Tamboran Resources Ltd (ASX:TBN, OTC:TBNRF) has increased unrisked 2C contingent gas resources by 32% to 2 trillion cubic feet (TCF) at its Beetaloo Basin assets within the Greater McArthur Basin in Australia's Northern Territory.

The increase follows the drilling of the Maverick 1V well, which has resulted in an initial resource booking within the EP 136 permit and an associated resource increase in the adjacent EP 161 permit and EP 76 permit.

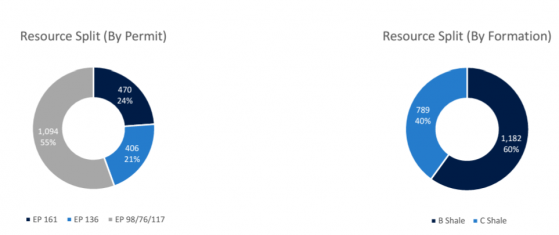

The EP 136 unrisked 1C contingent gas resources increased to 116 billion cubic feet (BCF) and unrisked 2C contingent gas resources increased to 406 BCF.

Meanwhile, the EP 161 unrisked 1C contingent gas resources increased to 91 BCF and unrisked 2C contingent gas resources increased to 470 BCF.

Shares higher

Tamboran is the largest acreage holder and operator with around 1.9 million net prospective acres in the Beetaloo Sub-basin, which has the potential to supply energy to hungry Northern Territory and east coast markets.

Investors have responded positively to the lift in resources with shares on the ASX 11.54% higher to A$0.145.

Potential accelerated production

Tamboran managing director and CEO Joel Riddle said: “Tamboran continues to demonstrate the continuous nature of Mid Velkerri B and C Shale across our 4.7 million (gross) acreage position in the Beetaloo Basin.

“Our strategic focus remains on the western region of the basin, where the SS1H well has successfully intersected the Mid Velkerri at depth and in close proximity to the Amadeus Gas Pipeline.

“This strategic positioning is expected to support a potential accelerated production to supply natural gas to the Northern Territory market.

“This is particularly critical given recent production declines from the offshore Blacktip gas field, which is expected to impact the region's gas supply.

“With gas-fired power driving the majority of the Northern Territory’s electricity supply, Tamboran is committed to delivering a secure source of natural gas to the benefit of Territorian families and businesses.”

2C contingent gas resource (BCF) by permit and by formation

Tamboran resource

Across EPs 76, 98, 117, 136 and 161, Tamboran’s total company unrisked 1C contingent gas resources have increased by 37% to 458 BCF and unrisked 2C contingent gas resources have increased by 32% to 2.0 trillion cubic feet (TCF).

The resource upgrade has been evaluated and certified by leading independent third-party resource certifier Netherland, Sewell & Associates, Inc. (NSAI), with an effective date of June 30, 2023.

Revised contingent gas resources do not incorporate results from the recently drilled Shenandoah South 1H (SS1H) well in EP 117.

Tamboran plans to evaluate the resources surrounding the SS1H location following flow testing, which is expected in the March quarter of 2023.

About Tamboran

Tamboran is focused on playing a constructive role in the global energy transition towards a lower carbon future, by developing the significant low reservoir CO2 natural gas resource within the basin.

Tamboran’s key assets include a 25% non-operated working interest in EP 161, a 100% working interest and operatorship in EP 136, EP 143 and EP(A) 197 and a 38.75% working interest and operatorship in EPs 98, 117 and 76 which are all in the Beetaloo Basin.

Tamboran will focus on the development of the proposed EP 98/117 Pilot Development, targeting first production by the end of 2025, and the proposed Northern Territory LNG (NTLNG) development at Middle Arm in Darwin, targeting first production by the end of 2030.

Read more on Proactive Investors AU