Tamboran Resources Ltd (ASX:TBN) has boosted the estimate of contingent gas resources from EP 161 in the Northern Territory’s Beetaloo Sub-basin with Santos holding 75% and operating the EP and Tamboran holding a 25% non-operating interest.

The update comes after the partners received extended production data from Tanumbirini 2H (T2H) and 3H (T3H) wells, as well as additional data on the reservoir continuity of the Mid-Velkerri C Shale, and an updated development strategy.

This upgraded assessment has led to a 73% increase in gross 1C contingent gas resources to 330 billion cubic feet (BCF), of which 83 BCF is net to Tamboran, and a 164% increase in gross 2C contingent gas resources to 1.6 trillion cubic feet (TCF), 404 BCF of which is net to Tamboran.

Significantly, the 2C contingent gas resources, which cover about 74 square kilometres, represent less than 4% of the EP 161 prospective acreage.

"The recent successful flow results from the T2H and T3H wells following the installation of production tubing have demonstrated the commercial potential of the Beetaloo Basin and an active hydrocarbon system within the EP 161 permit,” Tamboran managing director and CEO Joel Riddle said.

Outstanding results

The T2H and T3H wells have also achieved average 30-day (IP30) flow rates that exceeded commercial threshold for a 1,000-metre horizontal well within Tamboran’s Beetaloo Basin permits.

Average gas flow rates from T2H and T3H now total 2.1 million standard cubic feet per day (mmscfd) and 3.1 mmscfd, respectively, both over a 660-metre completed horizontal section

Both wells have stabilised and are declining in line with pre-drill expectations. Tamboran plans to release IP90 flow rates in the fourth quarter.

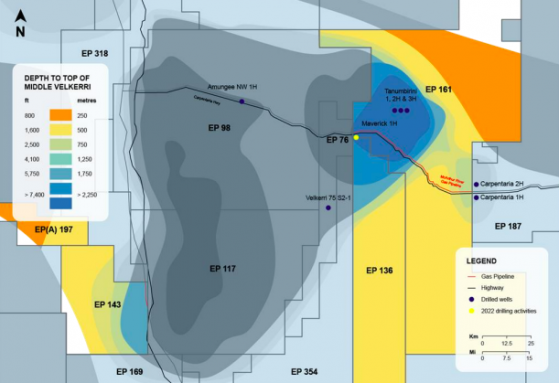

T2H, T3H and EP 136 Maverick 1H location map.

Material event

Tamboran CEO Riddle said: “The successful 30-days flow tests of the T2H and T3H wells are a material event in the de-risking of the Beetaloo Basin. These tests have demonstrated that the rocks are capable of delivering commercial quantities of gas, increasing our confidence that we can develop the basin economically.

“Both the T2H and T3H well have achieved a significant milestone by flowing at an average IP30 of 3.3 and 5.2 mmscfd, when normalised for a 1,000-metre horizontal section. Both wells exceed what Tamboran believes to be the commerciality threshold for our assets within the ‘Core’ Beetaloo Basin.

“The flow test performance also increases our confidence of delivering commercial flow rates from the 100% Tamboran operated Maverick 1H well, which remains on track to commence drilling shortly, with the rig currently on site and rigging up. We look forward to sharing more details on M1H over the remainder of calendar year 2022.”

TBN shares have been as much as 10.64% higher to $0.26.

Read more on Proactive Investors AU