Investing.com - Tesla Inc (NASDAQ:TSLA) is set to announce its Q1 earnings after the bell on Tuesday, offering a much-needed update on the electric vehicle (EV) manufacturer's present and future prospects amid a slide in investor sentiment.

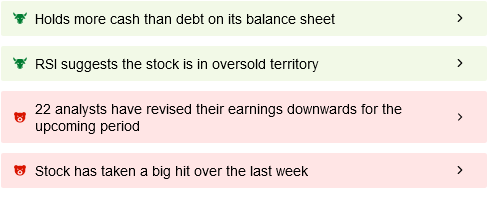

Tesla's Q1 has been a turbulent journey. The company's shares took a significant hit following disappointing Q4 results, vague 2024 delivery guidance, Q1 delivery misses, and unaddressed reports regarding the cancellation of a sub-$30K volume EV. Year to date, Tesla's stock has plunged a staggering 43% and is down 19% during its current seven-day losing streak.

Analysts estimate that Tesla will report adjusted earnings per share of $0.49 on top-line revenue of $22.27 billion for the quarter, marking its first revenue decline in four years. On the profitability front, Tesla is expected to report $1.49 billion in operating profit, a 40% slide from a year ago. In terms of non-GAAP metrics, analysts anticipate $1.79 billion in adjusted net income and EBITDA of $3.32 billion.

Tesla's revenue drop and profitability decline follow a weaker-than-expected sales quarter. In Q1, Tesla reported 386,810 global deliveries, falling significantly short of the estimated 449,080, and produced 433,371 vehicles, also falling short of the estimated 452,976.

The discrepancy of around 46,500 vehicles between production and sales has raised concerns about global demand for Tesla vehicles, leading to multiple rounds of price cuts. As recently as Monday, Tesla slashed prices for vehicles in the US and China, causing the stock to weaken during the day.

Investors will also be eyeing Tesla's future product roadmap. The much-anticipated next-gen platform, which was expected to underpin a sub-$30,000 mainstream EV (known as the Model 2), was seen as a significant volume opportunity for Tesla.

When Reuters reported that Tesla was canceling the cheaper EV, Musk refuted the claim on social media before later announcing the unveiling of the robotaxi, typically understood to have no steering wheel or pedals. The question of whether Tesla will eventually unveil a low-cost EV remains open.

Tesla's Q1 earnings report and subsequent conference call are also likely to address other significant business matters, such as the status of Tesla’s recently announced staff cuts of over 10% and management’s stance on upcoming shareholder votes in June. These votes deal with a change to Tesla’s state of incorporation and whether to approve Musk’s controversial pay package from 2018 that was voided by a Delaware court.