A morbid anniversary of sorts is upon us. Two years on from the SPAC boom of early 2021, and the chickens are coming home to roost for one of the most costly fads in recent history.

SPACs, or special purpose acquisition vehicles, were a major driving force behind the 2021 IPO boom, accounting for 61% of US public listings in the year compared to 25% in 2020.

By 2022, SPACs had already dwindled to 8% of new IPOs, leaving a trail of underperforming acquisitions and liquidated shell companies in their wake.

But why did SPACs ultimately fail, and what lesson can be learned?

Firstly, what is a SPAC?

SPACs, or blank cheque companies, typically have catchy names like KKR Acquisition Holdings I Corp, Social Capital Hedosophia Holdings Corp VI and Foley Trasimene Acquisition Corp II.

They are essentially publicly listed shell companies with no assets or revenue, formed with the sole purpose of seeking out a target company to combine in what’s called a reverse merger.

The target company thus becomes a publicly traded entity without going through the arduous and costly listing process.

SPACs have been around for decades, but they truly came to the fore in 2021. Over US$162bn was raised through SPACs in 2021, compared with US$13bn in the year after

One of their quirks is the two-year deal horizon. If a SPAC fails to ink a deal with a target company, the SPAC is liquidated and funds are returned to initial investors (typically private equity funds and venture capitalists).

This brings us to our morbid anniversary: As outlined below, the boom and bust of the capital markets that marred 2022 has left many of these shell companies stranded, having failed to find suitable marriage partners and are now facing high-value liquidations.

The life sciences case study

The devastation wrought by SPACs is particularly prevalent in the life sciences sector.

Data provided by intelligence platform Evaluate shows that 25 healthcare-focused SPACs are known to have been liquidated having missed their two-year horizons, with 21 of them occurring in the fourth quarter of 2022.

There are more to come; data show that 39 healthcare SPACS were still searching for a target company in March 2023, with 22 having less than six months to ink a deal.

With one exception, every single medical technology company that closed deals with SPACs throughout 2021/22 has “haemorrhaged value”, with an average 79% decrease in enterprise value (EV) from promises made in their merger announcements.

In monetary terms, that’s a whopping US$29bn (£23bn) in undelivered EV.

In the biopharmaceuticals space, of the 89 reverse merger deals traced by Evaluate, 13 no longer have a market listing and 43 have a market capitalisation of less than US$50mln.

SPAC failures are in no way contained to the life sciences sector.

Take the largest-ever SPAC, Bill Ackman’s Pershing Square (NYSE:SQ) Tontine Holdings, which failed to consummate a deal and was forced to return US$4bn to shareholders midway through 2022.

Or former Barclays PLC (LSE:LON:BARC) boss Bob Diamond’s Concord Acquisition Corp, which terminated its combination with cryptocurrency payments platform Circle after failing to agree on terms, bringing an end to the USDC stablecoin issuer’s IPO hopes (at least for now).

Esports group FaZe Clan’s US$725mln reverse merger with B. Riley Principal 150 Merger Corp, which was already revised down from a US$1bn valuation to US$725mln, is now worth an embarrassing US$44mln.

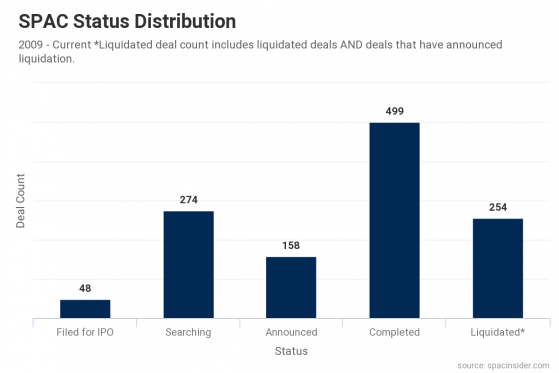

The list goes on. Between 2009 and today, 499 SPACs successfully IPO’d, while 254 were liquidated. There are currently 274 SPACs searching for a target, many of which will soon transition to the liquidated basket.

“With investors increasingly disillusioned with this mechanism, SPAC deals are going to become rare, if not actually extinct,” said Evaluate researchers.

Evaluate is not shy in its disdain for these special-purpose vehicles. “SPACs are whack and IPOs are the gold standard, the former merely being a route to market for weak companies,” said researchers, and their poor reputation is “deservedly so”.

Why did they fail?

For Merlin Piscitelli, chief revenue officer at M&A-focused SaaS platform Datasite, poor timing was a key factor in the SPAC debacle.

When SPACs blew up in 2020/21, private equity firms, which are some of the largest investors into SPACs, “probably had the best market in history” to operate in, said Piscitelli.

Money was cheap and these PE firms we all competing against each other for the best assets, and FOMO was rife.

With funny money being splashing about, due diligence became an undue burden, something to worry about tomorrow and target companies were seeing huge valuations put on them by these highly competitive PE-backed SPAC vehicles.

But ultimately, a public company, regardless of how it comes to market and at what valuation, has to adhere to strict reporting requirements and is going to be sharply scrutinised in the public eye.

“A lot of these companies weren't fit for being public, and they were just kind of put into the shells on hopes that with the wave happening in the overall markets, they would show growth and be able to maintain a public profile,” said Piscitelli

It’s the old adage of putting the horse before the cart. Or perhaps ‘fake it till you make it’ works better.

Underprepared companies suddenly found themselves burdened by the requirements of being a publicly listed company, with all the investor relations, communications and regulatory requirements that, noted Piscitelli, hadn’t even been built into some of the companies at that stage.

It almost feels like the Fyre Festival of the capital markets; a tantalising idea without the business nous or basic discipline to make it work.

High valuations and good growth stories that didn’t come to fruition made for an unfortunate mix, hence why, when asked if there were at least some success stories to come out of the SPAC boom, Piscitelli drew a blank.

Who won, who lost?

SPACs weren’t a disaster for everyone, particularly not the advisors who drew in vast sums from advising on the setup, structure, fundraising and potential target companies.

But even the blank cheque company sponsors themselves have managed to make a solid turnaround after exercising their warrants and getting out while the going was still good.

It hasn’t even been a disaster for the investors in SPACs that failed to find a target company. They simply got their investment back, often with interest accrued.

This leads to another point: Part of the allure for SPAC investors is the get-out clause allowing them to redeem their initial investment should they not be happy with the target company.

SPAC redemptions rates absolutely skyrocketed at the peak of the fad. From July to November 2021 the average SPAC redemption rate was around 60%.

In one particularly egregious example, everyone’s favourite listicle pedlar, BuzzFeed, saw a 94.4% redemption rate, meaning only US$16mln was raised out of an expected US$288mln, forcing the group to take out a US$150mln debt financing round.

BuzzFeed news is now shutting down.

Ironically, the biggest losers were the ones that held onto their shares through a successful reverse merger, only to see their investment plummet, almost without fail exception.

One of the repercussions of the SPAC drain is the current boom in the take-private market, as PE managers sniff out devalued companies with the potential to turn them around as we head into the rebound stage of the bottomed-out capital markets.

Jason Manketo, capital markets partner at Linklaters, reckons the “many tens of billions of dollars” worth of liquidations are likely to be redeployed into the private M&A markets, and, hopefully, the public M&A market.

Just don’t expect a resurgence in the SPAC field. Then again, Fyre Festival II is apparently going ahead, so who knows?

Read more on Proactive Investors AU