Surefire Resources NL (ASX:SRN) (FRA:GBL) is progressing its strong portfolio of projects with broad gold mineralisation intersected at Yidby Gold Project, drill planning underway at Kooline Silver-Lead-Copper Project and a production study started for Perenjori Iron Ore Project.

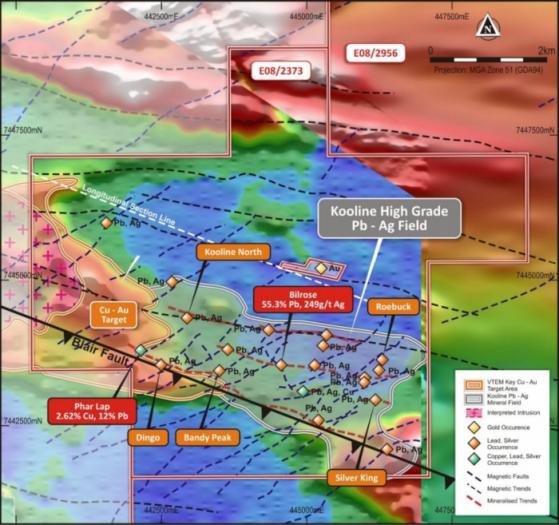

At Kooline, re-processing and interpretation of geophysical data has identified the potential for a large intrusive related silver-lead to copper-gold system immediately along strike.

The tenements include the previously mined high-grade lead-silver +/- copper lodes of the Kooline Mineral Field where previous rock chip sampling of exposed lode structures produced grades of up to 55.3% lead and 249 g/t silver from the Bilrose workings and up to 2.62% copper and 12% lead from the Phar Lap workings.

“Drilling in next few months”

Surefire managing director Vladimir Nikolaenko said the company had been granted WA Government co-funding to drill-test this key copper-gold target below/along strike from the Kooline lodes.

He said: “We've harnessed about 50 kilometres of the structure, and we're pretty well mineralised along most of it.

“So, we're very optimistic about the prospectivity of the project.

“We will now engage a structural engineer or geophysicist to mark the spot, or spots, where deep holes need to be drilled – then we could be up and drilling within the next few months.”

VTEM conductors

The key target area includes VTEM conductors within a 2x2 kilometre area, that correspond with an area of deep erosion/transported cover immediately along strike from the silver-lead workings.

This area is essentially untested and a series of deep pre-collared diamond drill holes have been planned and approved by the WA Government for Exploration Incentive Scheme (EIS) with co-funding of up to $150,000 direct drilling costs.

The drilling will target both high-grade extensions of the silver-lead lode structures as well as copper-gold mineralisation closer to the interpreted intrusive.

VTEM depth slice at Kooline Silver-Lead Field showing mineralised trends and key target area.

Perenjori Iron Ore Project

At the Perenjori Project, the company has engaged MinRizon Projects Pty Ltd to complete a high-grade iron ore production study.

The study will be based on the previous (JORC 2004) inferred mineral resource estimate by CSA Global of 191.7 million tonnes at 36.6% iron, released by Quest Minerals Ltd (ASX:QNL) in 2013 and will build upon a scoping study completed by Mintrex Pty Ltd.

Nikolaenko said: “Perenjori is a multi-faceted locality in terms of mineralisation.

“We've got a large landholding, we have seven tenements of varying sizes and each tenement has its own prospectivity.

“We certainly have the iron ore; we've currently got almost 200 million tonnes that's identified.

“We've engaged MinRizen to do a report on it for us and hopefully that will be completed in the next couple of weeks.

“Once we have that report, we'll be able to take the next step and commence drilling and upgrading the resource.”

Based on the outcomes of the study, the company will look to upgrade the resource to JORC 2012 indicated status through additional drilling, to allow feasibility studies to proceed.

Multi-element prospectivity

Nikolaenko said: “Perenjori also hosts a number of other tenements that are highly perspective for gold and they're on our shopping list to commence work on.

“We have just finished flying another large tenement to the northwest which we're quite excited about as it hasn't been explored in the past.

“It's got an unbelievable magnetic signature, over a distance of about 20 to 25 kilometres.

“It’s early days, but we are progressing with that and several other prospective tenements at the project.”

Yidby Gold Project

The Yidby Gold Project is also shaping up well with the first five of 18 holes completed in the current phase of drilling at Yidby Road Prospect hitting thick, high-grade gold intersections.

Results include:

- 32 metres at 3.68 g/t from 150 metres, including 3 metres at 26.47 g/t from 150 metres and 5 metres at 6.27 g/t from 177 metres;

- 83 metres at 0.64 g/t from 112 metres, including 14 metres at 2.09 g/t from 112 metres, 4 metres at 6.31 g/t from 112 metres and 3 metres at 4.15 g/t from 163 metres;

- 19 metres at 1.28 g/t from 84 metres, including 2 metres at 7.29 g/t from 84 metres and 2 metres at 4.14 g/t from 101 metres; and

- 16 metres at 0.88 g/t from 18 metres, including 9 metres at 1.44 g/t from 20 metres, including 3 metres at 3.25 g/t from 22 metres.

Yidby Road longitudinal Projection with new intersections down northerly plunging zone.

Large gold system

Nikolaenko said: “We await the results of the remaining holes that have also intersected multiple lode structures and indicate that we are on top of a large gold system.

“The next phase of drilling will continue testing along strike and at depth, where this exciting new discovery remains open.

“We've also done MMI to the west and there's quite a large target there.

“It's a very interesting concealed deposit and there's a lot more work to be done at Yidby”

“Incredible portfolio of projects”

Nikolaenko said that for a junior company, Surefire had an incredible portfolio of diverse and quality projects.

He said: “Most companies will have one or two projects, but we have a multitude of quality projects that have got strong possibilities of development.

“And at the end of the day, our portfolio is going to be too large for us to handle - we acknowledge that.

“But our goal going forward is to progress our work programs and elevate these projects to a point where we can do something with them.”

Read more on Proactive Investors AU