Bitcoin has emerged as a major benefactor of the chaos in the financial markets, in more ways than one.

Sure, the price action on the BTC/USDT pair has been exceptional, what with the massive 30% spike this week, sending the pair above US$26,000 for the first time since June 2022.

In comparison, the Nasdaq added around 5% while London’s footsie index crashed 5%.

The narrative has turned somewhat nostalgic, with some spectators heralding bitcoin’s reemergence as a safe haven asset, a viewpoint that has disappeared in recent years.

There is some justification for this opinion. As Mark Twain once quipped: “Buy bitcoin, they’re not making it anymore.”

OK, he was talking about land, but the same applies to bitcoin. Supply is limited to 21 million coins, and there will never be any more.

But while they’re not making bitcoin anymore, it’s still a hugely volatile asset. It’s also technically just a few lines of code on an invisible ledger, so the safe haven narrative is controversial at best.

Safe haven or not, investors clearly see the grandaddy cryptocurrency’s appeal at this point in time, what with the traditional finance sector throwing a tantrum, equities markets down with it.

So yes, bitcoin is on a roll, but that doesn’t necessarily apply to the wider cryptocurrency market, as evidenced by the second way bitcoin is surging: Dominance.

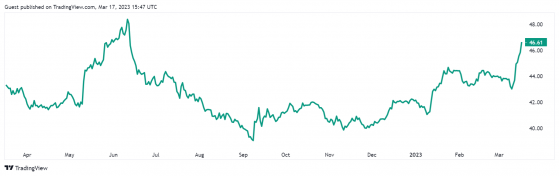

As of Friday afternoon, March 17, bitcoin constituted 46.59% of the entire value in the cryptocurrency markets, nearly 10% higher in the past seven days alone.

Source: tradingview.com

Though far from the 67%-plus dominance seen back in the fine year that was 2020, bitcoin’s latest dominance rally implies a considerable level of consolidation in the crypto markets, a subjective ‘flight to quality’ perhaps.

Is bitcoin volatile? Yes. Is bitcoin as volatile as say Solana? Hell no. So with bonds and equities plummeting left right and centre, investors are putting their money in the safest bet they have at their disposal.

Funnily enough, given how uncorrelated TradFi and bitcoin are right now, the same thing is playing out in the financial sector.

Following the triple collapse of Silvergate Bank, Signature Bank and Silicon Valley Bank, spooked customers of other regional banks were quick to withdraw their funds and stuff them into supposedly too-big-to-fail banks like JPMorgan (NYSE:JPM), Citibank and hopefully not Credit Suisse (SIX:CSGN).

So should you buy bitcoin since they’re not making it anymore?

As part of a diversified portfolio, maybe, just be aware that safe havens don’t always stay safe.

Read more on Proactive Investors AU