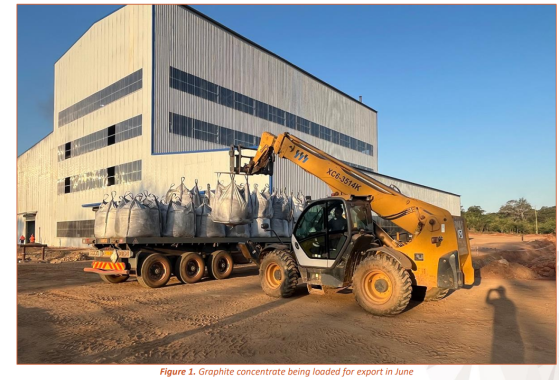

Walkabout Resources Ltd (ASX:WKT) is poised to make its maiden shipment of graphite concentrate from the Lindi Jumbo Graphite Mine in Tanzania to Europe, scheduled for early this month.

The company is hailing this as the emergence of a new global graphite mining jurisdiction in Tanzania.

Walkabout is developing the high-grade Lindi Jumbo Graphite Project in the country's southeast to capitalise on market conditions for large and jumbo flake graphite products.

Ramp-up plan

The mine continues to receive regular pilot orders, ranging from 20 to 80 tonnes, which are being fulfilled from concentrate produced during the commissioning and ramp-up phase.

To support this, plant throughput is being increased as part of a ramp-up plan to achieve at least one-third of the nameplate production capacity by the end of July.

Meanwhile, mining, operating and logistics costs are being closely monitored and managed, and the company is making efforts to mitigate the impacts of inflation.

At full production, Lindi Jumbo aims to be the highest margin-producing graphite mine globally.

The first shipment of pilot concentrate will be loaded onto a vessel bound for Europe in early July, with further exports planned for various destinations in Asia.

All exports from Tanzania require verification sampling and analysis at a Tanzanian Government-contracted laboratory to validate the product chemistry determined at the Lindi Jumbo lab.

The permanent operations team at Lindi Jumbo is nearing full strength, with around 100 people, including more than 40 from local communities.

The team continues to test and optimise the plant to ensure the concentrate produced meets the required grade, size and quality.

Final concentrate purity has been above 92% total graphitic carbon (TGC) with some runs achieving up to 95% TGC.

Most operating costs have now been contracted, with efforts to minimise diesel usage in the drying circuit.

One of lowest cost mines

Despite overall plant operating costs being expected to be around 35% higher than the 2019 definitive feasibility study (DFS), Lindi Jumbo remains one of the lowest-cost producing mines globally, with one of the highest basket prices.

First cash revenue from pilot sales will be received upon loading of the vessels in July. The company has drawn on its senior debt facility to fund commissioning and operating costs during the ramp-up phase.

The senior debt lender has agreed to extend the loan grace period to December 31, 2024, and the final repayment date to December 31, 2026, subject to conditions.

As one of the few operating graphite mines outside China, Walkabout says it is regularly approached by customers seeking further value from its coarse flake products.

The board is considering the timing to investigate downstream growth opportunities that could increase future graphite production from the Lindi Jumbo Graphite Mine.

"Demand is vibrant"

Managing director and CEO Andrew Cunningham said: “We have successfully unlocked a new graphite mining jurisdiction in Tanzania to meet global demand.

"Demand for Lindi Jumbo’s graphite product is vibrant and attracting market pricing. Our focus is on continuing to methodically ramp up production and product quality to meet this demand.

"Set to be the highest margin producing graphite mine globally at full production, Lindi Jumbo continues to impress and at current estimated operating costs is currently one of the lowest cost producing mines in the world with one of the highest basket prices globally."

Read more on Proactive Investors AU