Twenty Seven Co Ltd (ASX:TSC) has expanded its battery minerals strategy thanks to its latest option acquisition.

The multi-element explorer has picked up the rights to farm in and acquire a 100% interest in the Mt Edon Project in WA — home to a highly prospective lithium-caesium-tantalum mining lease.

Beyond battery minerals, Mt Edon is considered prospective for rare earth elements (REEs), while historical tantalum production has also been recorded within the tenement package.

Now, it’s on to due diligence work, which will include a targeted 500-metre reverse circulation drill program in October that will determine whether to proceed with the option.

Acquiring Mt Edon would only strengthen Twenty Seven Co’s battery metals portfolio, which includes the Rover Project in WA, where Rio Tinto (ASX:RIO) Exploration has identified a pegmatite unit considered prospective for lithium and tantalum mineralisation.

“Compelling and high-quality opportunity”

TSC chief operating officer Simon Phillips said: “TSC has undertaken extensive due diligence over recent months to acquire an advanced battery metals exploration asset for shareholders.

“The Mt Edon Project is a compelling and high-quality opportunity for TSC that significantly strengthens our existing focus on critical metals exploration to complement our precious metal portfolio.

“Mt Edon is located in a premier lithium exploration jurisdiction and with known high-grade lithium mineralisation and historical tantalum production recorded within the tenement package, our technical team is very confident we can unlock the full potential of this asset through modern exploration methods and targeted drilling.

“We look forward to providing further updates on our initial work programs and plans for Mt Edon in due course.”

About Mt Edon

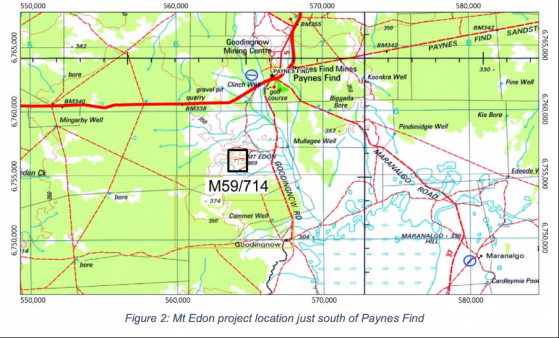

TSC’s new acquisition target contains the Mt Edon Pegmatite Field, which sits on a granted mining lease in the southern portion of the Payne’s Find Greenstone Belt – an area known to host swarms of pegmatites.

The wider tenement package is considered prospective for a suite of critical minerals, making it a prime exploration and mine development target.

Between 2019 and 2021, Mineral Commodities Ltd completed rock chip sampling and mapping in the area, but exploration was ultimately hindered by the pandemic.

Due to challenging terrain, it appears previous work was limited to just a few drill holes outside the tenement package.

The fine print

TSC has entered a legally binding farm in and joint venture term sheet with privately owned Entelechy Resources, setting the stage for a sole-ownership acquisition.

Under the contract, TSC has 120 days to complete due diligence — including drilling — and it must spend at least $140,000 on a work program.

The board will seek shareholder approval if it elects to exercise the farm-in right.

For $25,000 in cash and 250 million TSC shares, the explorer will move to a 51% beneficial interest — covering stage one of the farm-in.

From there, both parties will move to a formal joint venture agreement, which positions TSC to complete work required for a feasibility study.

After that, the company can issue shares to the tune of 49% of Mt Edon’s net present value, bringing it up to sole ownership.

For now, though, TSC is focused on getting a drilling contractor on-site to complete the 500-metre program. All approvals are in place to get the campaign underway.

Read more on Proactive Investors AU