US markets rose over night, buoyed by limited gains of just 1.0% to the employment cost index, the smallest gains in a year.

It was a good day for strong earnings numbers, lifting the share price of General Motors Company (NYSE:GM) (+8.4%) and Exxon Mobil Corporation (NYSE:NYSE:XOM) (+2.2%), but Caterpillar Inc (NYSE:CAT) was down -3.5% and McDonald's Corp (NYSE:MCD) -1.3%.

US government bonds were also stronger, dropping 10-year treasury yields by 3.5`% or 4 points and two-year yields by 4.21% or 6 points.

At end of trade, the Dow was up 1.1% or 369 points, the S&P 500 1.5% and the Nasdaq 1.7% or 191 points.

This year marked the largest gains for the Nasdaq in the month of January (10.7%) since 2001.

European markets

Eurozone markets were mostly lower yesterday, dampened by economic growth of just 0.1% in the December quarter.

German retail sales fell 5.3% in the month of December, with healthcare (-0.8%) and both real estate and mining (-1.2%) following suit.

Banks were up 0.6% and the continent-wide FTSEurofirst 300 index posted the best January gain in eight years, up 6.6%, despite slipping 0.2% yesterday.

The euro gained against the dollar during European and US trade, listing from lows near US$1.0800 to highs near US$1.0875 before hovering at US$1.0870 late in US trade.

The Aussie dollar and Japanese yen also gained against the US dollar yesterday, with the Aussie lifting from lows near US$0.6986 to highs near US$0.7058 late in US trade.

The yen rose from near JPY130.49 yen per US dollar to around JPY129.77 and closed near JPY130.15.

Commodities on the rise

Base metals generally gained yesterday; copper futures rose 0.6%, with stronger gains in aluminium futures of 1.7%.

Gold futures also rose, gaining 0.3% or US6.10 to US$1,945.30 an ounce. Spot gold was near US$1,928 an ounce late in the day, while iron ore futures rose 0.2% or US$0.29 to a seven-month high of US$123.37 a tonne.

Oil prices were a mixed bag; brent crude fell by 0.5% or US$0.41 to US$84.49 a barrel, but April contracts rose by US$0.96 centre and the US Nymex crude price rose by 1.2% or US$0.97 to US$78.87 a barrel.

Looking ahead

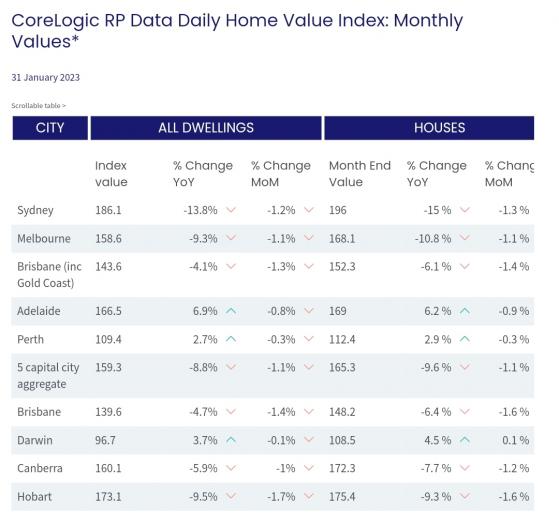

House price data is expected to be issued alongside manufacturing purchasing managers’ surveys and selected living cost indexes.

CoreLogic’s latest data reveals house prices are still falling month-on-month and year-on-year, perhaps caused by downward pressure applied by rising interest rates.

Reserve Bank officials Marion Kohler and Tom Rosewell are set to appear before the Senate Select Committee, while in China the Caixin manufacturing index is scheduled to be released.

Finally, in the US, the Federal Reserve will hand down its rate decision and the ADP (NASDAQ:ADP) employment report will be released with construction spending data, JOLTS job openings figures and the S&P Global and ISM.

Read more on Proactive Investors AU