Stellar Resources Ltd (ASX:SRZ) is confident its flagship Heemskirk Tin Project on the west coast of Tasmania will be able to play a key role in meeting the demand for new tin supply from tier-one countries in the Organisation for Economic Cooperation and Development (OECD), even as the significant supply deficit is forecast to continue.

Global tin supply has been falling due to issues in Peru and Indonesia and more recently, exacerbated by concerns that the Wa State in Myanmar, which accounts for about 10% of global tin supply, will suspend exports of the commodity from next month.

About 75% of global tin production is from non-tier one, non-OECD countries.

As tin continues to experience a supply crunch, its spot price on the London Metal Exchange has strengthened to about US$29,000 per tonne.

Undeveloped tin resource

The Heemskirk Project is the highest-grade undeveloped tin resource in Australia and the third highest-grade tin resource globally.

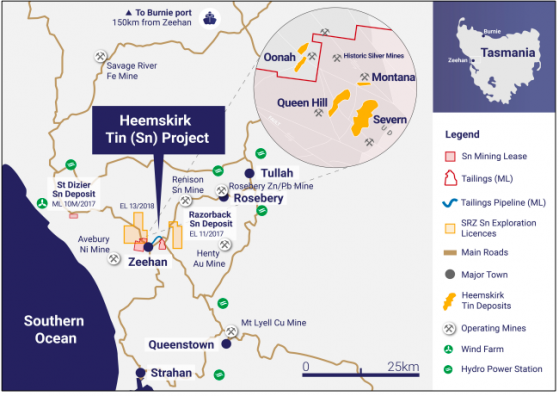

The project is just 18 kilometres southwest of the Renison tin mine, the largest and most productive tin mine in Australia, and includes four nearby tin deposits - Severn, Queen Hill, Montana and Oonah.

Stellar holds secure mining leases over the Heemskirk Tin Project, including the tailings pipeline route, tailings storage site and the St Dizier satellite tin deposit.

Heemskirk has a total mineral resource estimate (MRE) of 7.6 million tonnes at 1.1% tin at a cut-off grade of 0.6% tin. On a contained tin basis, its 81,976 tonnes places it within the five largest tin projects in the world.

Location of Stellar’s tin projects on the west coast of Tasmania.

Resource expansion drilling

Since the MRE was published in November 2022, Stellar has been actively pursuing expansion drilling to upgrade Heemskirk’s resource by late next month to support a pre-feasibility study before the year ends.

In reviewing exploration activities conducted in the second quarter, the explorer said it had completed nine diamond holes for 4,022 metres under the Phase 2B drilling program in mid-June at Severn, the largest of the Heemskirk Tin Project deposits.

The drilling program was designed to grow Severn’s indicated resource, primarily in wide high-grade areas of the deposit.

Standout assay results previously announced include:

- ZS157: 25 metres at 0.40% tin from 508 metres;

- ZS158: 2.4 metres at 0.64% tin from 373.7 metres;

- ZS159: 3.3 metres at 0.58% tin from 270 metres; and

- ZS159: 11.3 metres at 0.13% tin from 301 metres.

At the North Scamander Project, drilling intersected a 38.6-metre zone of sulphides with zinc, lead and copper mineralisation.

The zone intersected in hole NSD005 contains sphalerite, galena, chalcopyrite and associated pyrite hosted in massive veins, semi-massive veins, hydrothermal breccia and associated stringer-style veins.

Stellar also observed a second, less significant zone of breccia and stringer mineralisation extending over 17.7 metres from 223 metres downhole.

Meanwhile, fieldwork on the company’s northeast Tasmania exploration licences has been ongoing throughout the quarter, with surface sampling for lithium that may be hosted in micas and tin within four fractioned alkali granites on Stellar’s EL3/2022, EL19/2020, EL15/2020, EL17/2020 and EL3/2022 tenements.

Stellar holds 12 exploration licences covering a combined area of 2,212 square kilometres in northeast Tasmania, which is prospective for gold, tin, base metals and lithium.

Surface geochemistry programs exploring for gold are also underway.

Core samples from NSD005 showing massive veining and breccias.

Drilling grant

The quarter also saw the company awarded four exploration drilling co-funding grants to the sum of A$258,500 by the Tasmanian Government under Round Eight of the Exploration Drilling Grant Initiative (EDGI) program, which aims to encourage minerals exploration in the state.

Stellar will use funds from the grants to support drilling projects at North Scamander, Carbine Hill East, Evenden and Razorback, exploring for tin, base metals and critical minerals deposits.

Meanwhile, the company had a cash balance of $1.6 million as of June 30.

Read more on Proactive Investors AU