Strickland Metals Ltd (ASX:STK) has delineated numerous high-quality exploration targets from target review at its Yandal Gold Project and Earaheedy Base Metals Project.

As part of the review, Horse Well, Cowza and Great Western gold targets were selected to be drill tested in the coming months.

The new potential analogue target to Iroquois, the Rabbit Well zinc prospect was identified on 100% owned Strickland ground in the Earaheedy Basin.

Moving forward, diamond drilling of Rabbit Well, Iroquois and several Horse Well targets will kick off in five weeks, with IP surveying to begin in mid-August.

High-priority prospects

Strickland CEO Andrew Bray said: “After completing our $61 million sale of Millrose to Northern Star Resources Ltd (ASX:ASX:NST), we are now ready to ramp up exploration programs on the remainder of our Yandal and Earaheedy ground.

“The Strickland team has prioritised a number of exciting, high-priority prospects, targeting new gold and new zinc discoveries.

“Our ongoing work in the Earaheedy Basin has identified a new lookalike prospect to Iroquois - the Rabbit Well zinc prospect - on Strickland’s 100% owned ground.

“Rabbit Well is directly along strike from Iroquois and is defined by a coherent 2.7-kilometre long gravity anomaly (of the same tenor as Iroquois) with coincident base metal anomalism.

“By comparison, Iroquois has isolated densities ranging from 100 metres to 500 metres, suggesting Rabbit Well has the potential to be a much larger and more coherent prospect.”

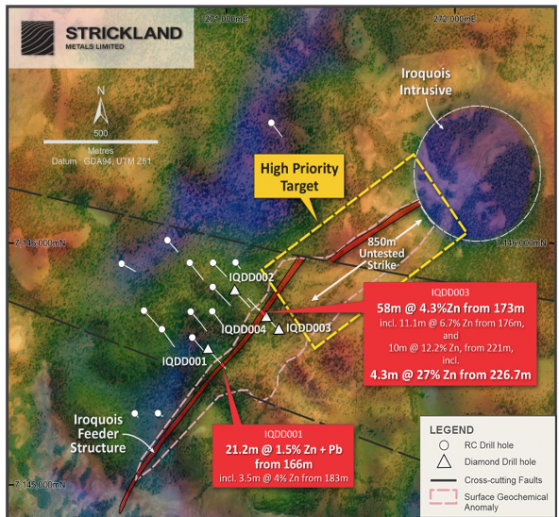

Plan view of Iroquois Feeder Structure in relation to the existing RC and DDH drill traces and the Iroquois Intrusion.

Targets

At Iroquois, Strickland has undertaken an extensive review of all exploration data generated to date, to develop an integrated exploration strategy specifically tailored to expanding and defining extensions to this high-grade mineralisation along strike.

One of the main objectives was to understand the key petrophysical properties of the massive sulphide mineralisation, so it could be determined which geophysical methods would be the most applicable for vectoring in on further high-grade mineralisation.

At Rabbit Well, the majority of the holes failed to penetrate the weathered clay-rich overburden, however, RAB holes RWRAB081 and RWRAB96 intersected a siliceous chert with vuggy quartz veining and sulphides.

The Horse Well area to date has not been systematically explored and the existing resource and advanced exploration targets are the product of residual outcrop, whereby surface geochemistry has been deemed effective.

A recent airborne magnetic survey across the wider Horse Well area has highlighted a distinct circular magnetic anomaly, five kilometres due west of the Horse Well resource base called the Great Western target.

At Celia South and Cowza, an initial drilling campaign across Millrose identified that the main controls on the high-grade primary gold mineralisation were associated with a key lithological marker horizon, called a Banded Iron Formation (BIF).

Forward plan

Bray added:“An IP survey is commencing later this month, with follow-up diamond drilling anticipated to commence shortly thereafter.

“Despite being well known for a number of years, the Horse Well gold mineralisation remains poorly understood and significantly underexplored.

“A 40,000-metre aircore program will shortly be underway with a view to developing a coherent exploration model and subsequently delivering an increase in mineral resources.

“To the west of Horse Well is the recently identified Great Western prospect. The underlying magnetic feature is interpreted to be in the flexure of a regional granite body, which is an ideal structure for large, high-grade orogenic gold deposits.

“There is strong gold-cobalt-molybdenum anomalism at the surface, along with copper-molybdenum anomalous gossans. Initial aircore programs will commence over Great Western upon receipt of heritage approval.

“And finally, at the Cowza gold prospect, the company believes it has the potential to replicate its success at Millrose.

“Cowza looks to be in a very similar setting to Millrose, with the same footwall gold mineralisation. Historically, all drilling has been focused on the western side of the BIF marker unit, whereas at Millrose, the primary mineralisation is all to the east of the BIF unit.

“This analogous location remains entirely untested by historical drilling. Strickland intends to follow up this eastern position in the coming months.

“We are looking forward to a very exciting finish to the year with potentially numerous additional gold and zinc discoveries in the offing.

“Importantly, the company remains extremely well funded as a result of the Millrose sale, meaning that major drilling campaigns at any future discoveries can be easily handled with the existing balance sheet.”

Read more on Proactive Investors AU