Yandal Resources Ltd (ASX:YRL) has delivered a maiden inferred resource of 17,000 ounces of gold for its Parmelia deposit within the Mt McClure Gold Project in the Yandal Greenstone Belt of Western Australia.

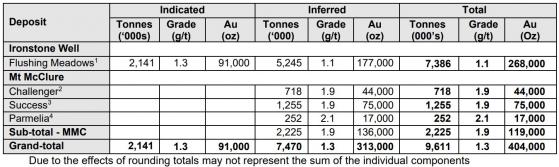

The new resource has helped boost the company’s total resources at Yandal to 404,000 ounces and demonstrates the potential to further increase the resource through targeted step-out drilling.

Mineral resource inventory summary.

The Mt McClure Gold Project covers 36 square kilometres of tenure about 20 kilometres south-west from the historical Bronzewing mine and is close to existing haul roads and Northern Star’s Orelia Development.

Mt McClure includes three historic mining areas; Challenger, Success and Parmelia which all have substantial mineralisation beneath the base of mining as defined by historical and more recent drilling by Yandal.

Yandal managing director Tim Kennedy said: “With the completion of the Parmelia MRE we now have 136,000oz of gold Resources at Mt McClure based predominantly on historic drilling completed in advance of proposed mining operations.

“The process of completing these MRE’s has demonstrated the fantastic potential at Mt McClure to increase the Resource base through targeted step-out drilling.

“It has also highlighted to our team the potential of new positions in the footwall to known mineralisation and several compelling structural and geophysical targets in the hanging wall sequence that are evident in aeromagnetic data."

Mt McClure Project plan showing recent drilling, interpreted bedrock lithology, major structures and proximity to third party prospects, haulage and processing infrastructure.

Strategy

Yandal’s strategy at Mt McClure is threefold:

1. define and quantify the remnant resources immediately below the historical open pits (completed);

2. target potential higher-grade zones beneath the defined remnant resources, potential strike extensions and new footwall zones; and

3. test structural and other high-value targets identified from aeromagnetic interpretation.

Next steps

Key exploration activities planned during the September and December quarters include:

- review historic and recent drilling data at the Mt McClure Project to establish controls on potential higher grade plunging shoots and RC (reverse circulation) drill testing to expand the initial resource estimates at Challenger, Success and Parmelia;

- RC follow-up along the high-grade Sims Find trend and other advanced prospects at Barwidgee;

- aircore programs to test priority targets at Ironstone Well and Barwidgee including Newport, Quarter Moon, Oblique and Barwidgee Shear; and

- aircore drilling at Mt McClure testing structural targets identified from aeromagnetic data.

Read more on Proactive Investors AU