In a remarkable shift in the commodities market, the uranium spot price reached a 16-year high, climbing 8.39% in November 2023 and achieving an impressive 67.10% year-to-date increase as nuclear energy hit the spotlight at the recently held COP 28 in UAE, according to a special report by Sprott Insights.

This surge in uranium prices has significantly outperformed other commodities, with the price breaking through the $80 per pound mark, a level not seen since the peak of the last commodity supercycle in 2007.

Dubbed the 'Nuclear COP', COP 28 marked a significant shift in global energy discourse, with nuclear energy emerging as a focal point, marking a pivotal shift in the global energy discourse

Nuclear COP

More than 20 nations, including heavyweights like the United States, France, Japan and the UK, pledged to triple global nuclear energy generation by 2050.

This commitment reflects a growing recognition of nuclear energy's vital role in achieving climate goals and the need for dependable baseload power to complement renewable energy sources.

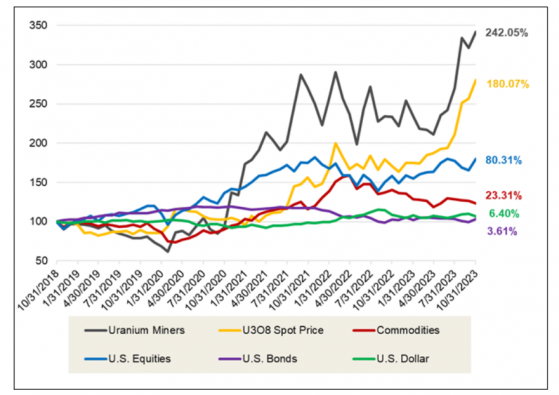

Physical uranium and uranium stocks have outperformed other asset classes over the past five years.

Geopolitical landscape

The geopolitical landscape surrounding uranium supply has become increasingly complex.

Notably, French President Emmanuel Macron's recent visit to Kazakhstan, the world's leading uranium producer, resulted in crucial agreements aimed at enhancing cooperation in nuclear energy and strategic minerals.

This development is particularly significant in light of France's strained relations with Niger, a key uranium supplier.

Similarly, legislative developments in the United States, such as the potential enactment of the Prohibiting Russian Uranium Imports Act, highlight the strategic shift in global uranium politics.

The United States, China and France represent around 58% of global uranium demand.

Uranium demand for nuclear power.

Future outlook

The global uranium market faces a concerning supply deficit, exacerbated by a decade of insufficient investment and long lead times for new projects.

The need for reactivating dormant mines and developing new ones is now more pressing than ever to meet the increasing demand.

With the persistent growth in demand and prevailing supply uncertainties, the uranium market is expected to maintain its bullish trend.

In conclusion, the report said that significant increases in uranium prices and the heightened focus on nuclear energy at COP28 underscored its growing importance in the global energy landscape.