(Adds comment from Alcoa )

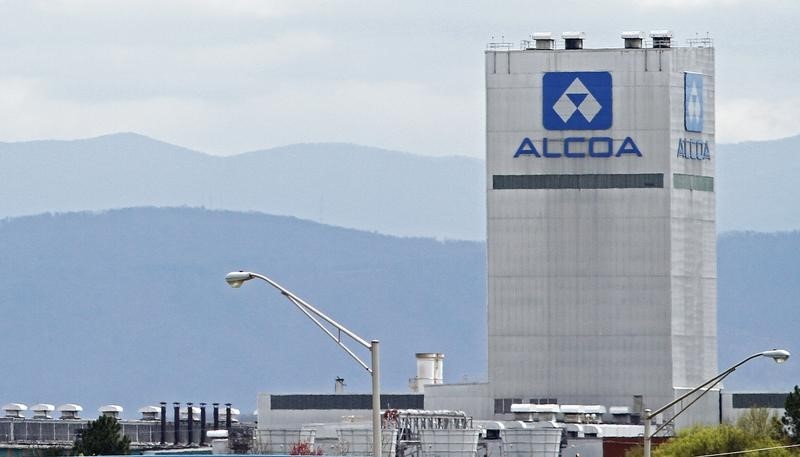

MELBOURNE, May 30 (Reuters) - Australia's Alumina Ltd AWC.AX has "serious concerns" about the impact of a demerger plan of U.S. partner Alcoa Inc (NYSE:AA) AA.N on the pair's bauxite and alumina production joint venture, the Australian company said on Monday.

Alumina said in a statement that it was concerned the plan would "result in a material adverse change in the nature, size, scope and financial wherewithal of Alumina's partner in AWAC (Alcoa Worldwide Alumina and Chemicals)."

Alcoa's plan, disclosed in September, would separate the company's plane and car parts business under the name Arconic, while the traditional aluminium smelting operations, including the 60 percent stake in AWAC, would retain the Alcoa name. Friday, Alcoa filed a lawsuit at the Court of Chancery in Delaware, seeking a declaration that Alumina has no right to block the plan and has no consent rights or rights of first refusal in relation to the plan.

"Alcoa's separation does not require Alumina Limited 's consent," Alcoa spokeswoman Monica Orbe said in an email on Monday. "We look forward to putting this matter behind us and launching new Alcoa and Arconic in the second half of 2016."

Alcoa also asked the court to declare its plan does not entitle Alumina to take over marketing rights in AWAC.

"Alumina considers that Alcoa's demerger proposal triggers consent and 'first offer' rights in favour of Alumina under the AWAC arrangements," Alumina said in a statement to the Australian Securities Exchange. "Alumina will vigorously defend the proceedings brought by Alcoa."

In its court filing, Alcoa said that following its September announcement, it had received letters from Alumina.

Alcoa said in the filing that Alumina threatened to make "public statements about the separation and Defendants' objections to it that would harm Alcoa by casting a cloud over the separation, and disrupting AWAC's operations by purporting to 'assume' marketing rights that Alumina does not have."

Alcoa said its demerger plan was similar to when Alumina Ltd split from Western Mining Corp more than a decade ago. It said that at that time, Alcoa had no rights of first refusal or right to block the split under AWAC agreements.

Alumina has proposed amending AWAC agreements to protect the interests of Alumina shareholders, and said the two sides have been in talks since early this year.

At present, Alumina does not have access to AWAC's cash flows and instead receives a dividend.

Alumina's biggest shareholder is China's CITIC Resources Holdings Ltd 1205.HK , with a 17.9 percent stake.

Alcoa has yet to disclose how it would allocate debt and liabilities, such as pension and closure liabilities, when it splits.

The case is Alcoa Inc v Alumina Limited , Alumina (USA) Inc, and Alumina International Holdings Pty Limited, Case No. 12385-, in the Court of Chancery, Delaware.