Stocks on Wall Street ended lower on Friday, with the major U.S. indices—including the NASDAQ, S&P 500 and Dow Jones Industrial Average—enduring their worst week since the dramatic drop in March.

With nerves mounting over the spike in coronavirus cases and the fast-approaching Nov. 3rd U.S. presidential election, this upcoming week will be eventful.

In this environment of heightened uncertainty and volatility some stocks have proven themselves better equipped to successfully navigate the markets' whipsaws, while others are more vulnerable.

Below we'll highlight one stock on track to continue to thrive and one likely to see further losses in the coming days:

Stock To Buy: Square

Square (NYSE:SQ)—the digital payment processor run by Twitter CEO Jack Dorsey—has been one of the big winners of the ongoing coronavirus crisis, as it benefits from the accelerated shift to online shopping and e-commerce during the pandemic.

Shares of the digital payment provider have outperformed the S&P 500 by a wide margin in 2020, soaring 148%. The stock closed at $154.88 on Friday, giving the San Francisco-based tech firm a market cap of roughly $68.7 billion.

Square—whose second-quarter earnings released in early August—crushed estimates, is scheduled to next report financial results on Thursday, Nov. 5 after the closing bell.

Consensus calls for earnings per share of $0.16 for the third quarter, down from earnings of $0.25 per share in the year-ago period. Revenue, however, is forecast to soar more than 200% from the same period a year earlier to $2.04 billion from $602.2 million.

Beyond the top-and-bottom line numbers, most of the focus will be on the performance of Square’s booming Cash App business. The mobile payment service, which allows users to buy and sell Bitcoin and recently added a stock-trading feature, saw year-over-year revenue growth of 140% in Q2.

Even more impressive, the consumer-facing app generated $875 million of Bitcoin sales and $17 million of Bitcoin gross profit in its last quarter, up a whopping 600% and 711% year-over-year.

Additionally, investors will pay close attention to the mobile payment processor’s update regarding gross payment volume (GPV) growth. Square's Q2 GPV, or the value of all transactions processed on its platform, decreased 15% year-over-year to $22.8 billion, mostly due to its exposure to restaurants and small businesses.

We expect Square, which has made a name for itself by providing innovative alternative payment processing methods to businesses, to report another strong quarter as the ongoing coronavirus pandemic has created an ideal environment for digital payment providers to succeed.

Stock To Dump: Mastercard

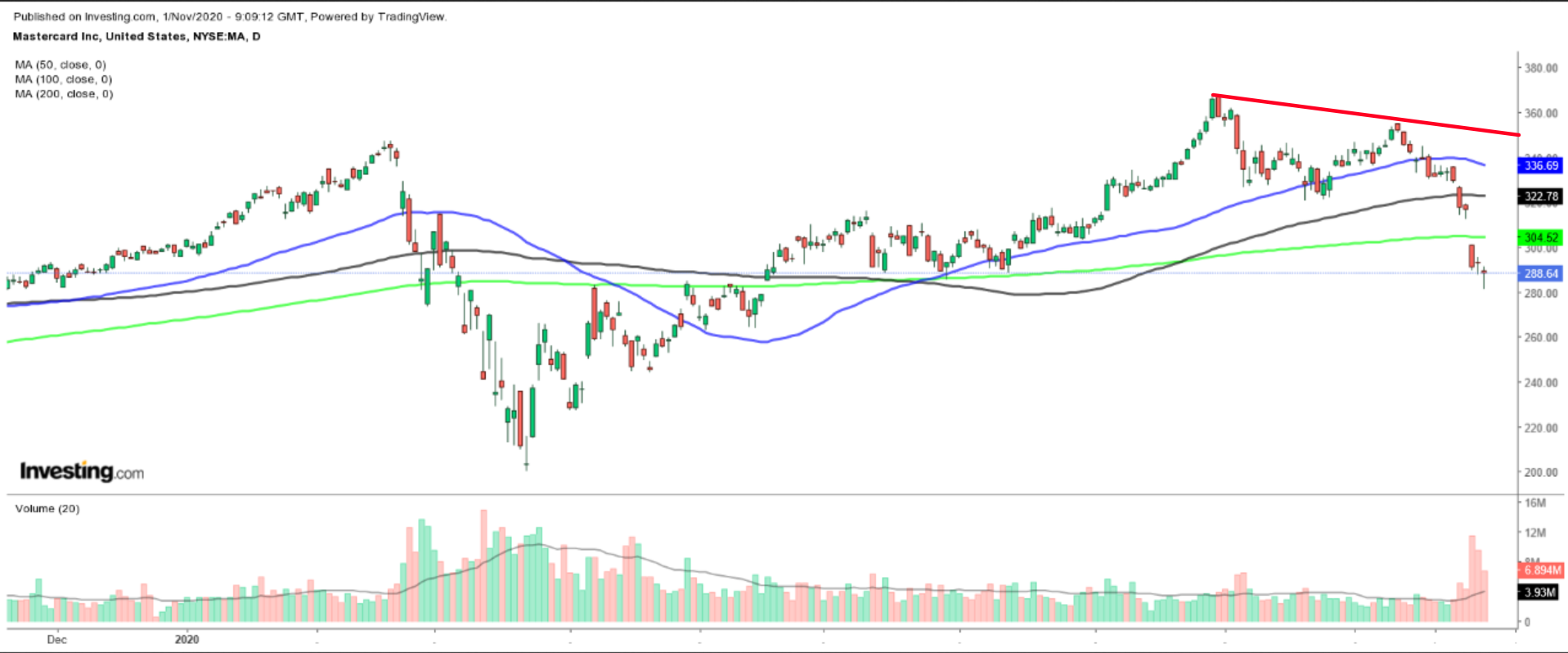

Financial services corporation Mastercard's (NYSE:MA) stock—which ended at $288.64 on Friday—suffered its worst week since the mid-March selloff, tumbling 12.4%, as investors rushed for the exits following the release of disappointing financial results.

The steep weekly decline saw shares erase their gains for the year, with the stock now down more than 3% year-to-date. Even more alarming, MA shares are currently 21.4% below their all-time high of $367.25, reached in late August.

Mastercard reported a sharp drop in third quarter net profit last week, as the coronavirus pandemic resulted in customers spending less on its credit and debit cards due to weak travel spending.

The Purchase, New York-based credit card processor announced earnings per share of $1.60, down 26% from the year-ago period and missing expectations for EPS of $1.61. Revenue meanwhile slumped 14% year-over-year to $3.84 billion, below forecasts for sales of $3.96 billion.

The fall in revenue was largely driven by a sharp decline in travel-related spending during the summer months, with the company reporting a decline of 36% in cross-border volume, which refers to when the card issuer and merchant are from different countries.

Gross dollar volume, which is the dollar amount spent using Mastercard branded credit, increased just 1% from the same quarter a year earlier to $1.6 trillion.

Mastercard CEO, Ajay Banga, said on the company’s earnings release on Oct. 28:

“We are seeing encouraging progress in the trajectory of domestic spending, while travel spending remains a challenge.”

Banga added that it will take time for consumers to build back the confidence needed to travel. Indeed, the renewed surge in COVID-19 cases in the United States and Europe will likely continue to disrupt global travel trends in the months ahead.

From a technical standpoint, Mastercard shares have fallen below their respective 50-day, 100-day, and 200-day moving averages in recent days, which usually signals more losses ahead.

Taking all this into consideration, MA shares look set to remain under additional pressure in the coming days.