Sunstone Metals Ltd (ASX:STM) is exploring for porphyry gold-copper and associated epithermal gold-silver deposits in Ecuador, and according to GBA Capital, its current share price doesn’t accurately reflect the company’s value and is “very competitively priced relative to ASX peers”.

In a research report, GBA said, “STM is currently trading at A$0.01 per share, which in our view doesn’t reflect fair value for the stock, considering the potential to add resource ounces via drilling out the Limon epithermal system and the numerous porphyry systems at Bramados and El Palmar.”

Sunstone is focused on developing its three key large-scale porphyry-epithermal projects — the Bramaderos gold-copper project; the El Palmar copper-gold project and the Verde Chico copper-gold project.

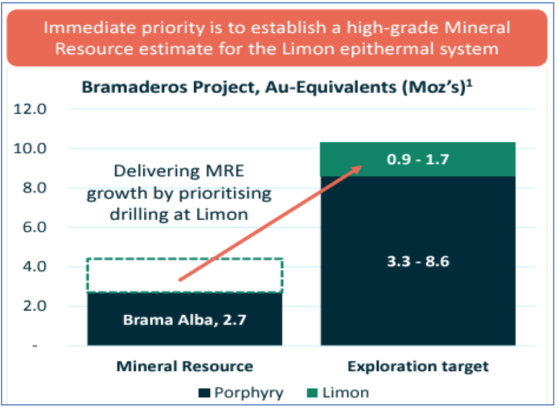

It has a resource inventory that currently stands at 2.7 million ounces gold-equivalent (gold+copper+silver), with exploration targets that could lift it to 10 million ounces gold-equivalent or more.

Investment view: Significant valuation gap

GBA has initiated coverage with a A$0.023 per share valuation, compared to the current share price of A$0.01 per share, with upside risk to $0.034 per share, using a sum of the parts (SOTP) valuation.

GBA believes STM is trading below its valuation because the market hasn’t caught up to the company’s change of focus, which involved adding higher-grade gold resources at Limon (Bramaderos), rather than drilling out potentially longer-dated porphyry deposits.

Based on the 2.7 million ounce gold-equivalent total resource, STM is trading at A$15 per ounce. This compares to the average industry EV/resource valuation for STM’s ASX peer group of around A$22 per ounce.

GBA makes note that very few exploration companies are truly comparable with each other, given the range of deposit types and jurisdictions in which they operate, and averages are inherently skewed; however, it says STM is trading at a 32% discount to this average.

The key to closing this gap and achieving the A$0.023 per share target could be 2H24 drilling at Limon, for which assays are expected this month, leading to a maiden gold-silver resource in 2025.

This will be an important milestone as it should lead into economic studies (scoping, feasibility with mining reserves) in 2025-26. Added value could also come from continuing exploration success at STM’s porphyry targets.

Key points

Bramaderos targets high-grade gold resources with ongoing drilling

Bramaderos is targeting more than 10 million ounces of gold-equivalent as resource drilling continues at the Limon gold-silver epithermal system. The exploration target at Limon is 0.9 to 1.7 million ounces gold-equivalent.

The strategy involves developing a higher-grade pit at Limon before mining the larger Brama-Alba gold-copper porphyry systems, which have a resource estimate of 2.7 million ounces gold-equivalent.

Joint venture partner SolGold is supporting ongoing resource drilling, with further activities planned for fiscal year 2025.

El Palmar and Verde Chico: prospective copper-gold projects in Ecuador

Located in the Tier 1 copper-gold belt of northern Ecuador, El Palmar and Verde Chico projects have reported high-grade drill results from surface porphyry systems.

The region has recently attracted significant investment, including US$120 million from Hancock and US$750 million from Franco Nevada and Osisko into SolGold’s Cascabel project.

Experienced management team driving exploration

The management team has seen recent additions, including managing director and CEO Patrick Duffy, formerly of Red 5 and Glencore/Xstrata, and non-executive director Neal O’Connor, former Xstrata Copper chief legal counsel.

The exploration team is led by Malcolm Norris and Bruce Rohrlach, known for their previous discoveries at Tampakan, Tujuh Bukit and Cascabel.

Positive outlook for gold and copper prices

The price outlook for gold is favourable, driven by ongoing geopolitical risks and expectations of falling global interest rates. Copper, vital for electrification and industrial processes, also has a strong demand outlook.

A continued rise in gold prices, towards US$3000/ounce, could benefit gold developers like STM, GBA added.

Read more on Proactive Investors AU