Stellar Resources Ltd (ASX:SRZ) has defined an updated indicated resource of 3.52 million tonnes at 1.05% tin (36,991 tonnes contained tin) for the Heemskirk Tin Project in Tasmania.

This represents a 24% increase in contained tin compared to the November 2022 mineral resource estimate (MRE) and a 58% increase from the 2019 MRE, significantly increasing confidence in the project.

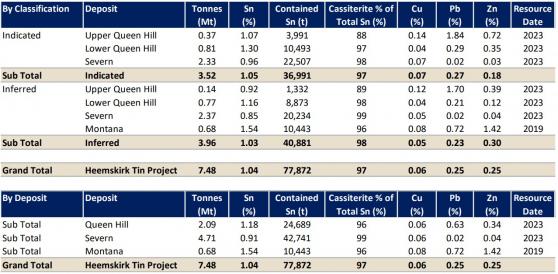

Heemskirk Tin Project mineral resource statement (2023).

The total MRE for the project has been updated to 7.48 million tonnes at 11.04% tin (77,872 tonnes contained tin).

While this is a minor (5%) decrease in contained tin in the total resource compared to the November 2022 MRE, it is the net result of removal of the Oonah resource and an increase in the Queen Hill resource.

The new Heemskirk Tin Project Total MRE continues to rank as the highest-grade undeveloped tin project in Australia and the third highest-grade globally of peer company projects.

Benchmarking of Heemskirk Tin Project measured and indicated mineral resource with peer company projects.

Stellar executive director Gary Fietz said: “Over the past 18 months, our Phase 2A and Phase 2B infill drilling programs have focused on increasing the indicated mineral resource at Severn.

“Our strategy has been vindicated with the results from these successful drilling campaigns, resulting in a 58% increase in contained tin in the Heemskirk Tin Project’s indicated mineral resource from the 2019 MRE.

“We expect the substantially increased indicated mineral resource to support a pre-feasibility study on the project, which is scheduled for later this year.”

The updated MRE has been undertaken by independent technical consultant GeoWiz and incorporates:

- Severn deposit – updated MRE incorporating results of the recently completed Phase 2B drilling (9 holes for 4,022 metres), which focused on increasing the indicated mineral resource in wide high-grade areas of the deposit. The Phase 2B holes have locally reduced the drill spacing which, along with previous drilling results, support additions to the Severn mineral resource.

- Queen Hill deposit – updated MRE completed using a more consistent geological interpretation that has reduced the number of ore zones from 12 to 3. No new drilling.

- Montana deposit – The 2019 MRE has been maintained.

- Oonah deposit removal – The Oonah inferred mineral resource (0.6 million tonnes at 0.9% tin) included in the 2019 Heemskirk Tin Project MRE has been excluded in this MRE update.

Read more on Proactive Investors AU