West Wits Mining Ltd (ASX:WWI, OTCQB:WMWWF) has unveiled a new and improved definitive feasibility study (DFS) for its Qala Shallows gold asset — a key building block within the company’s flagship Witwatersrand Basin Project near Johannesburg, South Africa.

The update comes just under a year after the gold stock released its initial Qala Shallow DFS in August 2022, with core production and financial metrics improving across the board.

West Wits chair Michael Quinert said the updated DFS set the scene for the company to deliver a “substantially larger gold project”.

“These figures emphasise the project's value and its potential to deliver substantial returns to our shareholders,” he explained.

“There is good reason to be excited about the future prospects of the Witwatersrand Basin project.”

Production profile

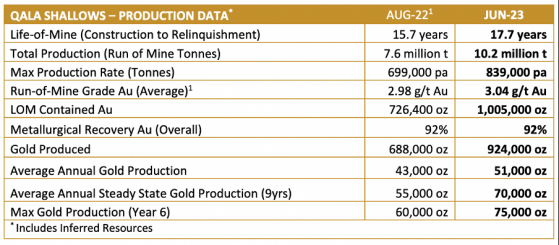

The revitalised Qala Shallows study envisages a 38% jump in the asset’s recovered gold rates, setting the bar at 924,000 ounces over the project’s near-18-year mine life.

Within that, WWI expects steady-state production to hit roughly 70,000 ounces (a 27% increase on previous figures) over a 9-year period.

The DFS models two mine schedules, updated in terms of JORC 2012 requirements:

- Base case: A life of mine plan that targets all measured, indicated and inferred resources; and

- Ore reserve: A life of mine plan that targets measured and indicated material only.

Finally, the asset’s ore reserves now stand at 4.03 million tonnes at 2.71g/t for 351,400 ounces of contained gold — up 21% from earlier calculations.

Financial highlights

The DFS has also delivered good news on the financial front; the company has managed to lower the asset’s all-in-sustaining cost by 10.7%, bringing the per-ounce metrics under the US$1,000 benchmark.

Meanwhile, pre-tax and post-tax net present value calculations (US$367 million and US$255 million, respectively) are more than double what was outlined in the 2022 study, while free cashflow is up 95% to US$522 million.

The new Qala Shallows DFS forecasts payback just after four years of operations — down roughly 20% from the five-year period previously estimated. Funding requirements are also lower, expected to hit US$54 million over a three-year period rather than the US$63 million anticipated in 2022.

WWI says higher operating and capital cost estimates (resulting from increased production) were offset by favourable revenue calculations for the three-year funding period, as well as favourable movements in the gold price and South African Rand.

Funding opportunities

The IDC — a prominent development finance institution in South Africa — has expressed formal interest in seeding ZAR300 million (roughly US$15.9 million) in funding to support Qala Shallows’ development.

Both parties are now collaborating to expedite the due diligence process and secure final approval, as set out in the terms and conditions relayed by the IDC’s Executive Credit Committee.

The early funding will help WWI mobilise a mining contractor and secure the equipment needed to kickstart operations.

From here, it plans to build a 30,000-tonne stockpile, laying the groundwork so it can begin delivering 15,000 tonnes of ore every month to Sibanye-Stillwater’s gold plant.

WWI is also committed to securing the balance of Qala Shallow’s US$54 million funding package as it continues talks with prospective investors.

Read more on Proactive Investors AU