Highlights

- Novonix (ASX:NVX)' shares were trading at AU$2.57 each, up 16.29% on ASX at 11.28 AM AEDT.

- The company has been chosen for US$150 million grant by the US Department of Energy (DOE).

- The money would be used to build a 30,000 tpa US production facility.

Shares of Novonix Ltd (ASX:NVX) were trading higher on Monday, in sync with the overall market which was also trading sharply higher.

At 11.28 AM AEDT, the shares of technology hardware & equipment company’s shares were trading at AU$2.57 each, zooming 16.29% on ASX. This outperforms ASX 200 Information Technology index, which was 1.76% up at 1,423.30 points today at 11.29 AM AEDT. Meanwhile, the ASX 200 index was also 1.88% up at 6,802.00 points at 11.30 AM AEDT.

Why are Novonix' shares trading higher?

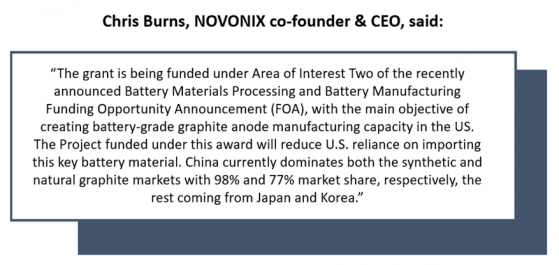

On 19 October, Novonix requested a trading halt to announce a ‘material funding arrangement’. On 20 October, Novonix announced that the US Department of Energy (DOE) had chosen Novonix Anode Materials division to begin grant funding discussions for US$150 million to enhance its domestic manufacturing of high-performance, synthetic graphite anode materials.

On 21 October, Novonix replied through an ASX filing to a query regarding the given grant being provided by the US Department of Energy.

Post this news, the company's shares closed at AU$2.28 each (on 20 October), up 7% from its previous close (19 October). Since then, Novonix' shares have been closing higher at AU$2.21 per share on 21 October. Today too, the shares have been jumping higher.

The US$7 billion allocated by the President's Bipartisan Infrastructure Law for the battery supply chain in the first wave of funding announced by the Department of Energy supports Novonix execution of its strategic growth plan for synthetic graphite anode materials made in US.

The company will use the money specifically towards building a 30,000 tpa US production facility, which includes site selection, plant layout, and engineering design with room for future development.

Image Source: © 2022 Kalkine Media ®

Data Source- Company announcement dated 20 October

This grant, which President Biden announced, strengthens the North American battery supply chain in the face of rising demand and calls to bring these vital businesses home. Negotiations will cover the specifics of the completed project, such as its overall cost, operational milestones, and when grant money will be made available. According to the agreement, government funding must at least be matched by the grant recipient. Novonix will update the market after talks with the DOE have been successfully concluded.

Novonix' stock performance

Shares of Novonix have climbed over 39% in the last month. However, the shares have fallen more than 51% in the previous six months and around 75% on a year-to-date (YTD) basis.