- U.S. inflation data, retail sales, bank sector contagion fears will drive markets in the week ahead.

- Boeing shares are a buy on news of huge Saudi Arabian aircraft order.

- Roku stock is set to underperform amid fallout from Silicon Valley Bank failure.

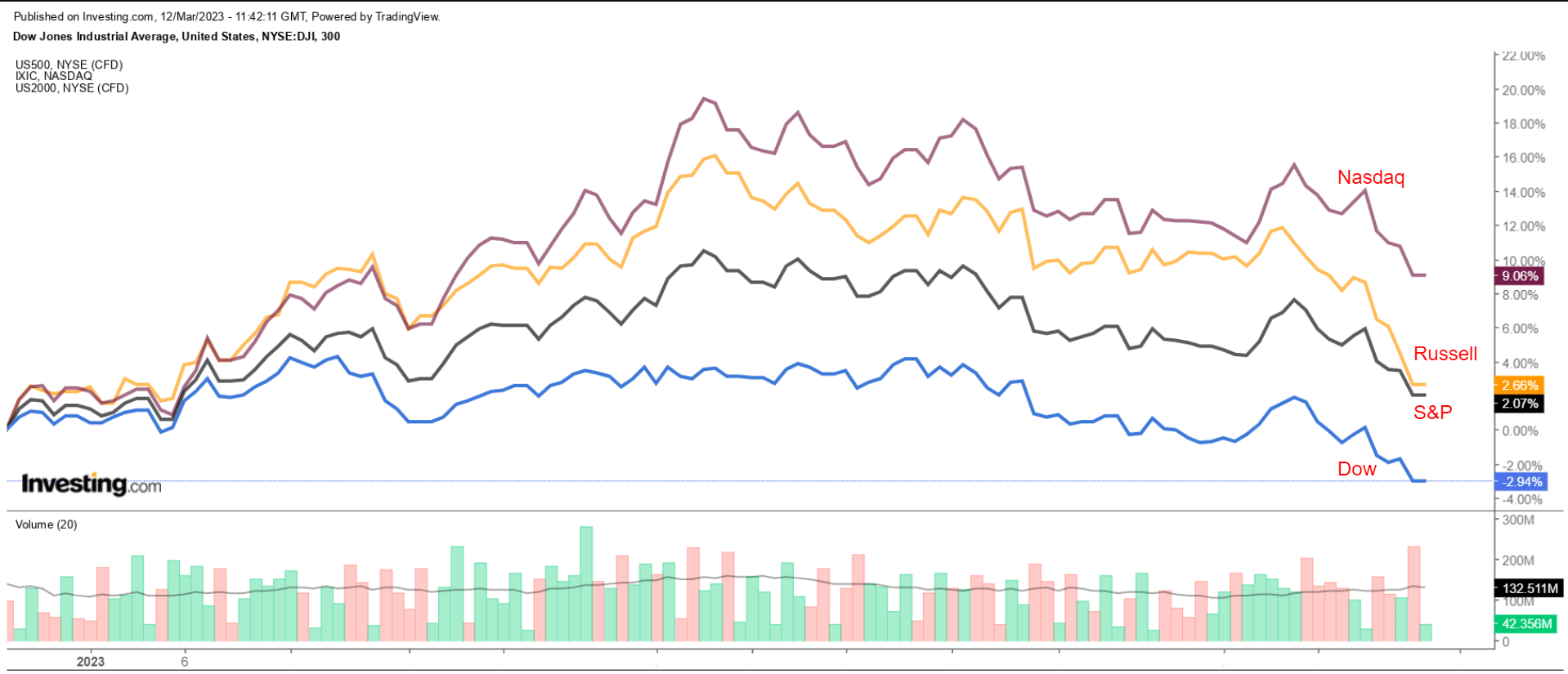

Stocks on Wall Street plunged on Friday, as investors ran for the exits over fears of contagion in the financial sector and uncertainty regarding rising interest rates following strong February employment data showing the economy added more jobs than expected.

For the week, the blue-chip Dow Jones Industrial Average fell 4.4% to notch its biggest weekly loss since June, while the benchmark S&P 500 lost 4.6% in its largest weekly percentage decline since September.

Meanwhile, the tech-heavy Nasdaq Composite slumped 4.7%, suffering its worst weekly drop since November. The small-cap Russell 2000 tumbled 8%.

The blockbuster week ahead is expected to be a busy one filled with several market-moving events as investors continue to gauge the outlook for inflation, the economy, and interest rates.

Fresh uncertainties around the health of U.S. banks will also be in focus after regulators shut down SVB Financial Group (NASDAQ:SIVB) in what was the largest bank failure since the 2008 financial crisis.

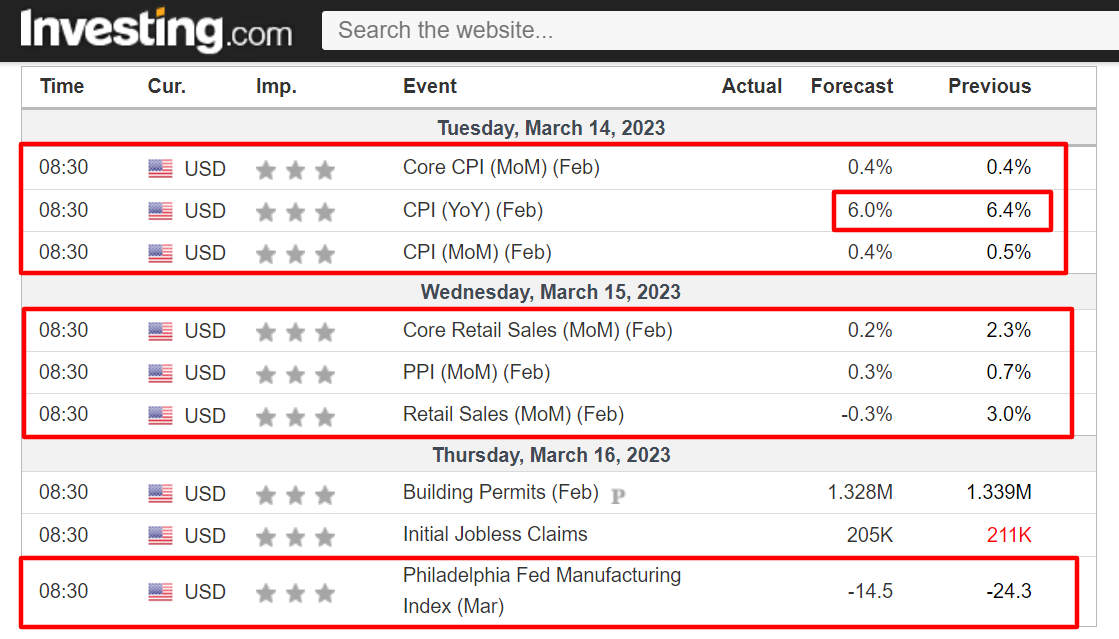

On the economic calendar, most important will be Tuesday’s U.S. consumer price inflation report for February, which is forecast to show headline annual CPI cooling to +6.0% from the +6.4% increase seen in January.

Reports on producer price inflation, retail sales, initial jobless claims and multiple manufacturing reports are also on the agenda.

The data will be key in determining whether the Federal Reserve will raise interest rates by 25 basis points or 50bps at the FOMC meeting on March 21-22.

Currently, financial markets are pricing in a 60% chance of a quarter-point increase at this month’s policy meeting and a 40% chance of a larger half-point rate hike, according to Investing.com’s Fed Rate Monitor Tool.

Elsewhere, on the earnings docket, there are just a handful of corporate results due, including FedEx (NYSE:FDX), Adobe (NASDAQ:ADBE), Dollar General (NYSE:DG), Five Below (NASDAQ:FIVE), Lennar (NYSE:LEN), and Xpeng (NYSE:XPEV).

Regardless of which direction the market goes, below I highlight one stock likely to be in demand and another which could see further downside.

Remember though, the timeframe is just for the upcoming week.

Stock To Buy: Boeing

I expect Boeing's (NYSE:BA) stock to march higher in the week ahead, following promising news that Saudi Arabia’s Public Investment Fund and the U.S. airplane manufacturer are closing in on a new aircraft order valued at $35 billion.

According to a report in the Wall Street Journal on Saturday, people familiar with the matter said the deal is expected to include a large number of wide-body commercial jets often used for longhaul international flights that will serve in the fleet of the Kingdom's new national airline, RIA.

The Saudi sovereign-wealth fund is expected to announce the groundbreaking order as soon as Sunday, during an official launch of the airline.

Boeing and its main competitor Airbus (OTC:EADSY) had been lobbying for the Saudi deal for months, according to the WSJ report, citing people with knowledge of the agreement.

The new order should further ease worries surrounding a lack of demand for Boeing’s commercial airplanes due to the uncertain economic outlook and will serve as a positive catalyst for the stock in my opinion.

The deal would mark another significant aircraft order for Boeing in recent weeks after Air India agreed to purchase a total of 220 jets from the U.S. aerospace giant in February. It was the largest commercial-jet order in aviation history, valued at roughly $85 billion.

BA stock ended Friday’s session at $203.07, within sight of its recent 52-week high of $221.33 touched on Feb. 14. At current levels, Boeing has a market cap of about $122 billion.

Shares have held up better than the broader market so far in 2023, rising 6.6% to far outpace the 0.8% year-to-date gain recorded by the Industrial Select Sector SPDR® Fund (NYSE:XLI), which tracks a market cap-weighted index of industrial-sector stocks drawn from the S&P 500.

Stock To Sell: Roku

I believe shares of Roku (NASDAQ:ROKU) will suffer a challenging week ahead as investors react to fresh negative developments plaguing the streaming platform and hardware provider amid fallout from the shock collapse of Silicon Valley Bank, a high-profile lender to the technology sector.

Roku disclosed in a filing to the Securities and Exchange Commission late Friday that recently failed SVB held $487 million, or roughly 26% of its $1.9 billion in total cash, with those deposits "largely uninsured." The company added that its remaining $1.4 billion in cash and cash equivalents is “distributed across multiple large financial institutions.”

Though Roku noted that it does not believe SVB's collapse will significantly hinder operations, it remains unclear how much money the streaming company will be able to recover.

“At this time, the company does not know to what extent it will be able to recover its cash on deposit at SVB,” Roku warned in the filing.

As an FDIC-insured lender, all accounts at SVB with up to $250,000 are fully guaranteed by the federal government. However, companies with accounts that exceed $250,000 must call an FDIC hotline to move forward.

Uninsured depositors will be given a receivership certificate for the amount of their uninsured funds. As the FDIC sells the assets of SVB, future dividend payments may be made to uninsured depositors, though the timing and total sum remain unclear.

ROKU stock closed at $59.99 on Friday, earning the San Jose, California-based streaming media company a market valuation of $8.4 billion.

Shares, which rallied throughout January and February along with the tech-heavy Nasdaq, are up a massive 47.4% thus far in 2023. Notwithstanding the recent turnaround, the stock remains approximately 88% below the July 2021 record peak of $490.76.

Disclosure: At the time of writing, I am short on the S&P 500 and Nasdaq 100 via the ProShares Short S&P500 (NYSE:SH) and ProShares Short QQQ (NYSE:PSQ). I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies' financials. The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.