Vango Mining Ltd (ASX:VAN) and Catalyst Metals Ltd (ASX:CYL) have entered into an agreement pursuant to which Catalyst will make an all-scrip, conditional off-market takeover bid to acquire all of the ordinary shares of Vango.

Catalyst will offer an implied value of A$66 million for Vango, which has a 1-million-ounce resource at 3.3 g/t in WA’s Marymia-Plutonic gold belt.

The offer will be subject to a 70% minimum acceptance condition, with 73% of Vango shareholders having already either agreed to accept or indicated an intention to accept the offer, in the absence of a superior proposal.

The off-market takeover bid will see Vango shareholders receive 5 Catalyst shares for every 115 Vango shares, subject to satisfaction or waiver of the bid conditions.

Vango shareholders will own up to 35.7% of the enlarged Catalyst group upon completion of the offer.

“Ideal recipe to create value”

The board of Vango has unanimously recommended that Vango shareholders accept the offer, in the absence of a superior proposal.

Vango executive chairman Bruce McInnes said: “Bringing together Marymia’s huge exploration upside and the funding and technical knowledge of Catalyst makes enormous sense for all shareholders.

“It is the ideal recipe to create value for all Vango shareholders and therefore the board supports the bid unanimously”.

Offer rationale

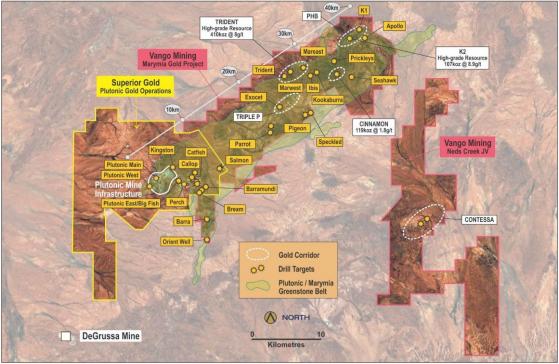

The offer is consistent with Catalyst’s strategy to control high-grade gold belts in Australia, with Vango’s highly prospective Marymia Gold Project having +40 kilometres of under-explored strike along the world-class Marymia-Plutonic gold belt in Western Australia.

In addition, the offer, if successful, will enable Catalyst to apply its significant exploration expertise, along with its operational learnings from its high-grade Henty Gold Mine in Tasmania to an aggressive exploration program across Vango’s highly prospective and strategic tenement package.

Vango’s tenements host an existing resource of 1 million ounces at 3.3 g/t and are immediately adjacent to the Plutonic gold mine, which is an operating mine with a resource of 6 million ounces, reserve of 600,000 ounces and 3Mtpa CIL processing plant.

The offer provides Vango shareholders with an opportunity to become shareholders in a gold mining company with scale, production diversification and complementary high grade gold portfolios across three significant gold belts in Australia.

Vango shareholders will also become shareholders in a financially stronger company, with enhanced trading liquidity and investment appeal.

Overview of the Marymia-Plutonic Gold Belt.

Catalyst managing director and CEO James Champion de Crespigny said: “This transaction is important for Catalyst and Vango shareholders.

“It turns a new leaf for the future of both companies.

“The combined group will have the financial strength and technical expertise to unlock the value of the prospective Marymia tenements.

“There is immense potential to create significant value for all shareholders by driving an aggressive exploration strategy on what has already proven to be a +15Moz Australian gold belt.”

Transaction details

The implied offer value of $0.052 per Vango share represents an attractive premium of:

- 19.1% to the closing price of Vango shares of $0.044 on 6 January 2023; and

- 33.5% to the 30-day VWAP of Vango Shares of $0.039.

In addition, Vango shareholders who collectively own or control a further 670 million Vango shares, representing 53% of all Vango shares, have stated their intention to accept the offer for all of those Vango shares, in the absence of a superior proposal.

Collins Street Value Fund, holder of ~A$9 million in convertible notes in Vango, is supportive of the transaction and has agreed to roll over its convertible note into Catalyst should Catalyst be successful in acquiring 100% of Vango shares.

Enlarged Catalyst overview

Upon completion of the offer, the enlarged Catalyst will control three high grade, highly prospective and strategic gold belts in Australia:

- In Victoria, a large, contiguous dominant tenement package covering 75 kilometres of strike length immediately north of the proven +22Moz Bendigo goldfields and near Agnico Eagle’s high grade Fosterville gold mine.

- In Tasmania, a strategic tenement package covering 25 kilometres of the under explored Henty fault and operates the high-grade Henty Gold Mine which has produced 1.4Moz of gold at a head grade of 8.9 g/t gold.

- In Western Australia, the strategic high-grade Marymia Gold Project, which has an existing resource base of 1Moz and considerable exploration upside potential. This includes +40 kilometres of underexplored strike along the world-class Marymia-Plutonic Gold Belt.

Read more on Proactive Investors AU