3.45 billion.

Apple has the highest slice in the ETF with 12.37%. Other leading tech heavyweights in the roster include Microsoft (NASDAQ:MSFT), Amazon (NASDAQ:AMZN), Alphabet (NASDAQ:GOOGL) (NASDAQ:GOOG), along with JP Morgan Chase (NYSE:JPM) and Johnson & Johnson (NYSE:JNJ).

The fund returned 28.5% in the past year and 14% so far in 2021. Like Apple stock, IOO also hit a record high in early September. Trailing P/E and P/B ratios stand at 28.72x and 3.65x, respectively.

Interested readers could regard a further decline toward the $70 level or even below as a good opportunity to buy into IOO. In addition to Apple, other names in the fund also have competitive moats as well as robust business models and brands. Their operations and revenues are global. Therefore, any weakness in their share prices are likely to be short lived.

2. Emles Luxury Goods ETF

Current Price: $29.61

52-Week Range: $24.92 - $32.32

Dividend Yield: 0.11%

Expense Ratio: 0.60% per year

The Emles Luxury Goods ETF (NYSE:LUXE) is a niche fund. It focuses on global firms that should benefit from an increase in the global consumption of luxury items. The fund began trading in November 2020. Its assets under management are $6.1 million. In other words, it is a small young fund.

Recent metrics highlight:

“The luxury goods market in the US is estimated at US$51.2 billion in the year 2021. China, the world`s second largest economy, is forecast to reach a projected market size of US$31.6 billion by the year 2026 trailing a CAGR of 6.7% over the analysis period. Among the other noteworthy geographic markets are Japan and Canada, each forecast to grow at 3.8% and 5%, respectively.”

Research led by Iryna Pentina of the University of Toledo in Ohio, points out: Apple is increasingly targeting the luxury market by introducing luxury versions of its watches (in alliance with Hermes) and phones (in alliance with Gresso).

In fact, Apple stock is one of the top 10 holdings of the LUXE fund, which has 59 holdings. Among other leading companies are car manufacturers Daimler (OTC:DDAIF) and Tesla (NASDAQ:TSLA); France’s Essilor International (OTC:ESLOY), a global leader in corrective lenses; French luxury goods group Hermes International (PA:HRMS) (OTC:HESAF) (OTC:HESAY)); and Japanese Fast Retailing (OTC:FRCOY).

Year-to-date, the fund returned 11.3% and saw a record high in mid-July. Since then, LUXE is down about 10%. As most of out readers would concur, luxury items typically enjoy strong customer loyalty and command premium prices, which means high margins for companies. Long-term investors could consider investing around $28.