Sovereign Metals Limited (ASX:SVM, OTC:SVMLF, AIM:SVML) is set to upscale its graphite program at Kasiya, a move set to have far-reaching implications for the lithium-ion battery industry.

A bulk sampling program is underway at Kasiya, aimed at extracting more than 100 tonnes of ore to produce more than 1,000 kilograms of natural graphite. This material will be crucial for lithium-ion battery anode test work and product qualification.

The bulk sampling program involves a mechanised drill program using a custom-made 300-millimetre-diameter spiral auger to extract material from future pits.

The goal is to produce more than 1,000 kilograms of flake graphite and natural rutile products, which will undergo further processing in Malawi before final refinement in Canada and Australia.

The 1,000 kilograms of flake graphite produced will be used for downstream test work and initial product qualification targeting the battery anode sector.

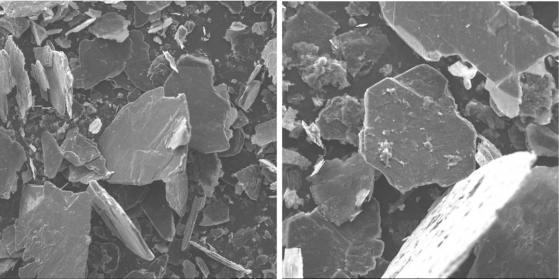

SEM micrograph of Kasiya graphite flotation concentrate from previous testwork.

Sovereign's strategic partner, Rio Tinto (ASX:RIO), is closely involved in this initiative, which seeks to qualify graphite from Kasiya, with a particular emphasis on supplying the spherical purified graphite (SPG) segment of the lithium-ion battery anode market.

Previous testwork has confirmed that Kasiya's graphite possesses near-perfect crystallinity and high purity, making it an ideal candidate for lithium-ion battery feedstock.

Kasiya, as revealed by its recent pre-feasibility study (PFS), has the potential to become one of the world's largest natural graphite producers, with an estimated annual output of 244,000 tonnes. Remarkably, it boasts the lowest cash operating costs globally, at US$404 per tonne, and an enviably low CO2 footprint.

Geopolitical significance

This development coincides with news of China's restrictions on the export of natural graphite, a critical mineral for several countries, including the US, EU, Japan, and Australia.

China currently dominates the production of flake graphite used in lithium-ion battery anodes, accounting for 61% of global production.

This move is essential, as it comes at a time when China is tightening its grip on the graphite market, highlighting the strategic significance of Kasiya's potential as a secure, long-term supply source for critical industries.