(Bloomberg) -- Donald Trump has long made it clear that he wants the Federal Reserve’s help shoring up the economy as he fights his trade war with China. To investors, it’s starting to look like that won’t be enough.

Stocks are in freefall and bonds are rallying around the world following the latest escalation by Beijing, just days after Trump announced new tariffs and the Fed lowered interest rates for the first time in a decade.

Money managers are now virtually certain the central bank will ease again in September but a growing cohort say cheaper money won’t fix what’s ailing the global economy.

Chief among their concerns: Reports of a slump in manufacturing worldwide, signs that profit margins are easing and fears that more companies will cut earnings forecasts given the uncertainty spurred by tensions in cross-border commerce.

“Another cut of the Fed can’t really offset all of that,” said Fabiana Fedeli, global head of fundamental equities at Robeco Institutional Asset Management BV. “If the consumer feels worse-off because of the tariffs -- and if companies are starting to see the effect on their bottom line -- this brings uncertainty from the point of view of making decisions on where, and when, to invest.”

What sets the latest proposed tariffs apart is that they include a more expansive list of goods like children’s clothes and smartphones. That’s a risk to consumer spending, a hitherto resilient pillar of U.S. growth.

Most worryingly for equity managers, some signs of damage are showing up in the earnings story. Expansion in profit margins for S&P 500 companies has crumpled for two straight quarters, historically a late-cycle omen for a brewing downturn, according to Strategas Securities LLC.

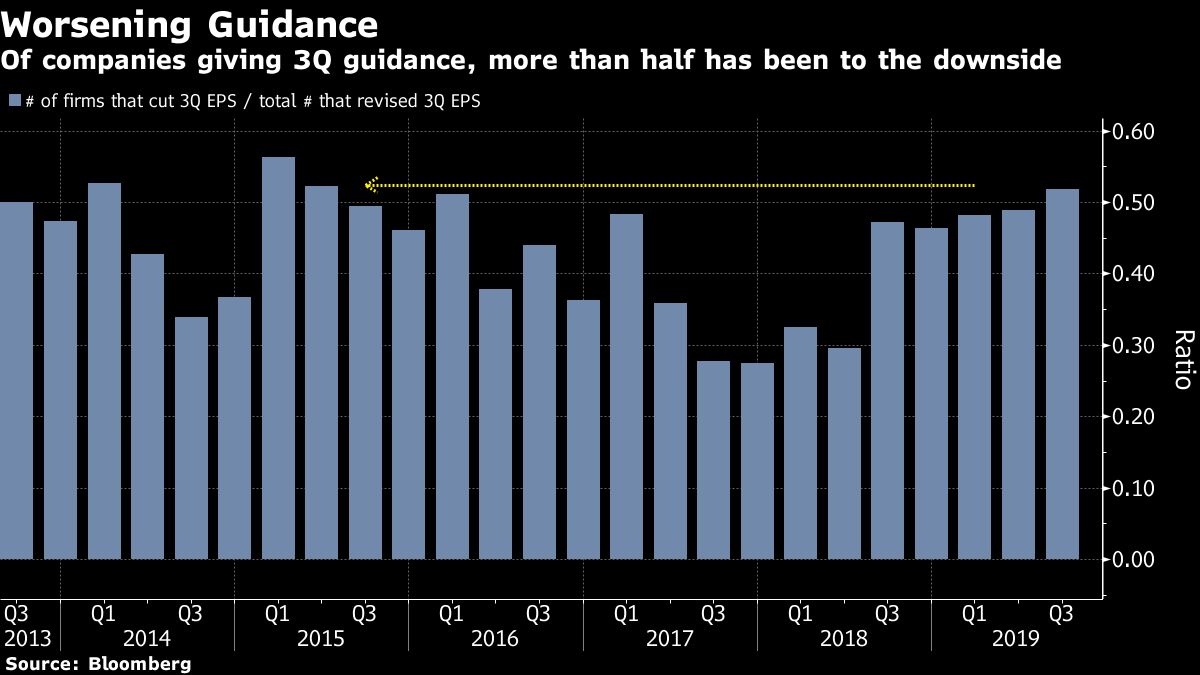

American companies are still expanding their earnings with a propensity to beat analyst expectations. But the outlook is darkening. Among firms that have provided third-quarter guidance, more than half were below analyst estimates, data compiled by Bloomberg showed. That’s the worst in four years.

While lower rates make future profits more valuable today, expectations for falling earnings could offset all that -- dragging U.S. share prices from recent records.

“We have largely put the burden of proof for economic and business cycle strength on the shoulders of corporate profits,” Strategas analysts led by Nicholas Bohnsack wrote in a note. “So margin compression means something.”

Bulls are hoping for a monetary offset of sorts. Interest-rate futures are pricing in a 28% chance of a 50 basis-point cut at the Fed’s September meeting. The fear is that the Jerome Powell put won’t pack the desired punch, as market fundamentals weaken.

“While a change in Fed policy can affect financial conditions -- and hence asset prices -- almost immediately, reversing an economic slowdown with easier monetary policy takes time,” wrote Morgan Stanley (NYSE:MS) strategist Mike Wilson, who has projected a 10% drop in the S&P in the third quarter.

Ports in the storm are looking scarcer.

A feature of this year’s bull run is a polarized market, ramping up premiums for perceived safety at every turn. Classic defensive plays are already aggressively bid up thanks to late-cycle angst. Growth shares, or companies expected to expand their earnings regardless of the economic cycle, are at their priciest versus the overall market in nearly two decades.

Stocks with the highest positive correlation to Treasuries -- or bond proxies -- have widened their valuation gap with the opposite cohort to the most since at least 2003, portfolios compiled by Societe Generale (PA:SOGN) SA showed. All that makes the market at risk of sharp rotations, especially if the mammoth bond rally reverses.

If the S&P 500 continues to tank even with the Fed dutifully slashing borrowing costs, might Trump -- given his fixation on the stock market -- be tempted to reach another truce with Beijing?

“If trade tensions are resolved and global growth re-accelerates as a result, the Fed will find itself having to make yet another u-turn,” said Edward J. Perkin, chief equity investment officer at Eaton (NYSE:ETN) Vance Management. “At some point, I believe there will be a violent rotation as investors find themselves mis-positioned.”

That could be months away, according to Perkin. In the meantime, more investors might be tempted to lock-in the double-digit stock windfall notched so far this year.

“The U.S. economy will not be able to rely on strong households to offset the weakness in global trade activity and weak domestic business activity.,” said Frances Donald, head of macroeconomic strategy at Manulife Asset Management. “Increased trade tensions substantially change the U.S. and global economic narrative for the second half of the year.”