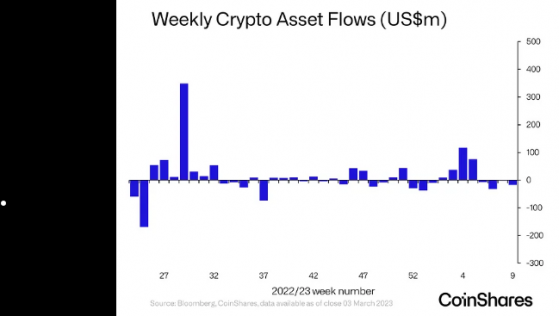

Digital investment products spanning bitcoin, ether and other major cryptocurrencies saw total outflows of US$17mln (£14mln) in the week ending March 3, resulting in the fourth consecutive week of digital asset fund outflows, according to CoinShares’ data.

When adding in the US$1.8mln in Short Bitcoin purchased, which bet on the benchmark cryptoasset falling in value, things look even more bearish.

Ether, for its part, saw around US$700,000 of inflows, but was dwarfed by the US$20mln moving out of long bitcoin futures.

CoinShares tracks cryptocurrency exchange-traded products (ETPS) listed around the worlds, including 21Shares, proShares, 3iQ and its own CoinShares ETPs.

The outflows coincide with a range of headwinds facing cryptocurrency investors lately.

For one, US securities authorities have been putting immense pressure on major crypto institutions including Binance and Kraken, the latter of which copped a US$30mln fine and was ordered to immediately cease all staking activity in February.

There are also serious concerns over the health of high-profile crypto bank Silvergate Capital Corp, which tanked in value on the New York Stock Exchange after failing to file its annual reports last week.

US dollar strength is also putting downward pressure on the price of bitcoin and other major digital assets.

Read more on Proactive Investors AU