Strickland Metals Ltd (ASX:STK) has revealed strong evidence in a review and modelling of recent drilling data that the Palomino and Clydesdale prospects at the Yandal Gold Project in Western Australia are part of the same mineralised system.

The company now believes Clydesdale is a splay shoot of mineralisation off the main Palomino structure, which could also be connected to the Marwari prospect.

Both Clydesdale and Palomino were investigated as part of Strickland’s 2023 aircore program, where peak results of 39 metres at 6.1 g/t gold from 25 metres (with a higher-grade component of 7 metres at 22.2 g/t) have yet to be followed up with deeper drilling.

Resource expansion potential

“Our ongoing work collating, reviewing and modelling data from the 2023 drilling programs is continuing to highlight fantastic resource expansion opportunities for our planned 2024 programs, while also showing the potential for major discoveries at depth,” Strickland Metals CEO Andrew Bray said.

“In particular, the work we have undertaken at the Palomino and Clydesdale prospects show the likelihood both prospects are part of the same mineralised system. This offers substantially more scale than previously thought.

“The mineralisation intersected at Palomino to date represents an important growth area for Strickland.

“It has a very high-grade oxide component from surface and the limited extensional drilling means the prospect is open both at depth and down-plunge.”

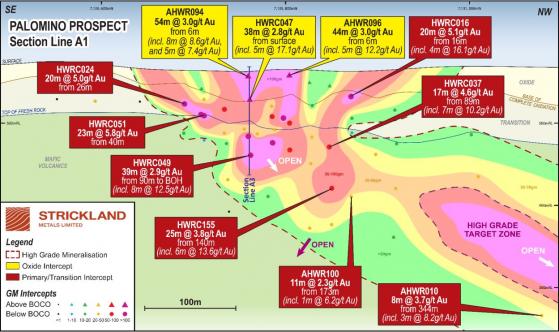

Palomino Long Section showing the primary north plunging high-grade mineralised lode that has been poorly tested at depth.

High potential at depth

“The company believes there is a clear path to not only substantially grow the existing mineral resource in the area immediately proximal to the existing mineralisation, but also for significant new discoveries beneath the current level of drilling,” Bray continued.

“As one example, the main lode in HWRC049 - 39 metres at 2.9 g/t gold from 90 metres to bottom of hole - remains open at depth and is yet to tested.

“Additionally, the main mineralised shear structure hosting Palomino is interpreted to continue for about 400 metres to the north, outside of the existing mineral resource, and is also yet to be properly tested.

“Approximately 200 metres to the west lies the Clydesdale prospect, where last year we intersected HWAC1376 - 4 metres at 7.8 g/t gold from 52 metres and HWAC1377 - 8 metres at 1.3 g/t gold from 56 metres (these results are yet to be followed up).

“Historically treated as two separate prospects, Strickland now believes these are part of the same system, with Clydesdale possibly representing a splay off the main Palomino structure.

“Consequently, these prospects offer significantly more scale potential than what was envisaged by any historical modelling.

“Additionally, given that the Marwari mineralisation is only about 250 metres east of Palomino, there is the potential that it too is part of the same substantial gold system at depth.

“This will be drill tested in the upcoming drilling programs. If it can indeed be shown that Clydesdale, Palomino and Marwari are all part of the same system, then this prospect area offers very significant scale for additional gold mineralisation.”

The company remains well funded to pursue its drilling program plans, with cash and Northern Star Resources (ASX:NST) shares totalling about $54 million at the end of the last quarter.