An updated scoping study from Stellar Resources Ltd (ASX:SRZ, OTC:SLROF) confirms the development potential of its 100%-owned Heemskirk Tin Project in Zeehan, Western Tasmania.

This study outlines robust economics and supports Stellar’s strategy to commence a pre-feasibility study (PFS), for which workstreams are underway.

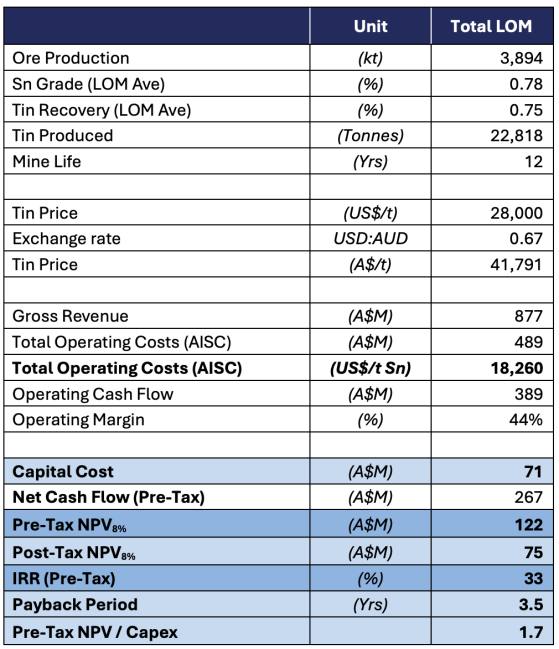

It confirms the potential for Heemskirk Tin Project to generate solid base case financial returns over a 12-year mine life at an average annual production rate of 350,000 tonnes, producing 22,818 tonnes of tin in concentrate over the life of mine (LOM).

The updated scoping study incorporates the September 2023 mineral resource estimate (MRE), utilising only indicated resource material, along with updated capital and operating estimates.

Results included a base case pre-tax NPV8% of A$122 million and pre-tax IRR of 33% at a tin price of US$28,000 per tonne. Under a spot price scenario, the project has a pre-tax NPV8% of A$190 million and pre-tax IRR of 46% at a US$32,000/tonne tin price.

The study highlighted a low all-in-sustaining-cost (AISC) of ~US$18,260/tonne recovered tin, all-inclusive to a sold product, required capital cost of approximately A$71 million.

Heemskirk scoping study key outcomes.

Heemskirk also has a low environmental impact, being an underground mine with a small surface footprint and utilising 100% renewable power.

The updated scoping study incorporates the September 2023 mineral resource estimate (MRE), utilising only indicated resource material, along with updated capital and operating estimates.

Stellar makes note that there remains significant additional upside potential via the re-classification of its large inferred MRE of 3.96 million tonnes at 1.03% tin, for 40,881 tonnes of contained tin, which was not included in base case study.

Low-cost operation with upside potential

Stellar executive chairman Simon Taylor said: “We are extremely pleased with the encouraging robust economics revealed by the updated scoping study that focused on a base case scenario of mining and processing 350,000 tonnes per annum of ore.

“The updated capital and operating cost estimates indicate a low pre-production capital cost of $71 million and an all-in-sustaining cash operating cost of US$18,260/tonne tin, including smelter costs.

"This places Heemskirk in the lower half of peer group companies globally with an ability to survive lower tin price cycles and capture large upside from rising tin prices.

“The study mining schedule has been built on the indicated resource only with first ore to the processing plant expected to occur approximately six months from the start of decline development and concentrate sales should commence approximately three months later.

“Over half of the mineral resource at Heemskirk is in the inferred category with large upside potential through converting further tonnes to the indicated category to not only extend mine life but also provide an opportunity to increase mining production rates, with initial results indicating that mining at 750,000 tonnes per annum is achievable.

“The study results strongly support our decision to initiate a pre-feasibility study last month to advance Heemskirk to be development-ready. This work will focus on increased mining rates, optimising plant size and adding ore sorting to our process flow sheet.

“The company is fully funded to complete the ongoing work and with two drilling rigs currently on site we look forward to updating our investors and the market as we continue to progress the project.”

Pre-feasibility study underway

Stellar has commenced the collection of data to incorporate into a PFS, which will investigate increased mining rates; optimising plant size and capacity along with applicability of other infrastructure within the region; the incorporation of ore sorting into the process flow sheet; and application of mining paste/fill as an alternative to tails deposition.

The company hopes to complete the PFS in the second half of 2025.

Read more on Proactive Investors AU