Tasmanian-focused tin explorer Stellar Resources Ltd (ASX:SRZ) has unveiled “outstanding” assay results from its recent phase 2B drilling program, which aimed to expand the indicated mineral resource at the Heemskirk Tin Project's largest deposit, Severn.

The company’s significant progress in picking out high-grade tin deposits at Severn reinforces what it sees as a leading position in the Tasmanian tin exploration sector.

Strong results

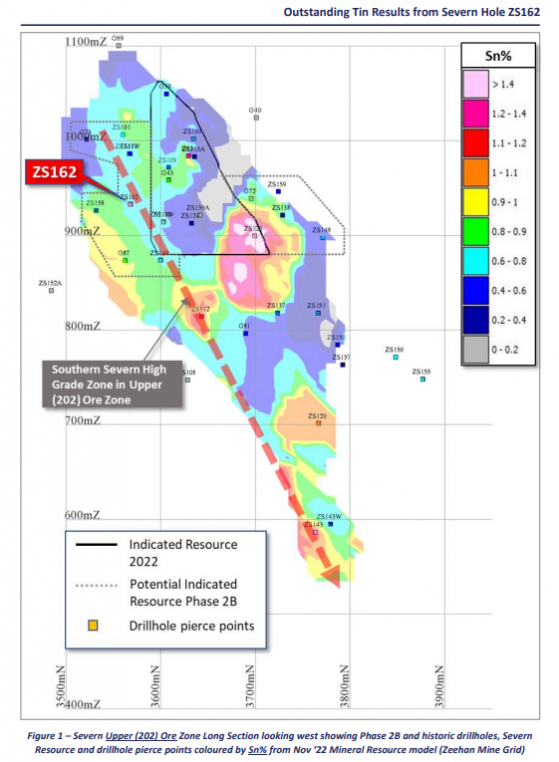

Drill hole ZS162 returned pleasing results from the upper ore zone at Severn, with a significant intersection of 20 metres at 1.16% tin starting from 312 metres. This included two high-grade sub-intervals of 8 metres at 1.56% tin and 8 metres at 1.34% tin.

Notably, this is the sixth-best significant intersection on record for the Severn deposit when considering grade thickness basis (Sn% per metre).

Moreover, it outperformed predictions made by the current mineral resource model, making it the best intercept recorded in the upper ore zone at Severn.

The company's ZS163 drill hole also revealed encouraging results, hitting the main ore zone at Severn, with 3 metres at 0.43% tin starting from 356 metres.

Positioned further north and higher than planned, ZS163 achieved a slightly higher-grade result than predicted by the current mineral resource model for this location.

"Among best on record"

Executive director Gary Fietz said: “The outstanding results from recently completed hole ZS162 are among the best on record at Severn and include a significantly higher-grade and thicker intercept of the upper ore zone in southern Severn than predicted by the current mineral resource model, highlighting a potential high-grade zone within the upper ore zone in southern Severn”.

“These results finish off a highly successfully Phase 2B drilling campaign at the Severn deposit and are expected to contribute significantly to increasing the Heemskirk Tin Project indicated MRE. The company anticipates releasing an updated MRE for the project in late August 2023.”

Stellar Resources recently completed the phase 2B drilling program, consisting of nine diamond holes and covering a total of 4,022 metres.

The results from these drilling efforts will be incorporated into an updated mineral resource estimate (MRE) which is due in late August. The success of the November 2022 MRE, which increased the Heemskirk Tin Project's indicated mineral resource by 24%, has bolstered expectations for the latest update.

Pre-feasibility study in train

With the Phase 2B drilling program results and MRE update in the bag, the company plans to support a pre-feasibility study on the Heemskirk Tin Project, scheduled for the second half of this year.

The study will be awaited with some anticipation by investors as it will provide an indication of the company’s ability to establish sustainable and profitable tin mining operations in the region.

Read more on Proactive Investors AU