Investing.com – Neither too large nor too small, mid-cap companies represent the best in terms of financial stability.

On one hand, they offer more growth potential compared to large caps that have already realized much of their potential, and on the other hand, they provide greater solidity compared to small caps. In short, more opportunities and fewer risks, the perfect combination for long-term investing.

The problem lies in understanding which companies will be the champions of the future, and the solution is provided by our ProPicks. By subscribing to InvestingPro+, you can leverage artificial intelligence (AI) models that select the top 20 stocks in their respective sectors every month, each poised to capture the market.

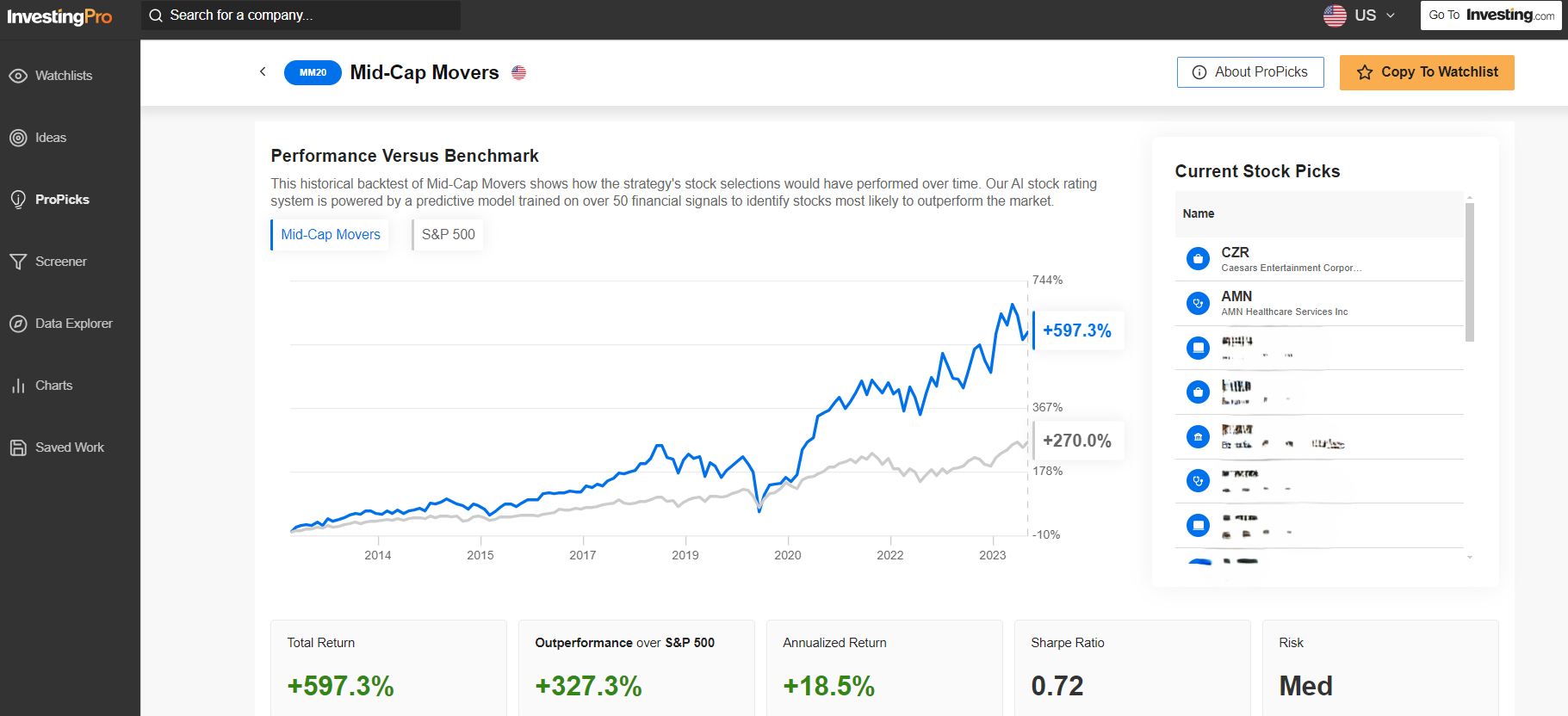

Mid-cap movements have yielded 327% more than the S&P 500 from 2013 to date. In the following graph, the historical backtest of Beating the S&P 500 shows how the strategy's stock selections would have performed over time

Our AI stock evaluation system is based on a predictive model trained on over 50 financial signals to identify stocks with the highest likelihood of outperforming the market.

The annualized return of the strategy from 2013 to today is 18.5%, with an outperformance of the S&P 500 by 327.3% and a total return of 597.3%. This is a significant increase compared to May when the total return was 571.2%, and we had already recommended it. So, if you didn't follow us in May, you've already missed out on a return of 26.1%.

Don't make the same mistake, subscribe now to InvestingPro and start earning with AI! ⚠️

Meanwhile, in the image above, on the top right, there are the first two stocks of the strategy, Caesars (NASDAQ:CZR) and AMN Healthcare Services (NYSE:AMN).

Subscribe here to access the complete list of stocks (WITH THE EARLY JUNE DISCOUNT)...

InvestingPro+ offers you 6 ProPicks strategies, including "Mid-Cap Movements", based on proven Pro AI models, all designed to help you achieve your investment goals.

It's an active strategy that updates you every month on which stocks to buy and which to sell.

How do you know where to invest to keep earning? Try InvestingPro+ and find out! Subscribe HERE AND NOW and get a 40% discount plus an additional 10% dedicated to our readers for a limited time on your annual plan!

Which stocks to buy and which to sell in June:

Below, for our readers, are some of the stocks to buy in June selected by the ProPicks strategy:

And two stocks that, on the contrary, according to artificial intelligence, are to be sold:

Subscribe here to access the complete list of stocks (WITH THE EARLY JUNE DISCOUNT)...

And if things in the markets were to change? No problem, every month the ProPicks are updated to allow all investors to adjust their portfolios optimally.

Here's how to get the discount to subscribe to InvestingPro+:

DISCOUNT CODE

By clicking on any of the links provided within the article, only for a limited time period, you can subscribe to access the complete list of current stock choices selected by the "Mid-Cap Movements" strategy with a SPECIAL DISCOUNT. (The link calculates and applies the discount directly. In case the page doesn't load, please enter the code proit2024 to activate the offer).

Additionally, you'll be able to leverage all our tools to optimize your investment strategy.

You'll have access to a range of exclusive tools that will help you tackle the market effectively:

- ProPicks: stock portfolios managed by a mix of artificial intelligence and human expertise, with proven performance.

- ProTips: digestible information to simplify complex financial data into a few words.

- Fair Value and Health Score: two synthetic indicators based on financial data that provide an immediate view of each stock's potential and risk.

- Advanced stock screener: Search for the best stocks based on your expectations, considering hundreds of metrics and financial indicators.

- Historical financial data for thousands of stocks: So that fundamental analysis professionals can look for all the details.

- And many other services, not to mention those we plan to add soon!