- Recession fears, U.S. jobless claims, and more earnings will be in focus this week.

- Eli Lilly is a buy with upbeat earnings, guidance on deck.

- Walt Disney is a sell with disappointing earnings expected.

- Looking for more actionable trade ideas? The InvestingPro Summer Sale is live: Subscribe for under $8/month

Stocks on Wall Street tumbled on Friday, with the Nasdaq sliding into a correction after a weaker than expected July jobs report stoked fears that the economy is headed toward a recession.

For the week, the benchmark S&P 500 and blue-chip Dow Jones Industrial Average both lost 2.1%, while the tech-heavy Nasdaq Composite slumped 3.4%.

Source: Investing.com

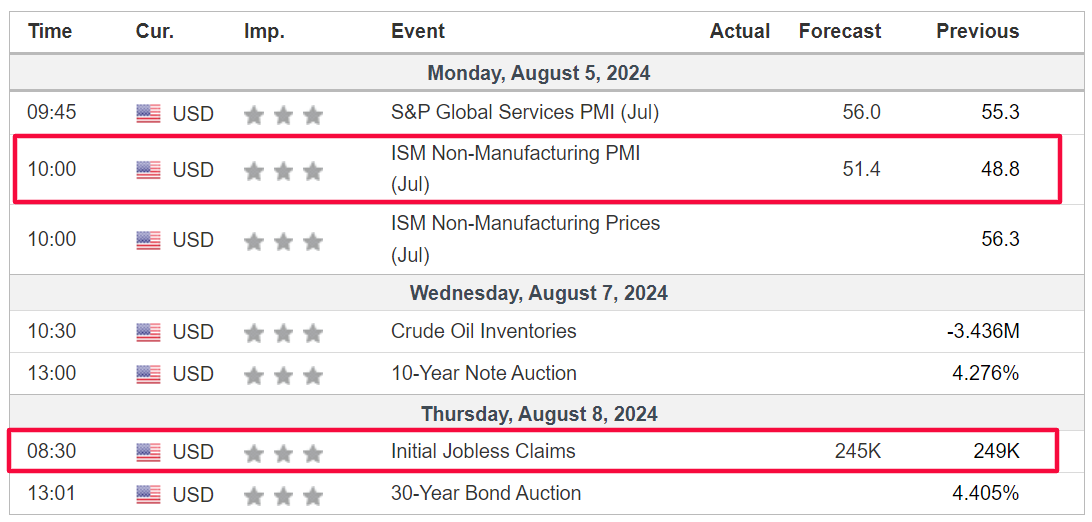

The week ahead is expected to be another eventful one as investors continue to gauge the outlook for the economy and interest rates.

The economic calendar is light, with the release of the latest jobless claims figures likely to garner most of the attention. There will also be some Fedspeak, with district governors Mary Daly and Tom Barkin set to make public appearances.

Source: Investing.com

Meanwhile, the pace of earnings slows down, though quarterly updates are still expected from notable companies such as Walt Disney (NYSE:DIS), Super Micro Computer (NASDAQ:SMCI), Palantir (NYSE:PLTR), Uber (NYSE:UBER), Shopify (NYSE:SHOP), Robinhood (NASDAQ:HOOD), Airbnb (NASDAQ:ABNB), Caterpillar (NYSE:CAT), and Rivian (NASDAQ:RIVN).

Besides that, in the healthcare sector, Eli Lilly (NYSE:LLY), the company that manufactures Zepbound and Mounjaro, and Novo Nordisk (NYSE:NVO), which manufactures Ozempic and Wegovy, both step into the earnings confessional.

Regardless of which direction the market goes, below I highlight one stock likely to be in demand and another which could see fresh downside. Remember though, my timeframe is just for the week ahead, Monday, August 5 - Friday, August 9.

Stock to Buy: Eli Lilly

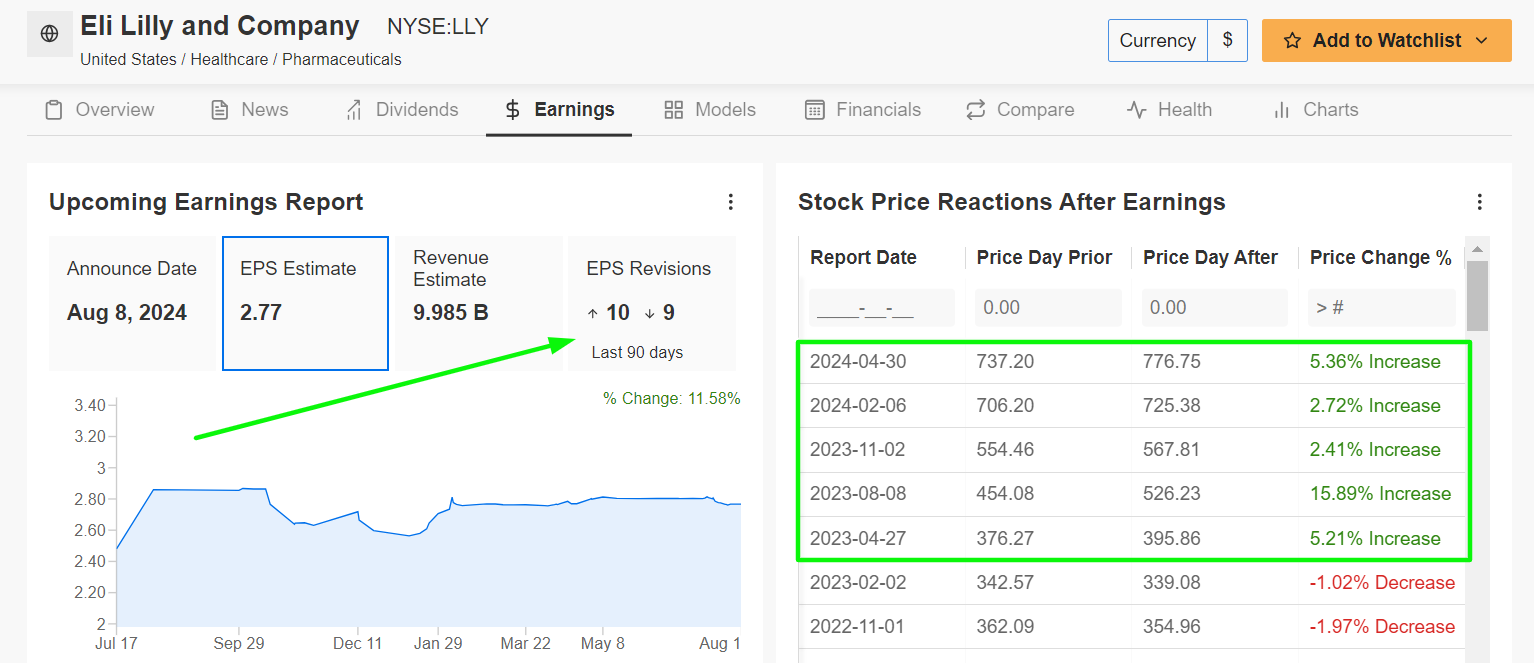

I expect a strong performance from Eli Lilly this week, as the pharmaceutical giant will likely deliver another quarter of solid top-and bottom-line growth and provide an upbeat outlook thanks to robust sales of its diabetes and obesity drugs.

The Indianapolis, Indiana-based healthcare juggernaut is scheduled to release its second quarter earnings report before the U.S. market opens on Thursday at 6:45AM ET.

Market participants expect a sizable swing in LLY stock after the update drops, according to the options market, with a possible implied move of roughly 8% in either direction. Earnings have been catalysts for outsized swings in shares this year, as per data from InvestingPro, with Lilly stock jumping approximately 5% when the company last reported quarterly numbers in late April.

Source: InvestingPro

It should be noted that 10 out of 19 analysts covering the company upwardly revised their profit and sales forecasts ahead of the report to reflect an improvement of around 12% from their initial estimates.

Consensus calls for Eli Lilly to post earnings per share of $2.77, jumping 31.3% from EPS of $2.11 in Q2 2023, as effective cost management and operational efficiencies are expected to bolster the company's margins.

Revenue is expected to rise 20.2% from the same quarter a year earlier to $9.99 billion. Analysts anticipate another strong performance from Lilly’s key drugs, especially Mounjaro, which has shown impressive growth in the diabetes and obesity treatment markets.

Investors will also be looking for updates on Eli Lilly's pipeline, particularly the progress of its Alzheimer's treatment, Donanemab, which could become a significant revenue driver if approved by the FDA.

LLY stock closed at $804.46 on Friday, within sight of its mid-July all-time high of $966.10. With a valuation of $724 billion, Eli Lilly is the world's most valuable healthcare firm and the eighth biggest company trading on the U.S. stock exchange.

Source: Investing.com

Shares have significantly outperformed the broader market so far this year, climbing 38% in 2024. The pharma giant has experienced a surge in its stock price over the past year, driven by strong sales growth in key therapeutic areas.

As InvestingPro points out, Eli Lilly is in great financial health condition, thanks to its robust earnings growth prospects and high free cash flows which have allowed it to maintain its dividend for 54 consecutive years.

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading. Subscribe now to InvestingPro for 50% OFF and position your portfolio one step ahead of everyone else!

Stock to Sell: Disney

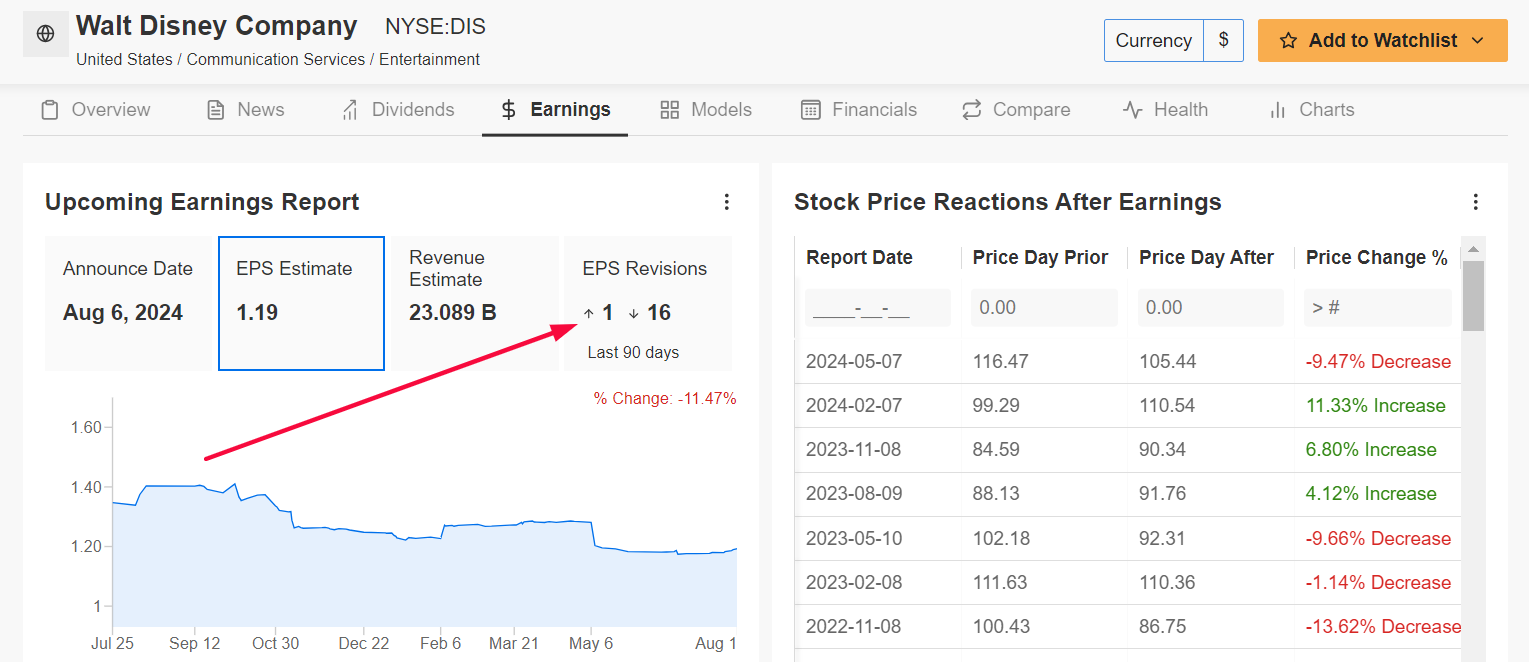

I believe Disney’s stock will suffer a difficult week ahead, with a potential revisit to recent lows on the horizon, as the entertainment conglomerate’s latest earnings will underwhelm investors amid a weak performance in its key streaming and linear TV businesses.

The Burbank, California-based company is likely to provide cautious forward guidance, reflecting the challenges in its streaming business and the uncertain economic environment impacting its theme parks and media networks.

Disney’s earnings for its fiscal third quarter are scheduled to come out ahead of the opening bell on Wednesday at 6:30AM ET. Options trading implies a roughly 6% swing for DIS shares after the update drops.

Underscoring several headwinds Disney faces amid the current macro environment, an InvestingPro survey of analyst earnings revisions points to mounting pessimism ahead of the FQ3 print, with 16 out of 17 analysts cutting their EPS estimates in the last 90 days.

Source: InvestingPro

Wall Street sees the House of Mouse earning $1.19 a share for the three-month period ended July 1, increasing 15.5% from a profit of $1.03 in the same quarter last year. Meanwhile, revenue is forecast to rise 3.3% year-over-year to $23.1 billion.

As always, all eyes will be on streaming subscriber tallies for Disney+ and ESPN+, which are both expected to dip slightly during the quarter as consumers become more cost conscious about their media spending habits.

Beyond day-to-day operations, I expect CEO Bob Iger to address several challenges the company currently faces on the post-earnings call, including slowing subscriber growth for its Disney+ streaming service, ongoing disruptions in its theme park operations, and weaker-than-expected box office performances.

DIS stock closed at $89.57 on Friday, falling back towards a four-year low of $78.73 reached in October 2023. At current levels, Disney has a market cap of $163.3 billion.

Source: Investing.com

The entertainment company’s stock has underperformed the broader market by a wide margin in 2024, with DIS shares down about 1% year-to-date.

Be sure to check out InvestingPro to stay in sync with the latest market trend and what it means for your trading decisions.

This summer, get exclusive discounts on our subscriptions, including annual plans for less than $8 a month!

Subscribe here and unlock access to:

- Fair Value: Instantly find out if a stock is underpriced or overvalued.

- ProPicks: AI-selected stock winners with proven track record.

- Stock Screener: Search for the best stocks based on hundreds of selected filters, and criteria.

- Top Ideas: See what stocks billionaire investors such as Warren Buffett, Michael Burry, and George Soros are buying.

Don't miss this limited-time offer.

Disclosure: At the time of writing, I am long on the S&P 500, and the Nasdaq 100 via the SPDR S&P 500 ETF (SPY (NYSE:SPY)), and the Invesco QQQ Trust ETF (NASDAQ:QQQ). I am also long on the Technology Select Sector SPDR ETF (NYSE:XLK).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies' financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.

Follow Jesse Cohen on X/Twitter @JesseCohenInv for more stock market analysis and insight.