What lies beneath? What lies hidden? They sound like the titles for a horror movie. And they are. But for explorers and miners, they’re the questions they ask before spinning the drill bit. Some spin the bit in hope. Others, look to clarify historical data for refined targeting. More wonder whether the discoveries of others extend to their tenements.

Lanthanein Resources Ltd (ASX:LNR) isn’t just another hopeful explorer looking for what lies hidden.

Case in point: the Gascoyne region, where the company’s Lyons rare earth prospects sit, is a highly prospective rare earth element region. Hastings Technology Metals’ Yangibana rare earth deposits and Dreadnought Resources’ Yin and Sabre discoveries both highlight the success found in the Gascoyne.

Those projects are just 2.5 kilometres and 32 kilometres from Lanthanein’s Lyons prospects respectively.

So, with proximity to success and a highly prospective region, not to mention the modern exploration techniques it has in its pocket, Lanthanein has a lot to work with.

One of Lanthanein’s key movers and shakers leading the charge to find exactly what lies hidden in its part of the Gascoyne region is the company’s technical director Brian Thomas.

In the blood

Mining has long been in Brian Thomas’ blood. His family history could be the subject of a vastly intriguing book. Both sides of his family had form in mining: copper mining, coal mining, mining investment ... and the song plays on.

It’s no surprise then, that Thomas developed an interest in mining and exploration early on in life.

“It was just one of those things that seemed natural. I've always been involved in the resources industry, mainly exploration, but also mining.

“I always knew I wanted to get into the capital markets, so I went off and did an MBA and I joined a Perth broking firm as a mining analyst.

“I lasted about three months before the partner of the company came to me and said, ‘we're thinking about replacing you’.”

Thomas wasn’t bad at his job. Quite the opposite: he was too good. He went from being a mining analyst to a corporate stockbroker.

“Every time I went out to do research on a company, I'd come back with a deal. They said to me we can employ another analyst to just write the research and you just keep doing what you're doing.”

Thomas continued to write the deals, not the research.

The firm then began to make its name in the IPO space, doing 15 to 20 IPOs in just three to four years – made up of a lot of small cap floats.

With a double major in geology and mineral economics under his belt, as well as an MBA and the real-world experience he was developing, Thomas was headhunted by a listed Australian firm McIntosh that was eventually ‘Merrilly Lynched’ and went from corporate stockbroker to investment banker.

“Doing all the debt security deals and financing and private placements wasn’t a lot of fun,” Thomas says about the Merryll Lynch takeover.

After moving into funds management for a couple of years, Thomas then found himself at a big four bank that was trying to rebuild its energy and resources portfolio.

“I became director corporate finance with Westpac for about four years, helping to rebuild their energy and resources business. I got them back into the mining game, project finance and financial markets.

Despite his success, Thomas laughs when he talks of the experience saying, “you go from being a geologist and an eternal optimist to working for a bank. It's the dark side. The glass is half empty. Not half full.”

It was then that Thomas really took the mining bull by the horns, leaving the bank and putting all his skillsets to the grindstone.

As a managing director, he helped develop a shell with African assets that four to five years later attracted a US buyer willing to part with around $40 million. The company had originally picked up the asset for around $8 million, spent $5 to $6 million and made a tidy profit.

Thomas worked with several listed companies before crossing paths with Frontier Resources, which was in the middle of a focus change and was looking for someone to help with the transition into rare earths having picked up a rare earths project in South Australia.

The company slowly moved away from its gold project in PNG and became a rare earths explorer, changing its name to Lanthanein in the process.

The value proposition that attracted Thomas

Lanthanein is focused on the discovery of critical minerals of rare earth elements (REEs) in tier 1 mining jurisdictions of Western Australia and South Australia, minerals that are vital to the future decarbonisation of the global economy as they enable new sustainable technologies.

We’ll get to that shortly, but that in itself is a pretty compelling value proposition.

“There are two value propositions that are key drivers,” Thomas says.

“When I first looked at the company, they had done a deal on ground in South Australia, right next door to Australian Rare Earths Ltd.

“Our ground had similar geology and it was technically very sound. The acquisition of that ground wasn’t just pure speculation – there was good technical basis and I thought, okay, these guys know what they're doing. It's a very real project.”

AR3 chairman Dudley Kingsnorth is an associate professor of geology at Curtin University and “is probably one of Australia's foremost authorities on rare earths”.

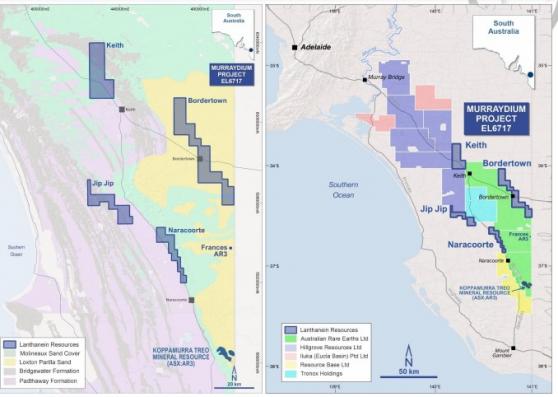

Lanthanein’s Murraydium REE Project in South Australia is targeting ionic clay hosted REEs and neighbours AR3’s REE resource at Koppamurra, which along with new AR3 prospect Frances, is hosted in the same Loxton Parilla Sands as present on Bordertown Block.

You can see Koppamurra’s resource below and what Lanthanein may be targeting in a similar vein:

“I thought, well Dudley's floated this thing with a resource. It's obviously real,” Thomas says.

Then there was the Gascoyne Project.

The previous owner of LNR’s Gascoyne Project had dropped some ground as rare earths went out of fashion; however, Frontier saw the upside.

Exploration geologist Thomas Langley picked up ground next door to Hastings Technology Metals. Hastings is developing the Yangibana REE Project, Australia’s next REE Mine.

This part of the Gascoyne region hosts high-grade REEs up to 8.01% TREO (total rare earth oxides).

The proximity of LNR’s Lyons project to Hastings is evident below:

The map also highlights the closeness to Dreadnought’s recent Yin Rare Earths discovery.

At time of writing, Hastings was capped at almost $410 million, while Dreadnought Resources was sitting at around $280 million. To put things in perspective, LNR has just a market cap of approximately $30 million.

Hastings REEs are hosted in the same ironstones derived from Gifford Creek Ferrocarbonatites present in the Durlacher Supersuite rocks that host the Lyons Prospects.

The mineralogy and metallurgical characteristics of REEs hosted in Lyons ironstones are identical to Hastings. High-grade rare-earth discoveries have been confirmed with exceptional results from rock chips across multiple targets on the Lyons Project Area.

That’s enough of the technical aspects, the other potential eyebrow-raiser is the area’s attraction for a bigger player to come and scoop up the assets.

“All these assets – Hastings, Dreadnought and Lanthanein – are still cheap. It wouldn’t be a surprise or beyond reason to think that a major player comes in and looks at the assets and what’s around them, the resource – Hastings has a bankable resource and is building a mine with an upgrade coming soon and do a quick amalgamation. Between the three companies you have a strong package,” Thomas says.

Rare earths are crucial to decarbonisation

There has been a groundswell toward rare earths over the past few years and not for nothing.

The world has changed. Priorities have changed. A resurgence of rare earths projects has occurred.

It’s not hard to understand why.

“As new technologies have come along, rare earths have been required for many different things. Magnets, light bulbs, screens on phones, there's a multitude of uses.”

Thomas says the thing that has really driven this last boom is China. Western economies are heavily dependent on China for refining REEs and will be for the next decade.

However, the winds of change are blowing hard and the reliance on China for the mining of the metals is expected to fall.

- 100+ countries have pledged to reduce methane emissions by 30% by 2030.

- 190 countries and organisations have committed to phase out coal-generated power.

- 20 countries have committed to cease funding oil, coal and gas projects by the end of 2022.

- 5 large public banks, including the European Investment Bank have committed to cease funding oil, coal and gas projects by the end of 2022.

- 30+ countries and dozens of states and cities have committed to the phase-out of the sale of new internal combustion engine (ICE (NYSE:ICE)) vehicles by 2035.

“If price continues to climb it will create an opportunity for replacement materials and mining of deposits of rare earth metals in areas outside of China. The real short-term gap may be the lack of processors outside of China.

“If prices continue to climb or stabilise at the high price, there will be a strong incentive for other nations with proven deposits to begin mining and processing.”

It is where companies like Lanthanein can have a real impact.

New mines are becoming operational in Australia, the US and Angola. They are appearing as the annual demand for REEs doubled to 125,000 tonnes in the 15 years to 2021 and is projected to reach 315,000 tonnes in 2030.

Adamas Intelligence forecasts that the value of global magnet rare earth oxide consumption will triple from $15.1 billion in 2022 to $46.2 billion by 2035.

Rare earth oxides are essential to many industries worth trillions of dollars. Not least the EV market.

Behind each battery is a motor and more than 90% of all EVs will be equipped with an NdFeB permanent magnet. Each EV consumes an incremental ~1kg of NdPr Oxide.

EVs are anticipated to grow at a CAGR of 29% over the next five years and hydrogen vehicles are also reliant on permanent magnet motor technology.

Hydrogen vehicles are anticipated to grow at a CAGR of 11% through to 2025.

When all is said and done, demand for Neodymium Iron Boron (NdFeB) permanent magnets used in electric vehicles and wind turbines, will support prices for neodymium (Nd), praseodymium (Pr), dysprosium (Dy) and terbium (Tb).

It’s a big market and with a big market comes large requirements.

With a move away from reliance on China, the doors are open for a company like Lanthanein and others with this type of exploration in their blood.

Dressed to the ‘nines’

Lanthanein is emerging at a time of change. When sentiment for rare earths is heightened and when like-minded companies in neighbouring areas are making good discoveries.

There is one last positive Thomas highlights: Mark Creasy.

Creasy has reached almost iconic status in the mining and exploration world.

Thomas and Creasy are connected through Lanthanein and Azure Minerals, while Tom Langley and other Lanthanein consultants have also worked with Creasy over the years.

It’s a strong team that has experienced success and it hopes to emulate that success moving forward in its rare earths ventures.

The company has certainly put on its best suit, now it’s time to see what impact it makes at the party.

Read more on Proactive Investors AU