West Wits Mining Ltd's (ASX:WWI) farm-in partner Rio Tinto (ASX:RIO) has kicked off the 2023 field season at the Mt Cecelia Project in Western Australia by completing a downhole electromagnetic (DHEM) survey operation.

The DHEM survey has been completed across all four holes drilled in 2022 to better delineate the location of any off-hole conductors at the primary target SGC_1.

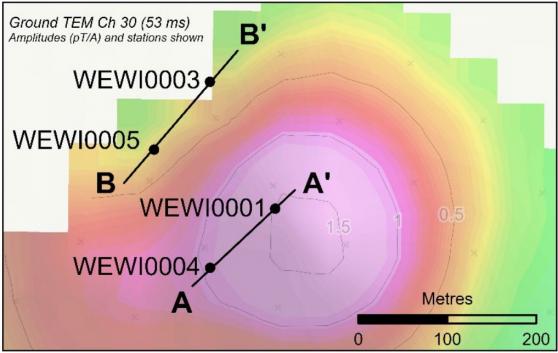

Four drill holes over the modelled ground transient electromagnetic.

The intention is to use these results, which are expected to be available in June 2023, to guide a diamond drill campaign which tests the SGC_1 target using existing heritage cleared areas with estimated completion late in the 2023 season.

The DHEM survey process involves geophysical instrumentation being lowered by wireline down the completed drill- holes and systematically collecting measurements at various positions through the hole to identify the position of conductive zones.

This geophysical information will further assist in follow up diamond drill hole planning.

“An opportunity to re-interpret targets”

West Wits chief executive officer and MD Jac van Heerden said: “The Mt Cecelia ground exploration program should enhance our understanding of Mt Cecelia Project’s anomalies, providing valuable insights that will direct our diamond drilling campaign planned for later this year.

“The promising results from our maiden drilling campaign at the SGC_1 target have given us great confidence in the potential of the project.

“As we move forward, we see an opportunity to re-interpret targets SGC_2 to SGC_8, based on the positive outcomes thus far.”

Read: West Wits Mining partner hits 82 and 56 metre gold intervals in maiden drilling at Mt Cecelia

The first pass drilling program at the Mt Cecelia Project targeted a moderately-strong EM conductivity anomaly identified from airborne and ground EM surveys previously undertaken by West Wits.

The anomalies were interpreted as potential bedrock conductors that may represent base metal sulphide mineralisation.

Assay results received for holes WEWI0001 and WEWI0004 reported in January 2023 highlighted significant intervals of gold mineralisation, with both holes ending in gold mineralisation:

- Hole WEWI0004 contained 24m (metres) @ 0.95 g/t Au (gold) within a broader mineralised interval of 82m @ 0.51g/t Au; and

- hole WEWI0001 contained 20m @ 0.93 g/t Au within a broader mineralised interval of 56m @ 0.55g/t Au.

The geology, including gold mineralisation, intersected in the initial RC drill program is considered unlikely to be the primary source of the EM conductivity anomaly at the SGC_1 target.

The observed presence of alteration zones indicates fluid movement and possible structural dislocation within the stratigraphic package.

This could be related to a range of different styles of mineralisation systems.

Diamond drilling will recover solid core which will assist in a better understanding of the prevailing geology and mineralisation, as well as provide better information on possible geological structures present.

Read more on Proactive Investors AU