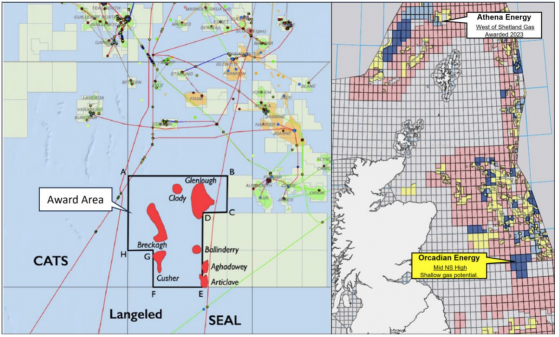

Triangle Energy (Global) Ltd reports its 50/50 joint venture with Orcadian Energy PLC (AIM:ORCA), the operator, has been offered a licence covering nine blocks in the UK Central North Sea as part of the second tranche of the 33rd oil and gas licensing round.

The award adds to Triangle’s UK portfolio which complements its highly prospective exploration acreage in the onshore Perth Basin.

New UK acreage

The Central North Sea acreage contains shallow gas exploration opportunities, identified on 3D and 2D seismic data by high amplitudes. These prospects are analogous to the A12 and B13 gas fields already producing in the Dutch waters of the North Sea.

Orcadian has identified five prospects and leads within the permit, of which the top two — named Glenlough and Breckagh — have best estimate gross prospective resources of 269 Bcf.

The existing seismic data shows the top reservoir to have a distinct seismic response which when reprocessed and inverted, should allow more accurate mapping of the gas bearing reservoirs.

The following seismic sections over the Glenlough and Breckagh leads show the high amplitude seismic markers associated with gas bearing sandstone reservoirs, termed a “direct hydrocarbon indicator or DHI”.

Orcadian has identified five prospects and leads within the permit, of which the top two, named Glenlough and Breckagh, have Best Estimate Gross Prospective Resources of 269 Bcf.

The new 3D seismic to be purchased over these anomalies will allow the JV to accurately map the areal extent of the DHIs and also estimate the sand thickness and therefore the prospective resources accurately.

Diversified asset base in tier-one locations

Triangle managing director Conrad Todd said: “We are very pleased to be offered these new blocks in the Central North Sea, which increases our UK portfolio and broadens Triangle’s asset base with further exploration upside.

“We now have a diversified asset base, all in tier-one locations. We look forward to advancing the UK assets whilst preparing to drill our exciting prospects in the Perth Basin this year. We also expect further announcements from the NSTA during this year regarding the other licence areas we have also bid for in the 33rd round.

“As with the West of Shetland permit P2628, the costs to be incurred in the next three years are modest, comprising seismic purchase or reprocessing and in-house studies, with any further activities at the discretion of the licensees.”

Work program to be confirmed

The joint venture will have further discussions with the North Sea Transition Authority, the national oil and gas permit regulator, to confirm the work program prior to finalising the award of the licence.

The work program is expected to comprise purchasing some 3D seismic and undertaking geotechnical studies for the first three year stage of the licence.

Read more on Proactive Investors AU