Toubani Resources Inc (ASX:TRE, OTC:AGGFF) has revised the mineral resource estimate (MRE) for the Kobada Gold Project in southern Mali, as part of a definitive feasibility study (DFS) to further the company's ambitions to develop West Africa’s next major gold mine.

The gold developer undertook the review to assess the suitability of the previous resource model, completed in 2021, in a larger scale processing and mining operation.

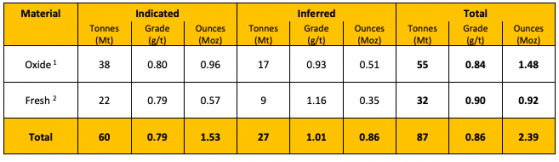

The new Kobada MRE now stands at 87 million tonnes at 0.86 g/t for 2.4 million ounces of gold, with 1.5 million ounces of shallow, free dig oxide resources.

Consultants Entech Pty Ltd completed the independent and external review using an updated geological interpretation as well as 8,183 metres of the 14,122 metres of drilling completed by Toubani this year.

The 2023 Kodaba MRE.

Milestone moment

“Today’s MRE update marks a significant step forward for the company,” Toubani chief executive officer Phil Russo said.

“We have now delivered the critical review and re-estimation of the 2021 MRE, given the new team now steering Kobada, mentioned in our decision to optimise the 2021 DFS last month.

“The company’s vision is to reposition Kobada as a reduced technical risk, low strip, bulk-tonnage, oxide-dominant open pit development project of scale.

“Today’s MRE update confirms we are well on our way in delivering on this goal.

“We now have a strong baseline of validated indicated oxide and fresh material to underpin the DFS update targeting a higher throughput and lower cost development project.”

DFS study to begin

With the resource update completed, Toubani will begin mining studies to inform the DFS update.

The update will assess the potential for a higher processing rate and consequently, increased annual gold production with an initial oxide-focused project phase followed by the inclusion of fresh material later in the mine plan.

The engineering group that will lead the study will be engaged in the coming weeks.

New drill plan

At the same time, Toubani is planning a drill program to define additional ounces as well as to increase the confidence of near-surface oxide material likely to be mined in the first 5-10 years of the project.

Significant mineralisation targets have been identified both within and outside the 2021 DFS pit design.

Drilling is scheduled to start at the end of the month, with the results fed directly into the DFS update.

The Kobada Project comprises an extensive strike area of 8 kilometre and includes the Kobada and Foroko deposits.

At this point, the deposits remain open at depth and along strike.

A rarity

“We see significant opportunity for drilling to drive continued growth in the confidence and size of our mineral resource base,” Russo said.

“We will be targeting conversion of a significant amount of shallow inferred free dig oxide resources at Kobada Main and Foroko, which was not part of the 2021 DFS.

“We have resource drilling planned for recent discoveries that were not included in this MRE update (Kobada West and Gosso).

“There is also significant exploration potential outside of all the known mineralisation with approximately 40 kilometres of the more than 50 kilometres of regional-scale shear zones yet to be drill-tested - gold developers with this level of district-style potential are a rarity in the gold universe.

“West Africa, and Africa generally, continues to be a destination for mine builds and M&A activity with Toubani continuing to advance Kobada down the path towards being an asset of significance in the region.”

Read more on Proactive Investors AU