Carefully cultivated resilience, a burning desire to prove the naysayers wrong and a strong social conscience.

Those three qualities led Alex Biggs, a working-class Brit from the southeast of London, to a decades-long career in the Australian mining industry and the CEO’s desk at Lightning Minerals Ltd (ASX:L1M).

In this article:

- Making the right connections

- Through the crucible

- Do what you say you’re going to do

- ESG as a value-adding framework

Biggs settled in Australia in 2003 as a mechanical engineer and spent some time working at the Weipa bauxite mine for Rio Tinto (ASX:RIO) Comalco.

“Somebody told me about the School of Mines in Kalgoorlie,” Biggs recalled, “I did my research, you know, that's me as a person, I'm pretty keen on being prepared for stuff.

“I realised that the school is very prestigious. I look at the School of Mines as the equivalent of Oxford or Harvard or Cambridge.”

In 2004, he decided one Thursday afternoon in November to apply to the premier mining school in Australia. By Monday, he’d been accepted and by January of the next year, he’d relocated to pursue a career in mining.

“It was fortuitous, a lot of things sort of lined up, but that was the best decision that I ever made.”

Biggs wasn’t just looking for a career or an industry – he was searching for a community, mentors and peers to debate and collaborate with, to innovate and experiment alongside.

“It was always about engineering those pathways and making the right connections, having the correct mentors, really being proactive on that front, and it certainly worked for me,” Biggs said.

“It's that type of industry. It's very practical, it's vocational and I think that's really important because when things are practical and vocational, you can't be anything but honest, because it shows.

“People will notice.”

Through the crucible

Alex Biggs has not had an easy life.

He left the UK for better opportunities, graduated with the leading Australian mining institution at his back and had begun to carve out a successful career for himself when strife and struggle reared its' ugly head, as it so often does.

In 2009, Biggs was diagnosed with a brain tumour.

“There was a period there where I thought, you know, maybe I’m not gonna make it,” he remembered.

“It puts things in perspective.”

Biggs figured he’d achieved a lot for 30 years of life, but he wasn’t ready to throw in the towel just yet.

“I sort of looked back and thought, ‘Well, you’ve really had a go. You haven’t sat back’,” he recalled.

“So, I decided that when I come through it – and it was when, it wasn’t if – I’m just gonna double down, and double down again, and that’s what I did.”

A boxer by training and a fighter by nature, Biggs defeated the tumour in the same way he approaches all struggles in life: a positive attitude, a healthy routine and the determination to always show up.

“What you’ve gotta do, and I say this to my team too, is just swim in deep water, all the time. I’ve done that my whole life – my whole career – and I haven’t drowned yet,” he chuckled.

“You need to keep challenging yourself and keep pushing yourself, keep asking questions, and keep putting yourself in uncomfortable positions and situations. That's how you make it.”

Do what you say you’re going to do

“Making it” in the junior mining industry isn’t easy to measure, let alone achieve.

Biggs has gone from strength to strength during his career, having occupied a management capacity in more than half a dozen resource and capital companies, with experience in operations, consulting and finance, and expertise in feasibility studies, project evaluation and project management.

His most recent jump was to Lightning Minerals, a newly listed critical minerals company targeting lithium as well as nickel, cobalt, copper and platinum group elements (PGE) in Western Australia.

“It’s a new IPO, so it’s a little bit different,” he explained, “You don’t have the kind of hangover and problems from the past, the hangers-on, and billions of shares on issue.

“You can build the company the way you want to build it.”

Lightning Minerals holds four projects - Mt Jewell, Mailman Hill, Mt Bartle and the flagship Dundas Project - prospective for lithium, nickel, copper, PGE and gold.

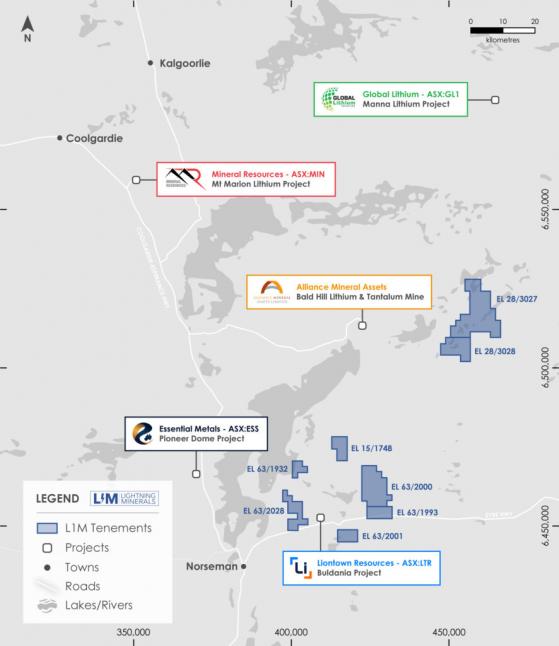

Map of Lightning Minerals' Dundas Project tenements (blue).

The company put boots to ground just two days after IPO and has already identified 15 outcropping pegmatites with potential for lithium mineralisation – you certainly couldn’t accuse it of dragging its feet.

“You need to move quickly,” Biggs said, “With the mining industry, it’s a race.”

“It’s a race to resource, it’s a race to build a mine, it’s a race to complete the latest drilling program, it’s a race to the assets themselves. It’s always fast.

“A lot of people get caught there, they say they’re going to drill somewhere and six months later they’re still not doing it.

“Do what you say you’re going to do. That’s it.”

ESG as a value-adding framework, not a cost

Building company culture from the ground up is a core part of how Biggs does business; he doesn’t compromise on doing things the right way.

“I look at us as fund managers. We are managing people's money and that’s the way to think about it,” he explained.

“It's custodianship, it's a tenure, being in this position. You’re in for a period of time.”

For Alex Biggs and Lightning Minerals, the way you do business is just important as what you’re doing.

Environmental, social and governance (ESG) policies are becoming ever more important as the global economy accelerates toward decarbonisation.

“Fundamentally, ESG comes back to a very simple thing and that is how you do business. If you’re a decent person, if you’ve agreed to uphold the social contract, that informs how you do business,” Biggs said.

“So that's our MO, that's our modus operandi, it should be as people that we go about things. If you approach your business in that way, ESG comes naturally.”

For Biggs, upholding society’s social contract to treat others as you would be treated is a core ethos; the philosophy that informs how he conducts himself in all aspects of life.

“Environmentally, we don't tip our waste in the river, or, you know, dump our oil on the floor,” he emphasised.

“When it comes to governance, it's the same. Can you measure it if you do the wrong thing? Is there a governance policy in place?

“It’s important that if you do something wrong, there’s a policy and a system that will catch you, and when it catches you, it will rinse you. That’s the way it needs to be.

“Everyone needs to understand that and I don’t put up with any of that sort of behaviour, from anybody within the business or external to it. It will not happen, I will not allow it.”

Biggs sees ESG as a tool; a framework to build a business around that adds value, both socially and economically, rather than just an expensive set of policies to implement or a way to greenwash a business.

“Now, sometimes when money gets involved, people seem to forget that a little bit. You know, those are the people we don't need in the industry,” Biggs stressed.

“I'm not gonna waste my time thinking about those people. I act the right way. My team acts the right way and I instil that in them.

“There's an old saying, ‘If you can't beat them, join them.’ I don't believe that.

“Be kind, be strong, build your own path.”

As Australia and the world divest from hydrocarbons and toward a more sustainable system, we’ll need fast-moving heavy hitters with an emphasis on doing things right to lead the way – Alex Biggs and Lightning Minerals are ready to show the industry how it’s done.

Read more on Proactive Investors AU