Investing.com -- US equity funds recorded their largest weekly inflows since March, receiving $55.8 billion in the period through Nov. 13, according to Bank of America (NYSE:BAC), citing EPFR Global data.

This robust flow was mirrored by a record $6 billion invested into crypto funds, showcasing a strong investor appetite for risk assets.

BofA strategists led by Michael Hartnett highlighted a “big rotation" from bonds into stocks, emerging markets and China to US, as well as gold to crypto assets.

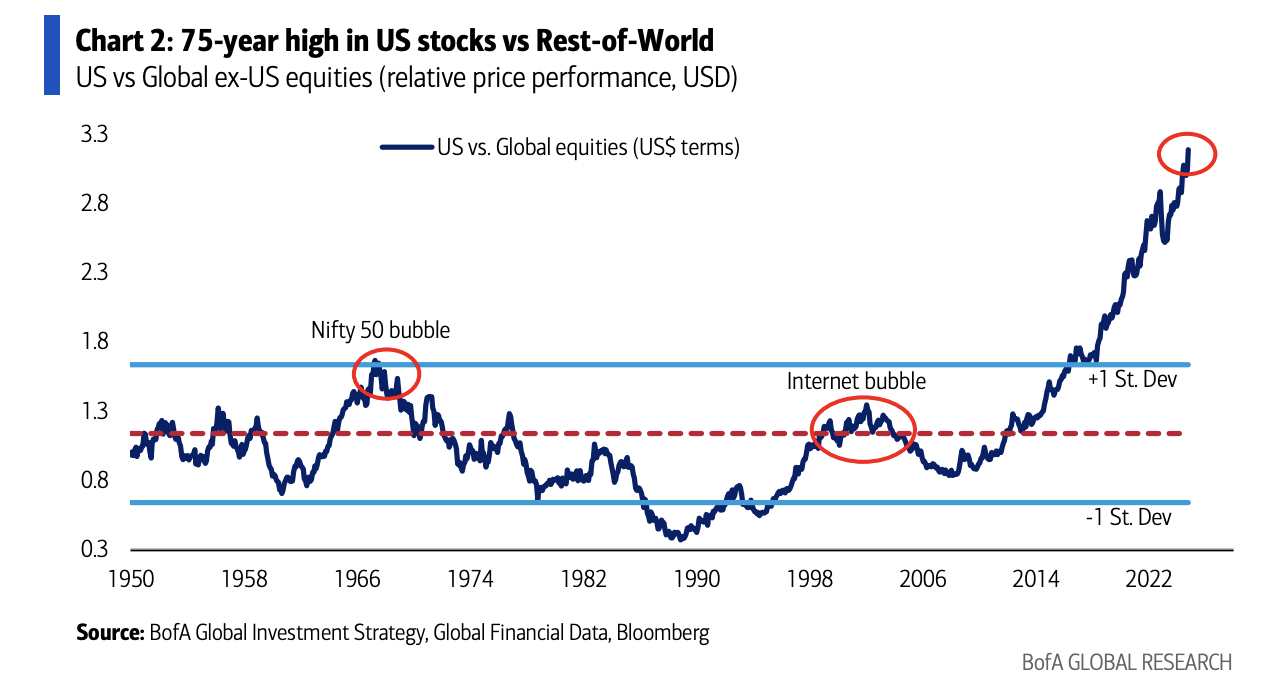

The bank’s note features an extraordinary chart that underlines the unprecedented dominance of the US stock market.

More concretely, the chart shows that US stocks are trading at a 75-year high relative to the rest of the world (RoW) equities in dollar terms.

The milestone is emblematic of “US exceptionalism” driven by factors such as strong US growth expectations, investors going “all in” on Trump’s second president, and elevated US dollar strength.

BofA strategists said their Bull & Bear Indicator dipped slightly to 5.9 from 6.2, which they believe “simply signals that extreme bullishness [is] thus far confined to US stocks rather than all global markets & other risk assets.”

US large-cap equities saw a record $44.1 billion inflow last week, with US small caps gaining $6.7 billion, their largest since July.

Meanwhile, emerging markets faced $7.5 billion in outflows, marking the largest weekly redemption since August 2015. Chinese equities have seen record outflows of $21.1 billion over the past five weeks.

European equities also suffered, with outflows for the seventh consecutive week at $3.1 billion.

By sector, materials funds saw a record $5.6 billion inflow, and financials recorded their biggest weekly inflow since January 2022 at $2.6 billion. Conversely, utilities experienced their biggest outflow since March 2015 at $1.1 billion.

Gold funds saw $1.6 billion in outflows, the highest since July 2022.

In fixed-income markets, US Treasuries saw their largest outflow since January, with $3.5 billion pulled from the asset class. Investment-grade bonds saw only $2.1 billion in inflows, marking the smallest year-to-date addition, while bank loans registered their largest inflow since April 2022 at $2.1 billion.