The ASX is expected to open lower this morning, with ASX futures flat at 7,524 and the ASX 200 pointing 2 points lower, down 0.03%.

Today’s performance is likely to mirror the Dow, which closed flat overnight ahead of Fed chair Jerome Powell’s potentially market-shaking and hawkish monetary policy speech.

"Given the risks around the inflation outlook - Allied price cap on Russian oil exports, persistent inflation that remains elevated in the service sector and the uncertain path of rents - all demand a hawkish speech around shaping inflation expectations," RSM chief economist Joseph Brusuelas said.

Investors were also hopeful that recent protests in China could lead to an easing of COVID restrictions. The Chinese Government is now looking at mandatory vaccinations for the elderly but one suspects President Xi Jinping will hold his ground while the protests are ongoing.

Bad news for oil stocks as well as the oil rally also came to an end with Oanda senior market analyst Ed Moya saying, "Oil’s rally ran out of steam after reports that OPEC+ might end up keeping their output steady. Expectations were growing for them to seriously consider an output cut as China’s COVID situation steadily worsened."

On a positive note, nickel futures rallied 5.16% overnight and copper is holding steady, despite a sharp China sell-off.

Here’s what we saw (source Commsec):

- The Euro fell from highs near US$1.0390 to lows near US$1.0320 and was near US$1.0330 in late US trade.

- The Aussie dollar eased from highs near US67.45 cents to lows near US66.80 cents and was near US66.85 cents in late US trade.

- The Japanese yen eased from near 137.87 yen per US dollar to near JPY138.85 and was around JPY138.75 in late US trade.

- Global oil prices were mixed on Tuesday. There was no agreement by EU nations on a price cap on Russian crude. A ban on Russian crude imports is slated for December 5. Looking ahead, OPEC+ oil producers are expected to keep output plans unchanged at the meeting this Sunday.

- The Brent crude oil price fell by US16 cents or 0.2% to US$83.03 a barrel.

- The US Nymex crude oil price rose by US96 cents or 1.2% to US$78.20 a barrel.

- Base metal prices rose on Tuesday on hopes for an easing of Covid restrictions in China.

- Copper rose by 0.6%.

- The gold futures price rose by US$8.10 an ounce or 0.5% to US$1,748.40 an ounce.

- Spot gold was trading near US$1,748 an ounce in late US trade.

- Iron ore futures eased by US14 cents a tonne or 0.2% to US$92.90 a tonne.

On the crypto front

eToro's market analyst and crypto expert Simon Peters provides an update on all matters crypto and blockchain.

Crypto fraud ratchets up in the UK

Data from the Action Fraud shows crypto fraud has surged around 32% in 2022. This is a worrying revelation but there are some clear actions that the crypto sector can take to protect customers and the public more widely from such frauds.

Scams are not exclusive to crypto. Financial fraud in general is an enormous problem in the UK - one that goes largely unpoliced other than through awareness campaigns. UK Finance statistics show losses among the public from general scams to the tune of £609.8 million in the first half of 2022 alone.

So, what can we do to reduce crypto scams? Firstly, users need to take any offer with a sceptical eye. Like any scam, something that offers too-good-to-be-true returns, or guarantees returns, is likely not trustworthy. But there is another step, which is well underway, that can protect users - regulation.

As we’ve seen in recent weeks, the sector is now very much moving in the direction of more constructive regulatory frameworks. A regulatory seal of approval for crypto businesses will help to reassure consumers that the services they are using are legitimate.

Dogecoin spikes on Musk plans

The perennial Elon Musk sentiment tracker - dogecoin - has seen its price spike briefly after the owner of Twitter published plans for the turnaround of the social media firm.

Musk’s plans to turn Twitter into the “everything app” has tantalised investors in dogecoin, which at several junctures has been the focus of Musk’s musings for Twitter. Dogecoins price spiked from just under US$0.09 to over US$0.105 in a matter of hours - a spike of around 20%, after Musk published his slide deck.

Unfortunately, the price has come back down somewhat to now trade around US$0.093. The truth for dogecoin is that this is pure speculation on what Musk might do.

The tech entrepreneur is one of the few people in the world with the power to move markets with his words but the likelihood of him sending dogecoin skyrocketing again is pretty limited at the moment.

Bank of Japan to launch digital yen in 2023

The Bank of Japan (BoJ) is reportedly looking to issue an experimental version of digital yen in 2023. The BoJ is said to be working with three major Japanese banks to develop the central bank digital currency (CBDC), focusing specifically on issuance and withdrawal mechanisms. The experiment will run for two years, with the BoJ to decide if a wider project can be launched after 2026.

CBDCs are an interesting area of crypto, in that they are almost the antithesis of why much of crypto was created. Managed and controlled by central banking authorities, CBDCs have come in for much opprobrium with many projects faltering simply because the public isn’t that enthusiastic for digital central bank money.

But CBDCs have gained traction in international banking and cross-border supranational circles, with cross-border payments an increasingly relevant area for the technology. Institutions such as the Bank for International Settlements (BIS) have been taking a close look at how CBDCs could function between nations, with successful experiments already between countries such as China, Hong Kong, Thailand and UAE.

Gold mining social and economic contributions

The World Gold Council (WGC) has released consolidated data on the economic and social contribution of its members operating locally and offshore, noting that Australia ranks just behind China and USA for ‘total in-country expenditure’, and highest with respect to ‘payments to suppliers’.

Here are the highlights:

- In 2021, WGC member companies directly contributed a total of US$57.1 billion to host economies.

- This comprised US$35.4 billion of payments to in-country suppliers, US$11.7 billion in employee wages and US$10.0 billion in payments to governments.

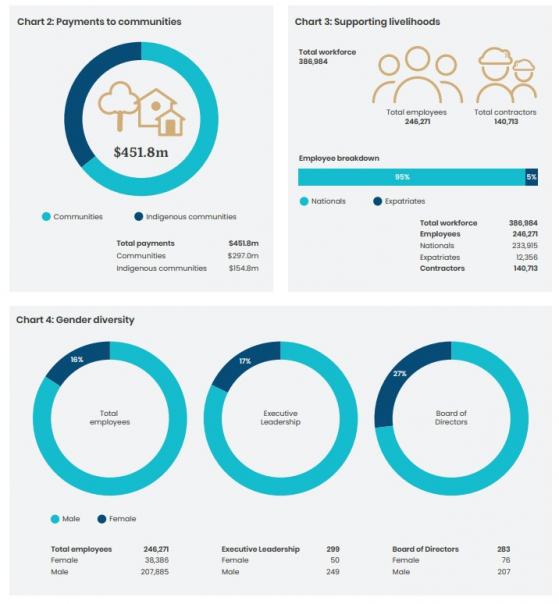

- On top of this, in 2021 contributions of over US$450 million were made to local communities and Indigenous groups in the 37 countries of operations.

- In 2021, WGC member companies directly employed close to 250,000 people and more than 140,000 contractors.

- Every job in the gold mining industry also supports six more indirect jobs in the supply chain or almost 10 more if induced jobs are included.

- Recent company efforts to train and develop local skills, as opposed to bringing in expatriates, have led to 95% of employees coming from the host country of operation.

Here are snippets of the overall work being done in these areas:

Read more on Proactive Investors AU