Volt Resources Ltd (ASX:VRC) has formally adopted an Environmental, Social and Governance (ESG) framework as it looks to develop and operate mines and plants that process minerals required for the manufacture of lithium-ion and other battery technologies.

The graphite producer and battery anode material developer acknowledges that while it aims to contribute to a low carbon economy, its activities have the potential to impact in either a positive or negative way.

As such, VRC is determined to ensure its activities are managed in line with best practices across all aspects of ESG.

Aspiring to be a battery minerals leader

“Volt aspires to become a leader in the battery minerals industry to support the transition to a carbon-free economy, while growing shareholder value through the sustainable development and operation of our assets,” Volt’s managing director Trevor Matthews said.

“Key to realising this is defining our environmental, social and governance (ESG) strategy within the framework industry-agreed principles, and staying true to the values in our company DNA of ‘Grow Together’, ‘Do the right thing’ and ‘Heshima Daima’ (a Swahili saying that translates to ‘always respect’).

“As we embark on our journey to embed our new ESG policy into every corporate, development and operational aspect of our business throughout their lifecycles, we do so believing that this approach will maximise the benefits our organisation delivers to all stakeholders for the long term.”

Volt has developed its ESG Policy, with the assistance of UK-based consultancy, Uvuna Sustainability, and in doing so the board identified the World Economic Forum’s (WEF) articulation of stakeholder capitalism to be most in line with its ESG principles and ambitions.

Volt has long supported positive ESG principles as evidenced by the ESIA for Bunyu’s feasibility and its conduct at Zavalievsky Graphite as an active graphite operation.

Economic pillar

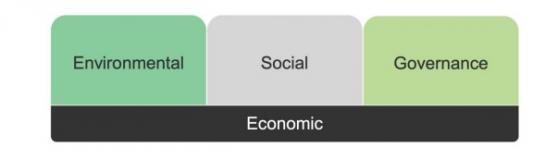

Volt believes that key to its long-term success are the four pillars aligned with the United Nations Sustainable Development Goals:

Volt's four-pillared ESG model is underpinned by the Economic enabler (ESG/E).

The WEF framework above includes an ‘Economic’ pillar which recognises the role of businesses in driving economic growth, innovation and shared wealth to establish and maintain prosperous societies.

VRC’s newly adopted ESG policy applies to its corporate offices, projects and existing and new operating sites throughout their lifecycles.

The company expects all business partners to adhere to the policy and will work with them to achieve compliance.

In this inaugural ESG Policy, Volt has prioritised implementation to the components of its business that are actively progressing with their development/operation. Their scope of ESG management at this time is limited to within site boundaries while recognising that these may have impacts beyond its boundaries.

Read more on Proactive Investors AU