The March quarter of 2023 will go down in the history books as the quarter that witnessed the advent of the AI wars.

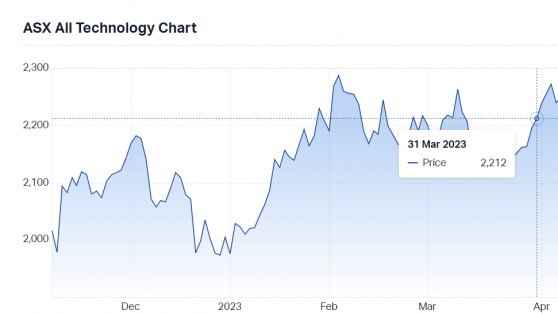

During the period, the global tech industry bounced back, following a disappointing performance in 2022.

Promisingly, the ASX tech indices outperformed the ASX 200 benchmark and ranked second only to gold stocks in terms of performance since the beginning of the year.

The XTX All Tech Index lifted 12.6% and the XGD Gold Index was up nearly 23.7% during the period.

Advancements in the Metaverse, blockchain and Web3 all seem to have taken a back seat, as organisations rallied their troops to deploy their latest AI offerings.

Tech stocks that delivered strong news flow:

archTIS

archTIS Ltd (ASX:AR9) delivered strong financial figures for the March quarter as revenue grew to 1.78 million, up 107% compared to the prior comparative period (PCP) in 2022.

During the period, the company's operating expenses decreased by 38% PCP, while new customers were acquired across various international markets.

Notably, ArchTIS also recorded annual recurring revenue (ARR) of $3.5 million, up 67% PCP.

The company attributed the positive results to increased sales to the Australian Department of Defence and several international customer wins.

archTIS managing director and CEO Daniel Lai said: “archTIS continues to deliver revenue growth despite difficult global economic conditions.

“We have expanded our international presence with new customer sales into the US, Germany, France and South Korea.

“We have also maintained financial discipline through the reduction of our overall expenses as we move towards sustainable cash flow targets.

“Most importantly we have made significant strategic inroads this quarter by progressing a number of exciting proof of concept opportunities across all regions with national defence agencies and suppliers.

“Finally, the release of Australian Defence Strategic Review (DSR) validates our strategy and will present further opportunities in our ambition to become the preferred provider of secure collaboration and information sharing products to global defence agencies and industry."

Financial highlights.

SRJ Technologies

SRJ Technologies Group PLC (ASX:SRJ) demonstrated impressive growth during the March quarter with cash receipts reaching 229% compared to the previous quarter, with revenues of A$526,000 secured.

During the period, the company clinched a contract with a top FPSO operator in West Africa, generating revenues of A$214,000 in 2023, in addition to securing a three-year contract worth roughly A$667,000 to supply BoltEx® products to PTTEP in Malaysia.

In addition, the company received initial orders for asset integrity solutions for pipework systems from two leading companies in the UK and Norway, Stork Technical Services Ltd and Jergo, respectively.

Moreover, SRJ inked a strategic alliance agreement with Cokebusters Limited, aimed at leveraging the combined expertise of both companies, with Cokebusters specialising in mechanical cleaning and intelligent pigging of piping systems.

SRJ revenue

Way2VAT

Way2VAT Ltd (ASX:W2V)'s March quarter delivered remarkable growth of 142% in various aspects of its business, including transaction volume, revenue, cash receipts, and revenue margin.

Compared to the previous year, transaction volume increased by a staggering 42% to $2.23 million, while revenue skyrocketed by $514,000, and cash receipts rose by 44% to $510,000.

The company has made significant progress in expanding its enterprise clients to 315 and securing a $3.544 million capital raise to focus on sales execution and revenue growth.

Furthermore, Way2VAT obtained a $1 million loan from Thorney Investment Group and a grant of $412k from the Spanish Innovation Authority to support the development of new product line technologies in T&E claim automation. company's strategy and plans for growth.

Although March quarterly metrics were lower than those of the previous FY22, the company believes that this is due to the seasonality of Way2VAT's transaction volumes and revenues.

SensOre

SensOre Ltd (ASX:S3N) has had a busy March quarter as the company invoiced $1.13 million in revenue from sales, services, and grants, while the total contract value (TCV) remained steady at $2.5 million.

During this period, the company continued to develop its technology and productisation of its key geochemistry and geophysics tools.

It achieved service milestones in various states, including the acceleration of data cube extensions in New South Wales and South Australia.

SensOre also completed multiple geochemical and geophysical data and integrated targeting services for lithium and nickel in Western Australia and the Northern Territory.

Furthermore, the company was awarded a grant to pilot new lithium exploration approaches and ramped up fieldwork for evaluating and negotiating additional joint ventures in Western Australia.

Sprintex

The highlight of Sprintex Ltd (ASX:SIX)'s quarter is the A$270,000 contract secured to supply high-speed electric fuel cell compressors for its sustainable hydrogen-powered shipping project.

During the period, the company completed development and validation testing for its 3kW and 25kW universal high-speed blower platforms, covering a wide range of applications.

Subsequently, Sprintex presented its products at the environmental protection expo and the hydrogen equipment expo in China, attracting significant interest.

Sprintex sees the water aeration industry as a major opportunity for the company and during the period, testing facilities were established at the e-compressor division to enable real-time testing of water oxygenation overall efficiency using the Sprintex SPA (Smart Pulse Aeration) technology.

Based on feedback from the industry, the company has now completed the design and development of an 800volt small (2-5kW) compressor range to address the demand for a smaller capacity unit that can be powered directly from hydrogen fuel cell output voltage, lowering both cost and complication in higher volume but smaller output hydrogen fuel cells.

The company secured funding of more than A$3.12 million through convertible notes to capitalise on commercialising these e-compressor sales opportunities.

Sensen

SenSen Networks Ltd (ASX:SNS, OTCQB:SNNSF) has ended the March quarter with record cash receipts of A$2.8 million, a 69% increase over the previous corresponding period (PCP) in 2022.

During the period, the company’s smart city solutions have been adopted by nine cities in Canada, up from two at the beginning of the year.

Among its customers is the City of Las Vegas, which has extended its contract for an additional three years and ordered two additional systems to deliver advanced automation through AI for enforcement operations.

Furthermore, Brisbane, Sunshine Coast, Logan City, and Chicago have expanded their contracts with additional systems delivering significant additional revenues from the existing accounts.

Spenda

Spenda Ltd (ASX:SPX) continued to execute its core strategies during the March quarter, including deploying funds from the debt warehouse facility, continuing the rollout of its key strategic customers, and growing B2B card payment flows to a minimum of $10 million per month.

The company drew $2 million from its debt warehouse facility, increasing the loan facility by 47% since inception to $12.2 million as of March 31, 2023.

The company ended the quarter in a strong financial position with closing cash and cash equivalents for the quarter at $4.7 million, with the net cash position was $5.4 million.

The Spenda platform is being integrated into the Carpet Court standard operating environment across all 205 Carpet Court member stores, with ~50% of stores successfully onboarded at the end of the quarter.

Continuous deployment of software upgrades, including enhancements to Spenda's Accounts Receivable solution, the addition of prepayments to Spenda's Accounts Payable solution, and further capabilities within the Spenda Wallet solution, have cut implementation times by 50%.

Completed integration services from the Mastercard (NYSE:MA) Provenance blockchain solution onto Continuity via Hedera Hashgraph.

The company has shown a consecutive quarter of growth, and all key leading indicators continue to perform strongly. The company expects these conditions to continue to drive positive cash flow and new opportunities as its unique recipe of integrated software, payment, and lending services continues to gain momentum in the market.

Skyfii

Skyfii Ltd (ASX:SKF, OTC:SFIIF)has reported strong momentum in the Airports vertical, with total operating revenues of $6.2 million in the March quarter.

The company’s rolling 12-month pipeline includes over $28 million of advanced-stage deals.

During the quarter, Skyfii delivered a number of meaningful new contract wins representing a total contract value of $4.7 million including Mount Auburn Cemetery (USA), a new Security Checkpoint rollout with JFK Airport (USA), Penn Station (USA), Ashfield Mall (APAC), Sicredi (Brazil), Central Park Mall (APAC).

Post-quarter end, Skyfii secured a contract with London Heathrow Airport that will see the deployment of bleeding edge LiDAR sensor technology across T2 Check-In, T4 Check-In and T5 Immigration.

Skyfii’s technology will allow London Heathrow to leverage advanced capabilities including ultra-live people flow mapping, auto queue detection and integration with multiple third-party data sets, including Heathrow’s flight database.

Skyfii revenue.

RemSense

During the March quarter, RemSense Technologies Ltd (ASX:REM) began its partnership working with Chevron (NYSE:CVX) to scan their LNG assets using virtualplant technology and renewed annual contracts with Woodside Energy.

The company is also assisting Programmed in evaluating virtualplant for wider application and conducted site trials with Newmont at their Boddington gold mine.

Additionally, RemSense kicked off work on adding new features to virtualplant that allow for the generation and management of inspection and remediation work packages.

The company is pursuing 76 qualified Australian-based opportunities worth $15.6 million in various stages of development and is implementing plans to form global partnerships with major asset management software providers to expand the use of virtualplant globally.

Read more on Proactive Investors AU