Tamboran Resources Corporation (OTC:TBNRF, ASX:TBN) Ltd has upgraded its contingent gas resources in the Beetaloo Basin of Australia's Northern Territory and recorded impressive performance from the Shenandoah South 1H (SS-1H) well.

The SS-1H well achieved an average 30-day initial production (IP30) flow rate of 3.2 million cubic feet per day (MMcf/d), normalised to 6.4 MMcf/d over 1,000 metres, surpassing pre-drill expectations.

“We are extremely excited to announce the results from the SS-1H well, which are the highest normalised rates achieved in the Beetaloo Basin to date,” managing director and CEO Joel Riddle continued.

Increase in resources

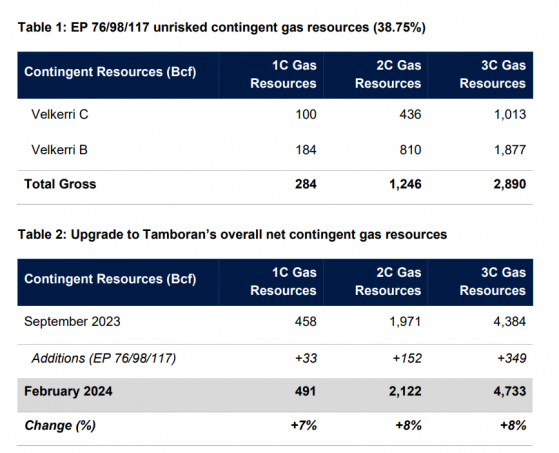

Tamboran has revised its estimates for the Beetaloo Basin across exploration permits 98 and 117 and welcomed a substantial increase in its gas resources.

The unrisked net 1C contingent gas resources have been raised by 33 billion cubic feet (Bcf) to 284 Bcf, and the 2C contingent gas resources have surged by 152 Bcf to 1.2 trillion cubic feet (Tcf).

Comes as Territory’s supply needs boost

“The Shenandoah South 1H well has de-risked some of the highest quality shale intersected to date in the Beetaloo Basin, with the IP30 flow results demonstrating strong and commercial deliverability,” Riddle said.

“Importantly, this has led to the first booking of contingent gas resources over the Shenandoah South region of the Beetaloo Basin, on the border of the EP 98 and 117 permits.

“The initial unrisked 2C contingent gas resources booking of 152 Bcf net to Tamboran over the Shenandoah South area is expected to support the initial proposed 40 MMcf/d Pilot Project.

“These volumes are anticipated to secure important gas supply into the Northern Territory gas market for the next decade. This comes at a time when local supplies of gas, which provide the majority of the Territory’s power, are at risk of running low.

“Tamboran stands by its commitment to deliver first volumes from the Beetaloo Basin into the Northern Territory before exporting volumes into the East Coast and international LNG gas markets.”

The upgrade, evaluated and certified by Netherland, Sewell and Associates, Inc. (NSAI) as of January 31, supports the advancement of the proposed 40 million cubic feet per day (MMcf/d) Shenandoah South Pilot Project.

The project, expected to be sanctioned in mid-2024, aims to deliver first gas to the Northern Territory by Q1 2026, contingent on securing necessary financing and approvals.

Demonstrated commerciality

Regarding the flow rate, Riddle said: “The normalised flow rates of 6.4 MMcf/d over a 1,000-metre (3,281-foot) lateral section demonstrate to us the commerciality of the Beetaloo Basin.

“The IP30 result gives us confidence to commence the construction phase of the proposed 40 MMcf/d Pilot Project at Shenandoah South under the Beneficial Use of Gas Legislation, which allows gas that would otherwise be flared to be sold into the local gas market.

"These volumes have potential to supply natural gas into the Northern Territory gas market in 1H 2026. Final Investment Decision is planned for mid-2024.

“Importantly, the rock properties, including reservoir pressure, effective porosity and gas-in-place, have delivered IP30 flow rates at Shenandoah South in the Beetaloo West area that compare favourably to production rates in some regions of the Marcellus Shale dry gas window.

“We will continue flow testing of the well over an initial 90-days to allow for an independent analysis of the expected 20-year EUR of the wells in the region. We then expect to commence drilling of the first two development wells for the proposed Pilot Project, which will be the first 10,000-foot wells drilled in the Beetaloo Basin.”

This result not only boosts confidence in the potential of the Beetaloo West region but also underlines the area's attractiveness for initial development, initiating the de-risking of over 1 million acres below 8,850 feet (true vertical depth).

With a stable, low-declining exit rate and favourable geological characteristics compared to the Marcellus Shale dry gas window, the well's performance has positioned Tamboran to progress with its drilling activities and development plans into 2024.

On the corporate front, Tamboran reported holding about A$55 million in cash to support its ongoing activities as of January 2024, including its 38.75% working interest in the Shenandoah South location's Pilot Project.