Will silver ever hit US$100 per ounce?

After all, silver has rallied and dipped but is yet to break a new record high, unlike most metals (it has recently been trading in the range of US$22-23 an ounce).

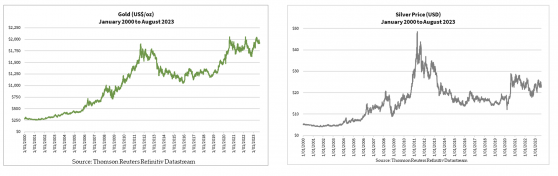

Just check the charts below:

Source: Thomson Reuters (NYSE:TRI) Refinitiv Datastream

Despite giving back half its gains from 2012-15, gold broke new records in 2020. The last two years have been volatile, but gold held its ground.

Silver went parabolic from 2009-11 but gave back much of its gains. It dipped hard in early 2020 before rallying by almost 140% in five months. But it’s still trading at half its all-time high.

However, these figures don’t account for the changing value of the US dollar.

The dollar has rallied by almost 50% in the last decade, based on the changes in the US Dollar Index [DXY]. So, you can’t really compare the prices in 2011 to today.

Here’s the US dollar-adjusted price history over the same period:

Source: Thomson Reuters (NYSE:TRI) Refinitiv Datastream

Based on this new chart, gold is almost 50% more valuable now than in September 2011. Silver is trading at a 30% discount to its all-time highs in April 2011.

So, is gold overvalued, or is silver undervalued?

Let’s look at this puzzle from a few different angles.

Price manipulation: fact or fiction?

Many know that commodity prices (including silver) aren’t set by simple supply and demand between mining companies, smelters, wholesalers and jewellers.

Rather, financial houses such as JP Morgan, HSBC and Goldman Sachs (NYSE:GS) play a significant part in setting prices through digital contracts traded on the commodities exchanges and the derivatives markets.

As expected, these institutions stockpiled a lot of physical metals and used their proprietary trading desks to rig prices at whim.

Fortunately, things have improved over the last three years as government regulators came down on these manipulators.

In August 2020, Scotiabank was convicted and fined US$127 million ($170 million) by the US Commodity Futures Trading Commission (CFTC) for manipulating the precious metals market. A month later, JPMorgan Chase (NYSE:JPM) & Co met the same fate.

That said, we can’t fully blame these bullion banks. Because within every conspiracy lies some basis for the participants to play into it.

The disconnect between the relative abundance, production and price of silver and gold

Let’s start with the relative price of gold and silver. Here’s a chart showing the gold-silver ratio since 1990:

Source: Thomson Reuters Refinitiv Datastream

The gold-silver ratio has varied widely from 31-121, averaging around 68-70.

You might logically assume that the relative abundance or mining production of gold to silver is around 1:68-70.

Is that the case?

An infographic by Visual Capitalist implies that silver is 18-20 times more abundant in nature than gold.

Source: Visual Capitalist

Statista also showed that gold production in the past 10 years ranged from 2,800-3,300 tonnes, while silver ranged from 24,000-27,000 tonnes — roughly 10 units of silver per unit of gold produced.

From these results, you can infer that either gold is overvalued or silver is undervalued.

But another perspective suggests that the price of silver is actually reasonable.

Why silver is fairly priced

One key metric I like to use for gauging a mining company’s relative performance is the profit margin per ounce sold. This is the difference between the realised price of sales and all-in-sustaining costs (AISC). A better-performing producer would have a higher profit margin.

The problem is that very few ASX-listed producers own silver mines. Those that do mostly mine gold, producing silver and base metals as by-products. Therefore, they report their AISC in terms of gold-equivalent production.

So, for my analysis, I turned to major international producers such as Fresnillo (LON:FRES) PLC, Pan American Silver Corporation Ltd, Hecla Mining Co and First Majestic Silver Corporation Ltd. These report AISC in terms of silver-equivalent production.

I found that the average AISC is around US$15-18 ($22-27) an ounce. They sell their silver at around US$24 an ounce — or an average profit margin between 33-60%.

On the other hand, the average AISC of major gold producers is around US$1,100-1,300 ($1,650–1,950) an ounce, while they sell their production at around US$1,900 an ounce — a 45-80% profit margin.

So, gold producers enjoy a higher profit margin than silver producers. This seems reasonable, as gold is scarcer.

Based on average profit margins, it’s possible to argue that silver is underpriced. However, it’s a stretch for it to be worth more than US$50 ($75) an ounce. That would mean silver producers earn a profit margin that greatly exceeds the margin for gold producers.

In other words, silver isn’t as underpriced as we’re made to believe.

Future catalysts for a silver rally

But there’s more to it than looking at the relative mining volume of gold and silver, the production costs and profit margins, and price manipulation.

It’s important also to consider the factors that determine silver’s future supply and demand, which could influence its price.

Based on data from The Silver Institute, the annual global silver supply in 2022 is around 1 billion ounces. Demand was 1.242 billion ounces and is expected to rise, largely driven by industrial and jewellery demand, energy generation, 5G communications and electric vehicles.

So, silver is facing a supply deficit. And it could continue unless more mines come into production.

That takes a long time.

Bringing a deposit into operation involves several steps, including obtaining permits, confirming the orebody and reviewing mine economics. Once that’s completed and the board is satisfied, the company must secure funding to build the infrastructure.

As current silver mines deplete and inflation drives up production costs, the price of silver could rise. After all, a lack of supply creates scarcity.

So you might consider slowly buying silver bullion.

Gold is hard money, while silver is still treated as an industrial metal. Therefore, the price of silver will behave accordingly.

You could also consider buying shares of silver explorers on the ASX. But note that these are riskier, more speculative investments. You’ll need to conduct thorough research before going down this path.

Author Brian Chu is editor of The Australian Gold Report.

Read more on Proactive Investors AU