Xantippe Resources Ltd (ASX:XTC, OTC:XTCPF) is hoping to shore up its lithium interests in Argentina through a 25% stake in a Catamarca lithium brine property and a growth-focused capital raise.

The ASX-lister has tabled a non-binding proposal to acquire a 25% interest in the Fundos del Plata IV mining property for US$5 million — a move that would boost its exposure to lithium brine assets in South America’s famed Lithium Triangle.

Xantippe remains in negotiations with the seller, Minera Collasuyo, and plans to conduct due diligence as it finalises the deal and chases third party approvals.

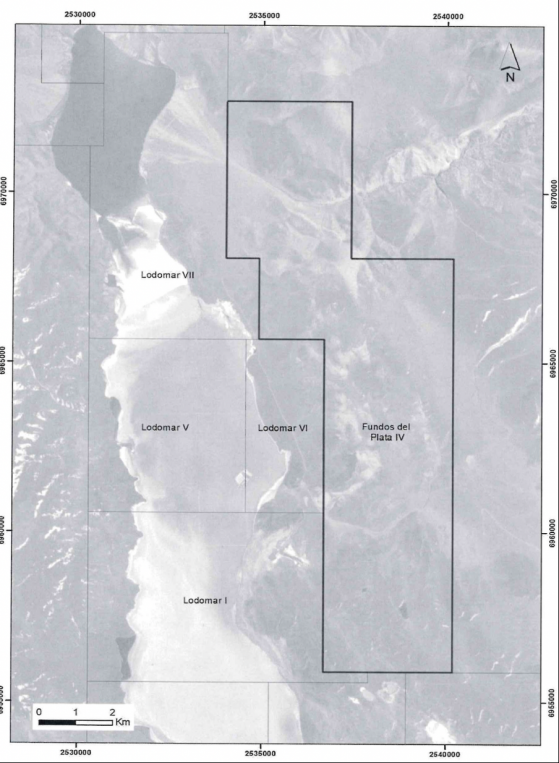

The Fundos del Plata IV mining property.

Concurrently, the lithium stock has launched a renounceable entitlement offer to raise up to A$45.9 million — capital that will fund exploration programs, help initiate lithium technology, facilitate logistics and supply chain operations and provide working capital.

Exploration a high priority

Xantippe executive chairman John Featherby said he looked forward to updating shareholders on the company’s progress as it moved through due diligence.

“This proposal to acquire a 25% interest in the Fundos del Plata continues the company’s strategy of becoming a major lithium brine producer in the heart of the prolific Lithium Triangle of South America.

“We are delighted to have the opportunity to acquire such a high-quality project alongside such significant global mining companies like Zijin Mining.

“Subject to acquisition and necessary approvals, we will commence exploration activities as soon as possible.

“The acquisition of Fundos del Plata IV would add to our strategy of extending our footprint in Latin America and developing a Lithium product sourced from brines in South America that will offer a clean product using direct lithium extraction, which requires a smaller environmental footprint and uses less water.”

Xantippe has two months to exclusively conduct due diligence and negotiate a binding deal. This means there’s no guarantee that an agreement will eventuate, but the ASX-lister will keep shareholders abreast of any material developments.

Entitlement offer and consolidation

XTC’s entitlement offer opens the door for eligible shareholders to acquire four new shares for every one already held at 0.1 cents a pop.

The offer is set to open on August 1 and close 10 days later, with results announced to the market on August 17.

A share consolidation will follow the raise in September, proposed to convert every 200 ordinary shares into one to manage volume and build a platform for future growth.

It’s hoped the consolidation will optimise Xantippe’s capital structure and deliver a more appropriate share price for a wider range of investors.

Importantly, as the consolidation applies equally to all security holders, it will have no material effect on the percentage shareholding interest of each individual shareholder.

A full breakdown of the key indicative dates is tabled below:

Featherby concluded: “With the appointment of Roth Capital Partners as strategic advisors, operations and relationships now established in Argentina and a core team in place, XTC is looking to capitalise on its strategic position within the Latin American lithium potential.

“It is an exciting time for the company.”

Read more on Proactive Investors AU