Spenda Ltd (ASX:SPX) has rolled out the red carpet and its CC Spenda technology platform to national flooring retailer Carpet Court.

The fintech stock will deploy infrastructure to support transactions across a growing network of more than 200 Carpet Court stores, which bring in roughly A$500 million in annual retail sales.

The software platform also allows Spenda to offer lending services across the entire Carpet Court network, underscoring a complementary five-year lending deal with the flooring specialist.

Thanks to that agreement, Spenda will act as a business partner and offer capital financing on a 30-day term and fixed funding fee, calculated based on the money advanced to the store.

Showcasing software capabilities

Carpet Court CFO Mark Hogan said: “The Spenda platform is delivering efficient end-to-end payment services for the NSC and members. The extended terms facility continues our digital transition and provides a flexible funding solution for members.

“We look forward to, building on these initiatives with the standard operating environment pilot in coming months.”

Spenda managing director Adrian Floate added: “The Spenda solution is rich in functionality and as such it can often be difficult to showcase the full capabilities of our software in a way that our investors can easily digest.

“The Carpet Court rollout has allowed us to show how we phase an implementation and monetise Spenda’s services in clear stages, from acquiring a Node and delivering initial services to the connected Spoke network, and now further upgrading the Spokes with a working capital financing solution, retail software and additional payment infrastructure.”

Show me the money

While Spenda can’t put exact numbers to the deal’s revenue upside, it believes it could bring in up to A$30,000 per store per annum.

On top of that, Spenda and Carpet Court are launching a pilot program for individual stores that would establish a standard operating environment and implement Spenda point-of-sale terminals.

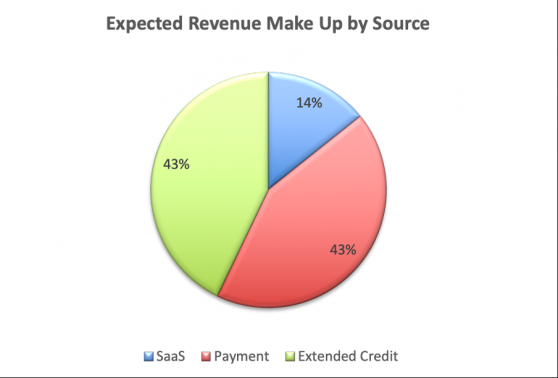

This could generate extra revenue streams, including one-off implementation fees, ongoing monthly SaaS fees and payment processing fees, although it’s still early days.

Assuming full adoption of each program and initiative, Spenda’s layered revenue stream will look something like the chart below:

Read more on Proactive Investors AU