A significant high-grade gold intercept at the Warmblood prospect of Strickland Metals Ltd (ASX:STK) within the 100%-owned Horse Well Project in Western Australia’s Yandal Greenstone belt has unlocked a 1.4-kilometre gold trend.

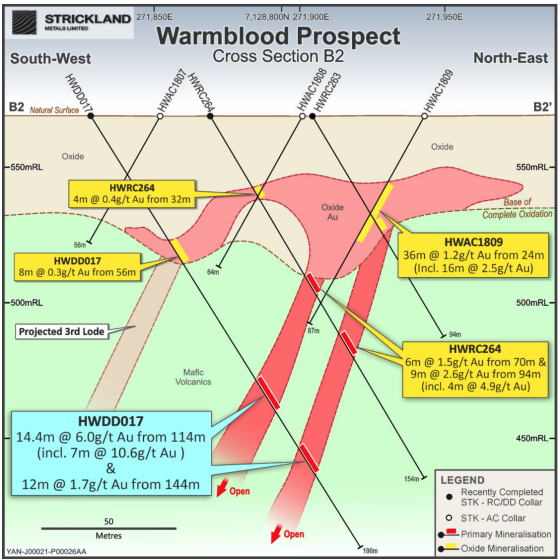

This result of 14.4 metres grading 6.0 g/t gold from 114 metres has led to the prospect being described by the company as a potential “game changer” that demonstrates the possibility for substantial mineralisation at depth.

Diamond drilling at Warmblood has returned the result, which included 7 metres at 10.6 g/t gold, and mineralisation remains open at depth and down-plunge.

This is the first hole to test for depth extensions to mineralisation outside the current Warmblood resource, with mineralisation appearing to open up and improve at depth.

Warmblood cross-section B2 highlighting two of the high-grade primary domains that are open down-dip.

The company adds that recent multi-element analysis on historic pulp samples shows this trend continues for a further 400 metres north of the drill hole (HWDD017) and 1,000 metres to the south.

This gives a total prospective strike length of 1.4 kilometres that is yet to be adequately drill tested.

The recent high-grade intercept in relation to the coherent 1.4-kilometre gold-bismuth-telluride-tungsten-silver mineralised trend.

“Ripe for additional resource growth”

Strickland managing director Paul L’Herpiniere said: “The result at Warmblood is potentially a game-changer for the prospect as it demonstrates the possibility for substantial mineralisation at depth.

“This is the first time drilling at Warmblood has tested for down-plunge extensions, and indeed the first diamond drilling to have occurred at the prospect.

"If positive results from Warmblood continue as the company expects, this extension of mineralisation has the potential to underpin a much larger open pit optimisation.

“Results like this, especially when viewed in the context of the defined extents of the associated multi-element geochemical trend, continue to confirm Strickland’s belief in the interconnected nature of the Horse Well prospects, with each primary lode having a north-west plunge.

“Historical drilling failed to demonstrate the geometry of the mineralisation, while these recent results indicate that the licence area is ripe for additional resource growth and further discoveries.”

Investors have welcomed the results with STK shares trading 11.36% higher on the ASX at $0.098.

Horse Well’s Palomino prospect

Additional diamond drilling north of the Palomino prospect, also within Horse Well, has further expanded the primary mineralisation down-plunge, beyond the limits of the current resource. Results include 14.9 metres grading 3.9 g/t gold from 222.1 metres deep, including 2.4 metres at 10.9 g/t gold.

Closer to surface, further drilling testing the oxide and transitional domains has returned high-grade mineralisation including 19 metres at 3 g/t gold from 45 metres (including 3 metres at 12.0 g/t); 14 metres at 2.8 g/t from 37 metres (including 9 metres at 4.2 g/t); and 16 metres at 2.4 g/t from 79 metres (including 7 metres at 5.1 g/t).

The company notes that it now has more than 40 sample submissions awaiting assay that have been delayed “due to factors beyond the company’s control”.

Palomino: high-grade oxide, transitional and primary mineralisation in relation to the gram x metre (GM) gold intercepts.

Read more on Proactive Investors AU