Asian share markets are seeing a big surge in Japan as the vacuum of closed Chinese markets for the Chinese New Year break and a much lower Yen is helping lift spirits alongside a continued strong lead from Wall Street. The USD is firming again across the board with the Australian dollar still looking very weak as it rolls below the 65 cent level.

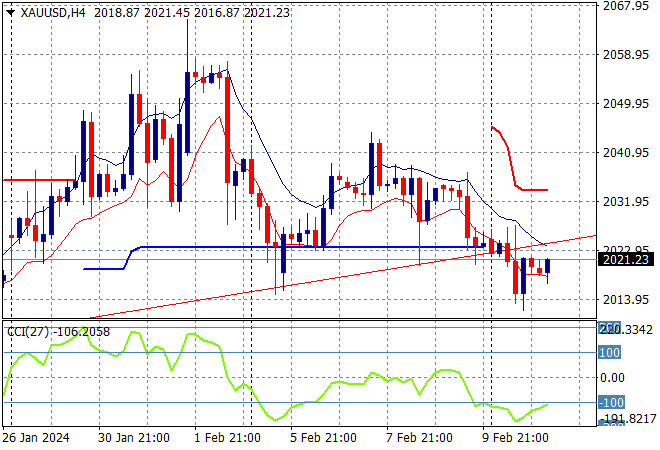

Oil prices are gaining slightly with Brent crude inching above the $82USD per barrel level while gold is failing to push higher in Asian trade as it begins to stumble at the $2020USD per ounce level:

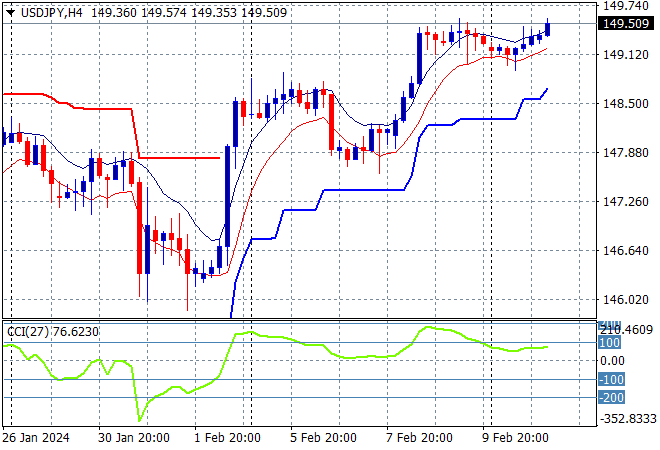

Mainland and offshore Chinese share markets remain closed during the Chinese New Year holiday. Japanese stock markets are surging with the Nikkei 225 closing nearly 3% higher at 37883 points while the USDJPY pair has lifted slightly from its Friday night close to just above the mid 149 level, poised for a breakout:

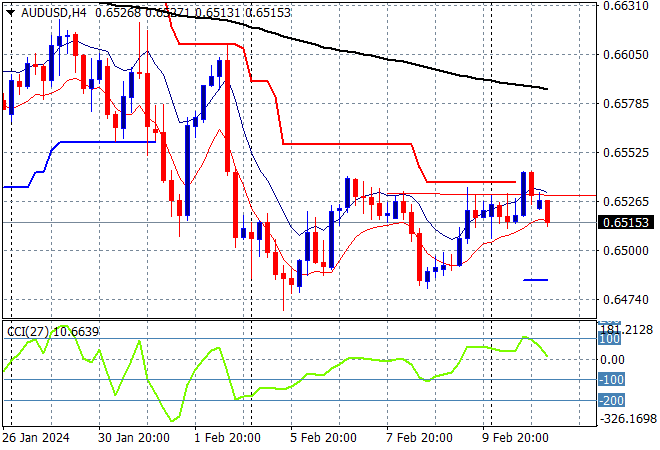

Australian stocks are still not doing well as the trading week continues with the ASX200 down nearly 0.2% at 7606 points while the Australian dollar is rolling over again following the recent half hearted bounce above the 65 cent level from last week’s RBA meeting:

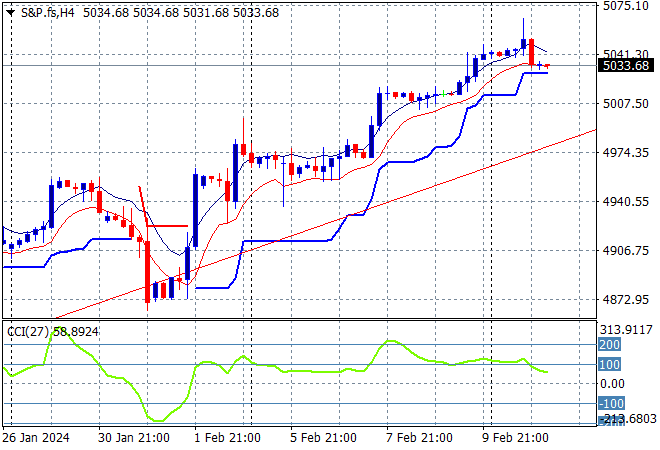

S&P and Eurostoxx futures remain solid and on trend going into the London session as the S&P500 four hourly chart shows price action zooming well above the 5000 point level, although ATR support is slowing down:

The economic calendar includes UK unemployment, the German ZEW survey and the January core inflation/CPI print in the US.