Toubani Resources Ltd (ASX:TRE) delivered on a significant objective during the June quarter, substantially increasing the indicated mineral resource estimate (MRE) at the Kobada Gold Project in southern Mali that will underpin a definitive feasibility study (DFS) update.

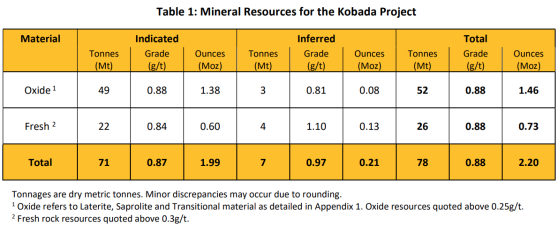

Following a highly successful resource definition drilling program, the company lifted its indicated category MRE by 30% to 71 million tonnes for 2 million ounces of gold at 0.87 g/t — a 10% grade increase.

The total indicated and inferred MRE for the Kobada Project stands at 2.2 million ounces over a 4.5-kilometre strike length, and is predominantly near-surface oxide material and open pittable.

Resource definition drilling also lifted the shallow, free dig oxide indicated resources by 44% to 1.4 million ounces of contained gold (49 million tonnes at 0.88 g/t) with more than 80% of the oxide inferred resources targeted in the resource definition drill program converted to the higher confidence indicated category.

A significant objective achieved

Toubani managing director Phil Russo said: “We delivered on a significant objective in the June quarter with a highly successful resource definition program informing a substantial increase in our indicated resources to 2 million ounces in total.

“To achieve this strong result, as well as increase our indicated grade by 10%, is an excellent outcome that sets the Kobada DFS Update due later this year for a positive outcome.

“The adoption of the 2023 Mining Code was also a major milestone for Mali which, in our view, lays the foundation for investment and a return to regulatory stability in the country which has a long history of supporting and working with its mining sector.

“We are excited to continue towards the Kobada DFS Update and reveal Kobada as a robust, highly attractive and technically simple oxide development project."

“Exceptional” resource definition drilling

The MRE upgrade follows an “exceptional” resource definition drilling campaign in the June quarter that delivered numerous compelling intercepts, including:

- 71 metres at 1.86 g/t gold from 79 metres, including 15 metres at 4.04 g/t;

- 57 metres at 2.48 g/t from 85 metres, including 1 metre at 25.7 g/t and 9 metres at 5.08 g/t;

- 24 metres at 5.75 g/t from 131 metres, including 2 metres at 57.4 g/t;

- 51 metres at 2.72 g/t from 123 metres and 16 metres at 1.45 g/t from 176 metres;

- 19 metres at 20.6 g/t from 105 metres including 2 metres at 178 g/t (screen fire assay).

Toubani highlights that significant exploration upside remains outside of the Kobada MRE with around 40 kilometres of the more than 50-kilometre regional-scale shear zones yet to be drilled, as well as at depth at Kobada, where drilling is limited.

Updated DFS underway

Toubani Resources is now progressing an update to its 2021 DFS for the Kobada Gold Project, which initial optimisation studies highlight as a large, technically simple oxide development project.

Kobada is moving through various technical work streams towards an update of the 2021 DFS, which is on track for completion later this year. Toubani believes it will demonstrate its potential to produce at an increased scale over an extended life, elevating the project into another tier of development asset.

The completion of the 2024 MRE allows for mining studies to be finalised with updated pit optimisation studies and mining schedules to be completed by Orelogy Consulting Pty Ltd.

Development and engineering of the process flowsheet and plant design by Lycopodium Minerals is well advanced and the updated processing schedule will enable finalisation of key design elements.

Other workflows such as update of the TSF design by Knight Piesold and refinement of design and engineering for non-process infrastructure are also advancing rapidly, ahead of financial modelling and optimisation of the capital and operating cost estimates for the project.

Read more on Proactive Investors AU